EX-99.1

Published on August 29, 2025

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 1 Aug 2025 Investor Presentation

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 2 Disclaimer No Offer or Solicitation This presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of U.S. federal securities laws. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based on information available as of the date of this presentation and our managements’ current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside of our control. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. We do not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the price of crypto assets and volume of transactions on Coincheck’s platform; the development, utility and usage of crypto assets; changes in economic conditions and consumer sentiment in Japan; cyberattacks and security breaches on the Coincheck platform; demand for any particular crypto asset; adverse changes to any laws or regulations in the United States, Japan or the Netherlands or Coincheck’s failure to comply with any laws or regulations; administrative sanctions, including fines, or legal claims if we are found to have offered services in violations of the laws of jurisdictions other than Japan or to have violated international sanctions regimes; Coincheck’s ability to compete in a highly competitive industry; Coincheck’s ability to introduce new products and services; any interruptions in services provided by third-party service providers; the status of any particular crypto asset as a “security” in any relevant jurisdiction; legal, regulatory, and other risks in connection with our operation of the Coincheck NFT Marketplace that could adversely affect our business, operating results, and financial condition; our obligations to comply with the laws, rules, regulations, and policies of a variety of jurisdictions if we expand our international activities; the inability to maintain the listing of our Ordinary Shares on Nasdaq and other risk factors (the “Risk Factors”) discussed under "Item 3 - Key Information— D. Risk Factors" in the company’s Annual Report on Form 20-F, filed with the U.S. Securities and Exchange Commission (SEC) on July 30, 2025. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. All information set forth herein speaks only as of the date hereof. Forecasts and estimates regarding Coincheck’s industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results the ability to grow and manage growth profitably. Non-IFRS Financial Measures This presentation includes certain financial measures not prepared in accordance with IFRS, which constitute “non-IFRS financial measures” as defined by the rules of the SEC. The non-IFRS financial measures are EBITDA and Adjusted EBITDA. We believe that EBITDA and Adjusted EBITDA enhance an investor’s understanding of our financial and operating performance from period to period, because by excluding certain items that may not be indicative of our recurring core operating results, we believe that EBITDA and Adjusted EBITDA provide meaningful supplemental information regarding our financial and operating performance. In addition, we believe EBITDA and Adjusted EBITDA are measures commonly used by investors to evaluate other companies in our industry. However, there are limitations to the use of these non-IFRS financial measures as analytical tools and they should not be considered in isolation or as a substitute for other financial measures calculated and presented in accordance with IFRS and may not be comparable to similarly titled non-IFRS measures used by other companies.

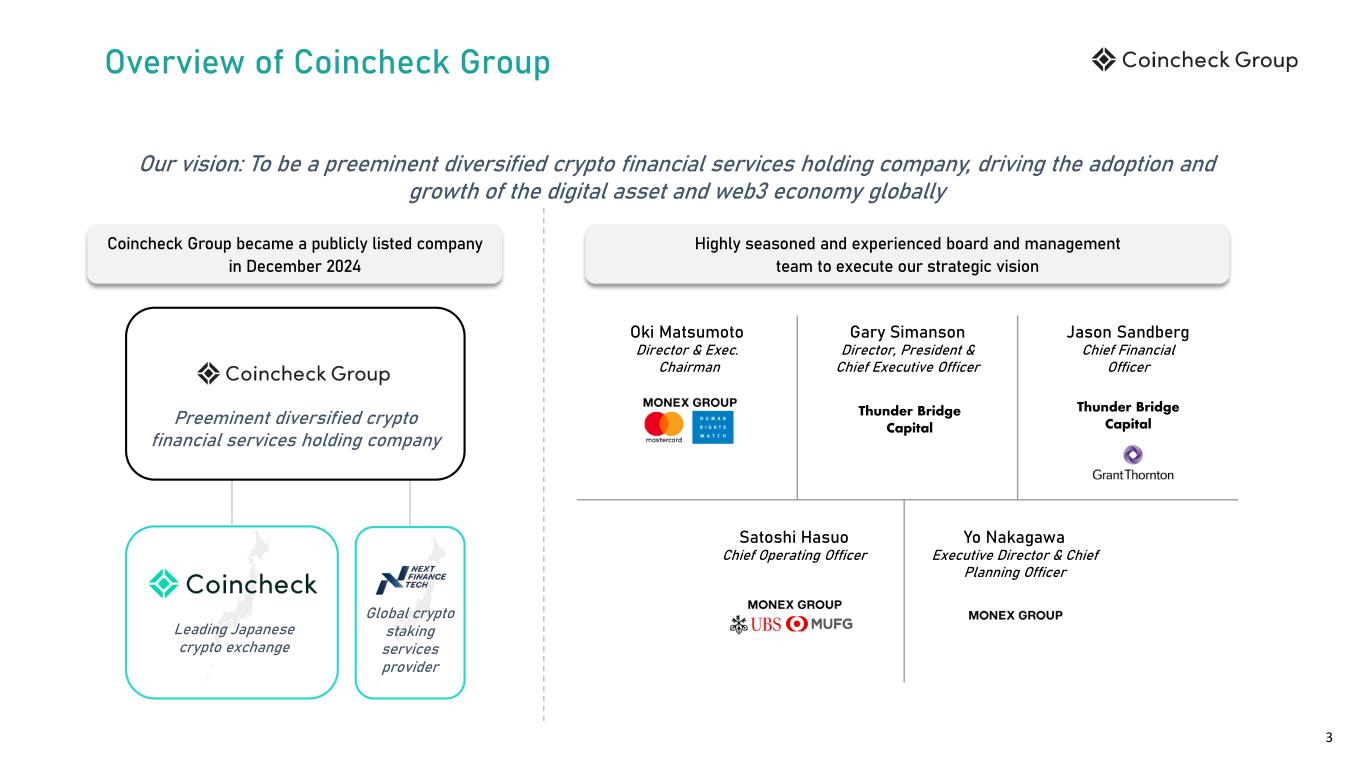

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 3 Oki Matsumoto Director & Exec. Chairman Gary Simanson Director, President & Chief Executive Officer Jason Sandberg Chief Financial Officer Overview of Coincheck Group Preeminent diversified crypto financial services holding company Coincheck Group became a publicly listed company in December 2024 Highly seasoned and experienced board and management team to execute our strategic vision Our vision: To be a preeminent diversified crypto financial services holding company, driving the adoption and growth of the digital asset and web3 economy globally Satoshi Hasuo Chief Operating Officer Yo Nakagawa Executive Director & Chief Planning Officer Thunder Bridge Capital Thunder Bridge Capital Leading Japanese crypto exchange Global crypto staking services provider

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 4 Coincheck Group Growth Strategy Building new crypto and Web3 services supporting the Coincheck crypto asset ecosystem both organically and through mergers and acquisitions Seeking to provide and explore additional on-ramp services between fiat and crypto assets, and various user applications Continuing to explore new financial service businesses that would appeal to our young customer base, such as payments and commerce enablement Accelerating our development of NFT platforms in Japan, including by partnering with content creators and gaming companies Continuing to grow our customer base and revenue to retain a leading market position, to build on our first-of-its-kind IEO launch and to expand supported crypto asset coverage Coincheck Group is well-positioned to execute on its strategic vision Capturing nascent and growing institutional interest, capitalizing on our trusted brand name within Japan and in the overall global crypto economy

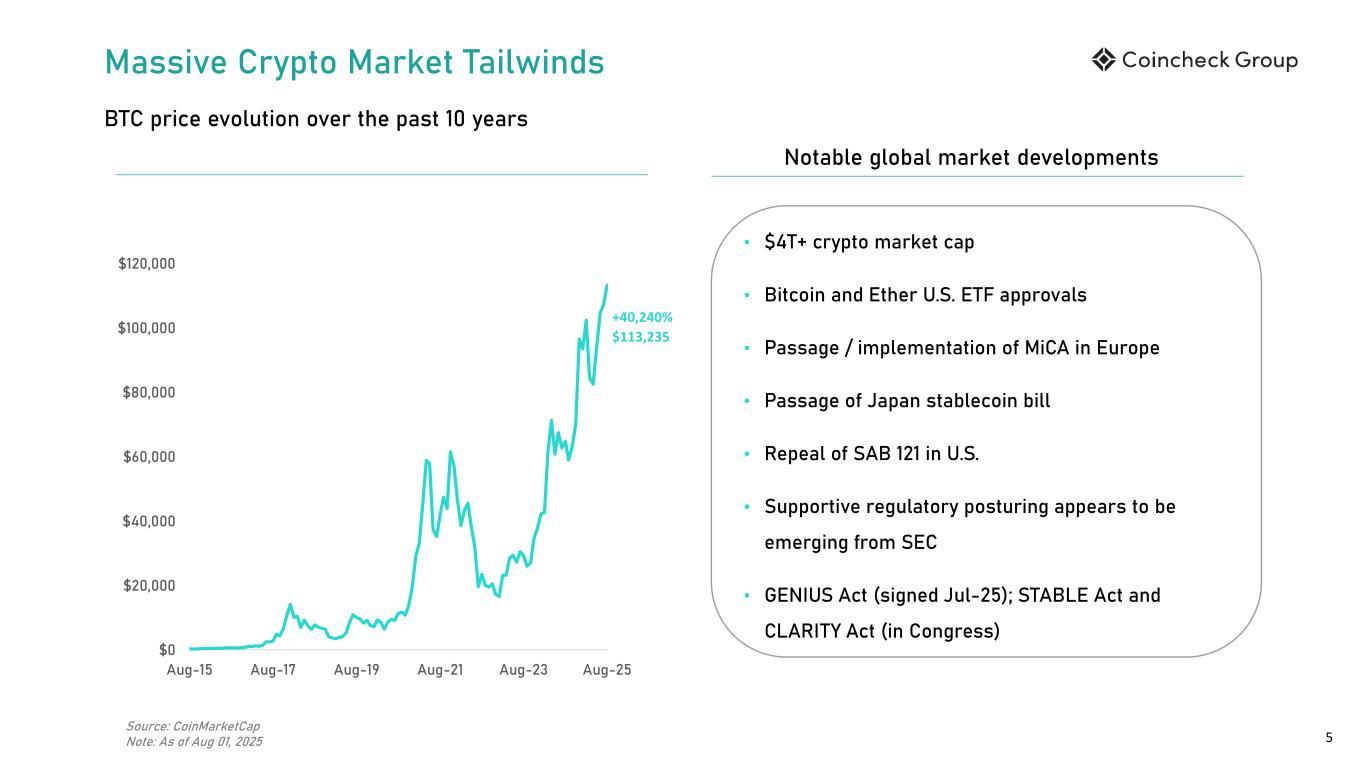

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 5 Massive Crypto Market Tailwinds BTC price evolution over the past 10 years Source: CoinMarketCap Note: As of Aug 01, 2025 $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 Aug-15 Aug-17 Aug-19 Aug-21 Aug-23 Aug-25 +40,240% $113,235 Notable global market developments • $4T+ crypto market cap • Bitcoin and Ether U.S. ETF approvals • Passage / implementation of MiCA in Europe • Passage of Japan stablecoin bill • Repeal of SAB 121 in U.S. • Supportive regulatory posturing appears to be emerging from SEC • GENIUS Act (signed Jul-25); STABLE Act and CLARITY Act (in Congress)

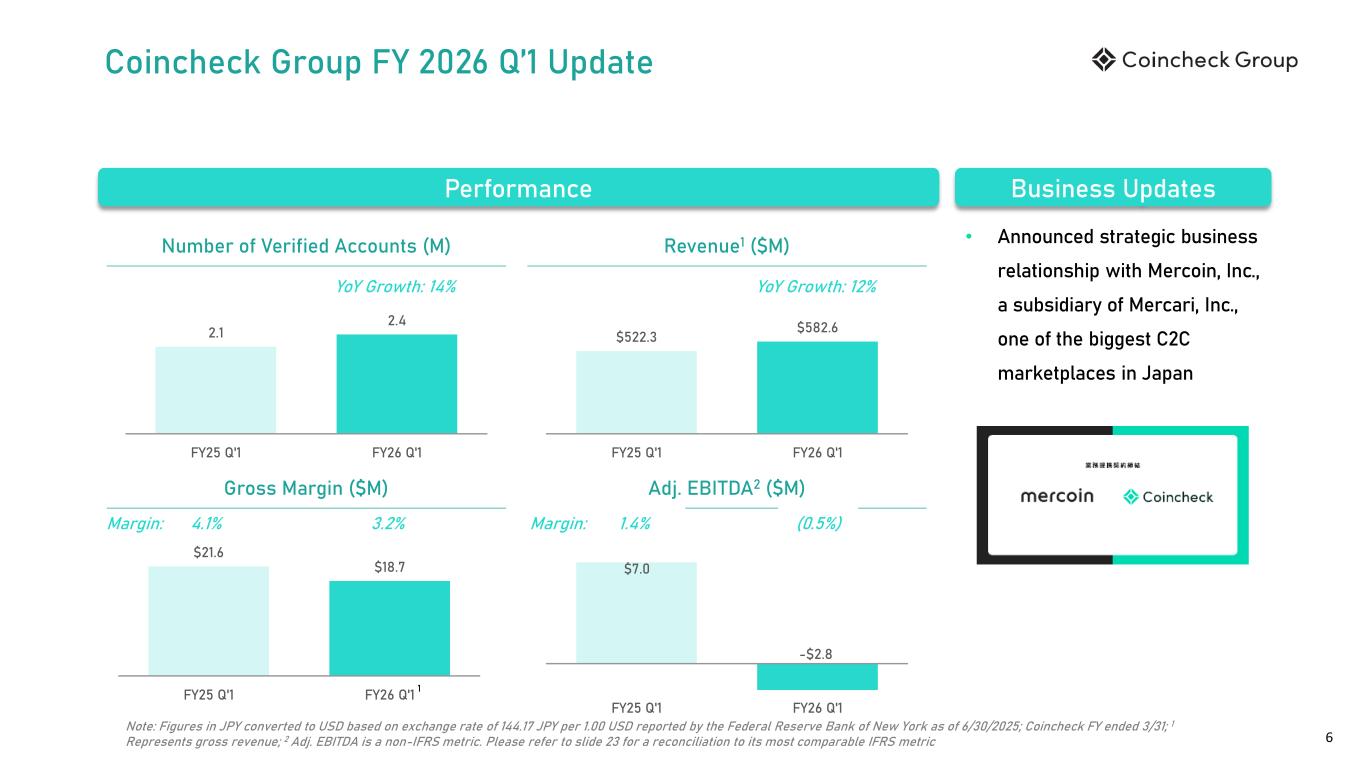

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 6 • Announced strategic business relationship with Mercoin, Inc., a subsidiary of Mercari, Inc., one of the biggest C2C marketplaces in Japan Performance Coincheck Group FY 2026 Q’1 Update Note: Figures in JPY converted to USD based on exchange rate of 144.17 JPY per 1.00 USD reported by the Federal Reserve Bank of New York as of 6/30/2025; Coincheck FY ended 3/31; 1 Represents gross revenue; 2 Adj. EBITDA is a non-IFRS metric. Please refer to slide 23 for a reconciliation to its most comparable IFRS metric 2.1 2.4 FY25 Q'1 FY26 Q'1 Number of Verified Accounts (M) YoY Growth: 14% Business Updates $522.3 $582.6 FY25 Q'1 FY26 Q'1 Revenue1 ($M) YoY Growth: 12% Margin: 4.1% 3.2% $21.6 $18.7 FY25 Q'1 FY26 Q'1 Gross Margin ($M) $7.0 -$2.8 FY25 Q'1 FY26 Q'1 Adj. EBITDA2 ($M) Margin: 1.4% (0.5%) 1

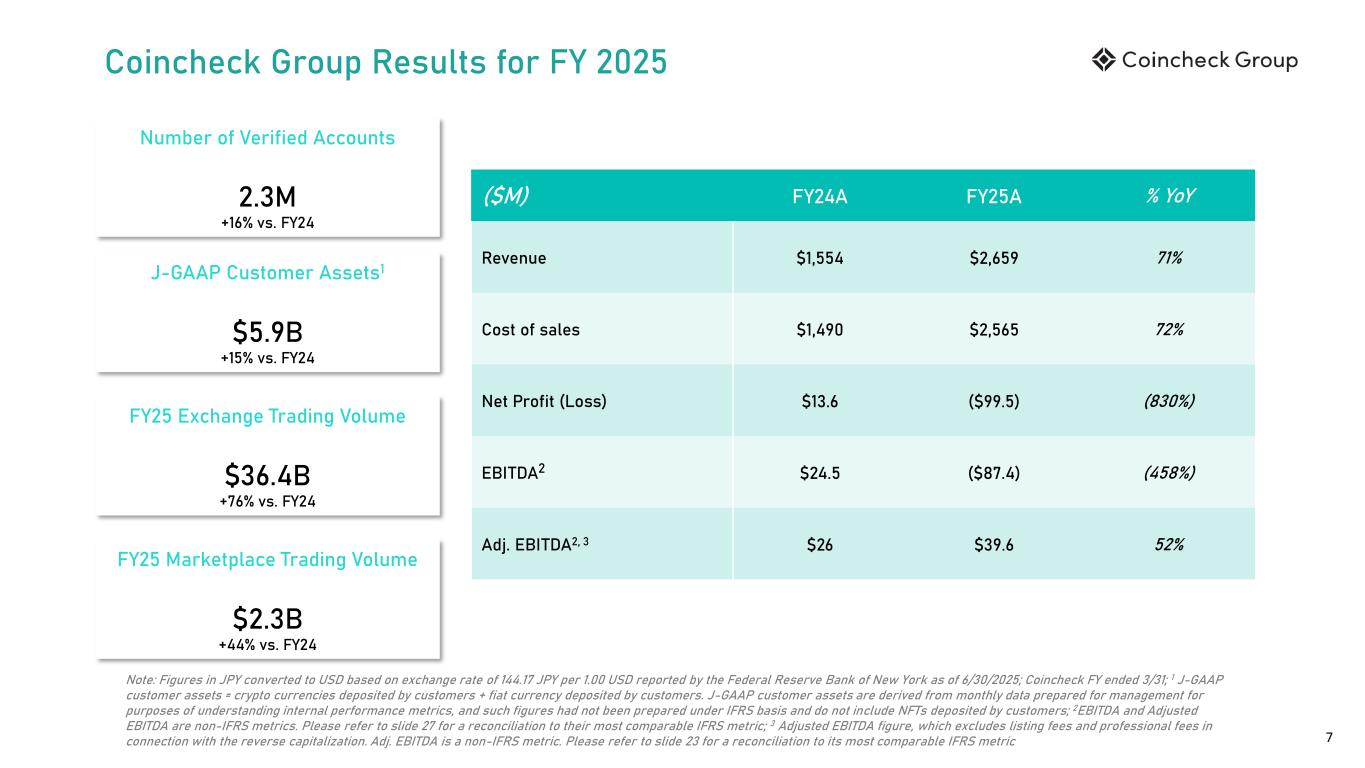

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 7 Coincheck Group Results for FY 2025 Number of Verified Accounts 2.3M +16% vs. FY24 $5.9B +15% vs. FY24 J-GAAP Customer Assets1 $2.3B +44% vs. FY24 FY25 Marketplace Trading Volume ($M) FY24A FY25A % YoY Revenue $1,554 $2,659 71% Cost of sales $1,490 $2,565 72% Net Profit (Loss) $13.6 ($99.5) (830%) EBITDA2 $24.5 ($87.4) (458%) Adj. EBITDA2, 3 $26 $39.6 52% Note: Figures in JPY converted to USD based on exchange rate of 144.17 JPY per 1.00 USD reported by the Federal Reserve Bank of New York as of 6/30/2025; Coincheck FY ended 3/31; 1 J-GAAP customer assets = crypto currencies deposited by customers + fiat currency deposited by customers. J-GAAP customer assets are derived from monthly data prepared for management for purposes of understanding internal performance metrics, and such figures had not been prepared under IFRS basis and do not include NFTs deposited by customers; 2EBITDA and Adjusted EBITDA are non-IFRS metrics. Please refer to slide 27 for a reconciliation to their most comparable IFRS metric; 3 Adjusted EBITDA figure, which excludes listing fees and professional fees in connection with the reverse capitalization. Adj. EBITDA is a non-IFRS metric. Please refer to slide 23 for a reconciliation to its most comparable IFRS metric $36.4B +76% vs. FY24 FY25 Exchange Trading Volume

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 8 Providing Japanese Customers & Institutions with Direct Access to the Global Crypto Economy Coincheck, the Leading Japanese Crypto Platform • Wholly-owned subsidiary of Coincheck Group • Leading Japanese crypto exchange • Operates one of the largest domestic multi-cryptocurrency marketplaces and crypto asset exchanges in Japan • Services supporting 351 cryptocurrencies on our Marketplace and Exchange platforms for trading and custody, as well as other crypto activities including Initial Exchange Offerings (IEOs) and NFTs • Registered crypto asset exchange service provider with the Financial Services Agency of Japan (JFSA) • Operates under the Japan Virtual Currency Exchange Associate (JVCEA), a self- regulatory organization that governs Japan’s crypto exchanges Note: 1 As of June 30, 2025

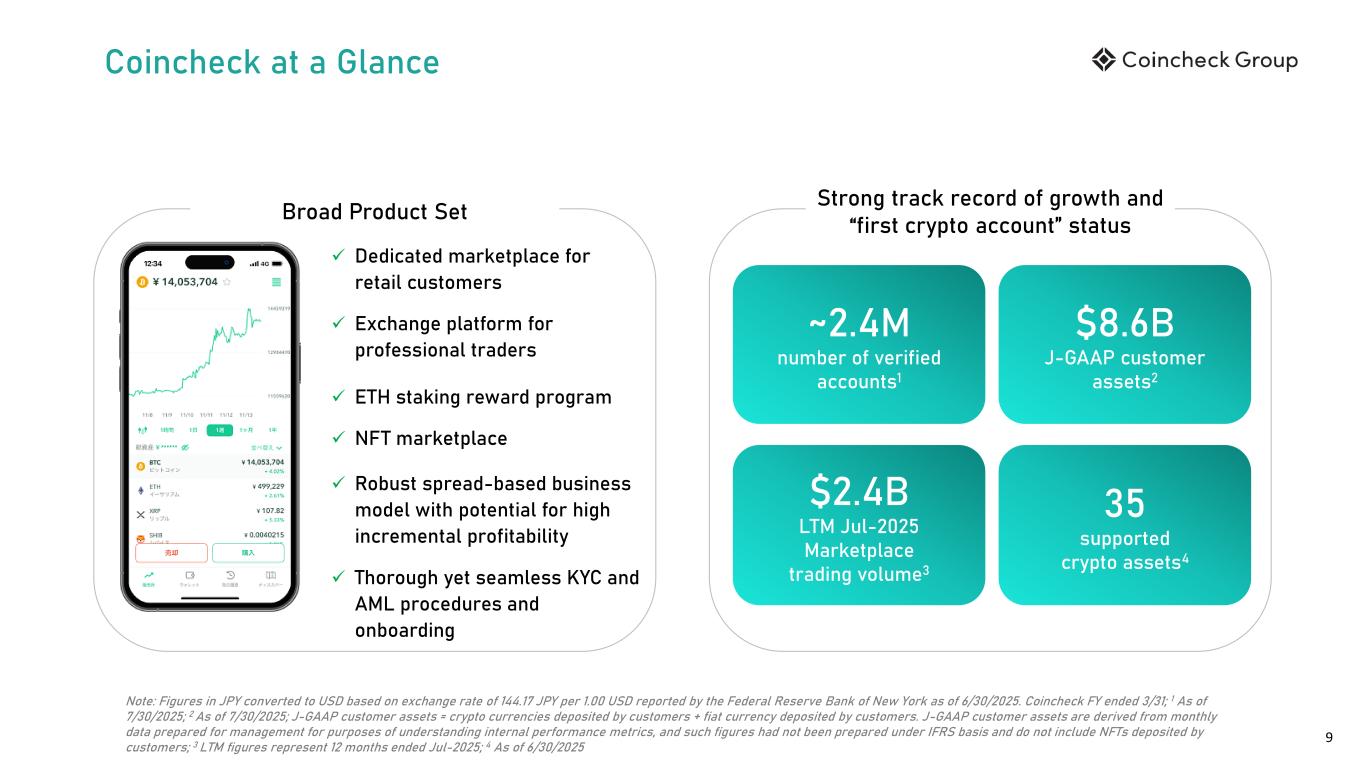

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 9 Coincheck at a Glance Note: Figures in JPY converted to USD based on exchange rate of 144.17 JPY per 1.00 USD reported by the Federal Reserve Bank of New York as of 6/30/2025. Coincheck FY ended 3/31; 1 As of 7/30/2025; 2 As of 7/30/2025; J-GAAP customer assets = crypto currencies deposited by customers + fiat currency deposited by customers. J-GAAP customer assets are derived from monthly data prepared for management for purposes of understanding internal performance metrics, and such figures had not been prepared under IFRS basis and do not include NFTs deposited by customers; 3 LTM figures represent 12 months ended Jul-2025; 4 As of 6/30/2025 Broad Product Set ✓ Dedicated marketplace for retail customers ✓ Exchange platform for professional traders ✓ ETH staking reward program ✓ NFT marketplace ✓ Robust spread-based business model with potential for high incremental profitability ✓ Thorough yet seamless KYC and AML procedures and onboarding Strong track record of growth and “first crypto account” status ~2.4M number of verified accounts1 35 supported crypto assets4 $8.6B J-GAAP customer assets2 $2.4B LTM Jul-2025 Marketplace trading volume3

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 10 Broad Product Suite with Numerous Growth Avenues Coincheck’s Leadership Position in Japan Robust Regulatory and Compliance Infrastructure Well-Positioned in a Large and Rapidly Growing Market Track Record of Sustained Growth and Diversification Highly Regulated Market, with Strong Regulatory Tailwinds Highly Engaged Customer Base Leading Scale and Market Position

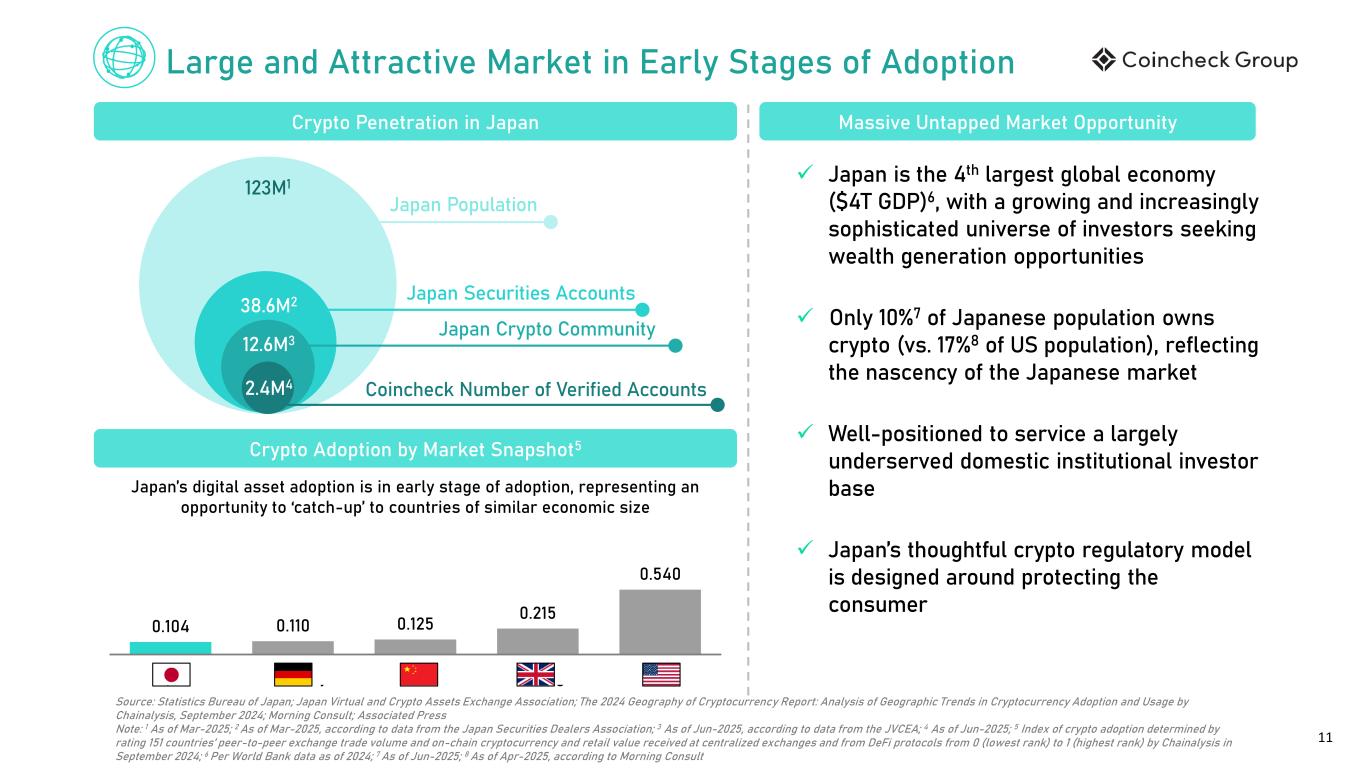

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 11 Large and Attractive Market in Early Stages of Adoption Crypto Adoption by Market Snapshot5 Massive Untapped Market Opportunity ✓ Japan is the 4th largest global economy ($4T GDP)6, with a growing and increasingly sophisticated universe of investors seeking wealth generation opportunities ✓ Only 10%7 of Japanese population owns crypto (vs. 17%8 of US population), reflecting the nascency of the Japanese market ✓ Well-positioned to service a largely underserved domestic institutional investor base ✓ Japan’s thoughtful crypto regulatory model is designed around protecting the consumer Crypto Penetration in Japan Source: Statistics Bureau of Japan; Japan Virtual and Crypto Assets Exchange Association; The 2024 Geography of Cryptocurrency Report: Analysis of Geographic Trends in Cryptocurrency Adoption and Usage by Chainalysis, September 2024; Morning Consult; Associated Press Note: 1 As of Mar-2025; 2 As of Mar-2025, according to data from the Japan Securities Dealers Association; 3 As of Jun-2025, according to data from the JVCEA; 4 As of Jun-2025; 5 Index of crypto adoption determined by rating 151 countries’ peer-to-peer exchange trade volume and on-chain cryptocurrency and retail value received at centralized exchanges and from DeFi protocols from 0 (lowest rank) to 1 (highest rank) by Chainalysis in September 2024; 6 Per World Bank data as of 2024; 7 As of Jun-2025; 8 As of Apr-2025, according to Morning Consult Japan’s digital asset adoption is in early stage of adoption, representing an opportunity to ‘catch-up’ to countries of similar economic size 2.4M4 12.6M3 123M1 Japan Population Japan Crypto Community Coincheck Number of Verified Accounts 0.104 0.110 0.125 0.215 0.540 Japan Germany China United Kingdom United States 38.6M2 Japan Securities Accounts

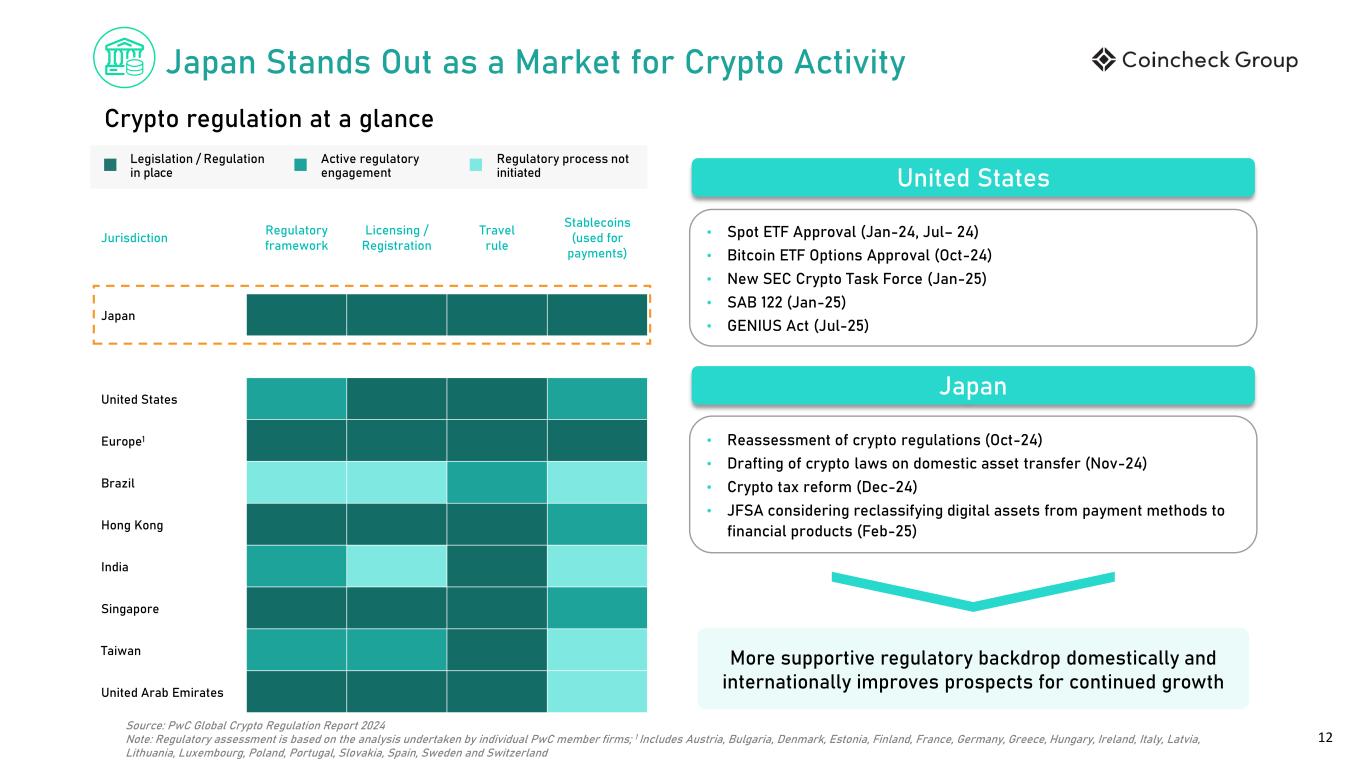

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 12 Jurisdiction Regulatory framework Licensing / Registration Travel rule Stablecoins (used for payments) Japan United States Europe1 Brazil Hong Kong India Singapore Taiwan United Arab Emirates Japan Stands Out as a Market for Crypto Activity Legislation / Regulation in place Active regulatory engagement Regulatory process not initiated Source: PwC Global Crypto Regulation Report 2024 Note: Regulatory assessment is based on the analysis undertaken by individual PwC member firms; 1 Includes Austria, Bulgaria, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Poland, Portugal, Slovakia, Spain, Sweden and Switzerland Crypto regulation at a glance • Spot ETF Approval (Jan-24, Jul– 24) • Bitcoin ETF Options Approval (Oct-24) • New SEC Crypto Task Force (Jan-25) • SAB 122 (Jan-25) • GENIUS Act (Jul-25) United States Japan • Reassessment of crypto regulations (Oct-24) • Drafting of crypto laws on domestic asset transfer (Nov-24) • Crypto tax reform (Dec-24) • JFSA considering reclassifying digital assets from payment methods to financial products (Feb-25) More supportive regulatory backdrop domestically and internationally improves prospects for continued growth

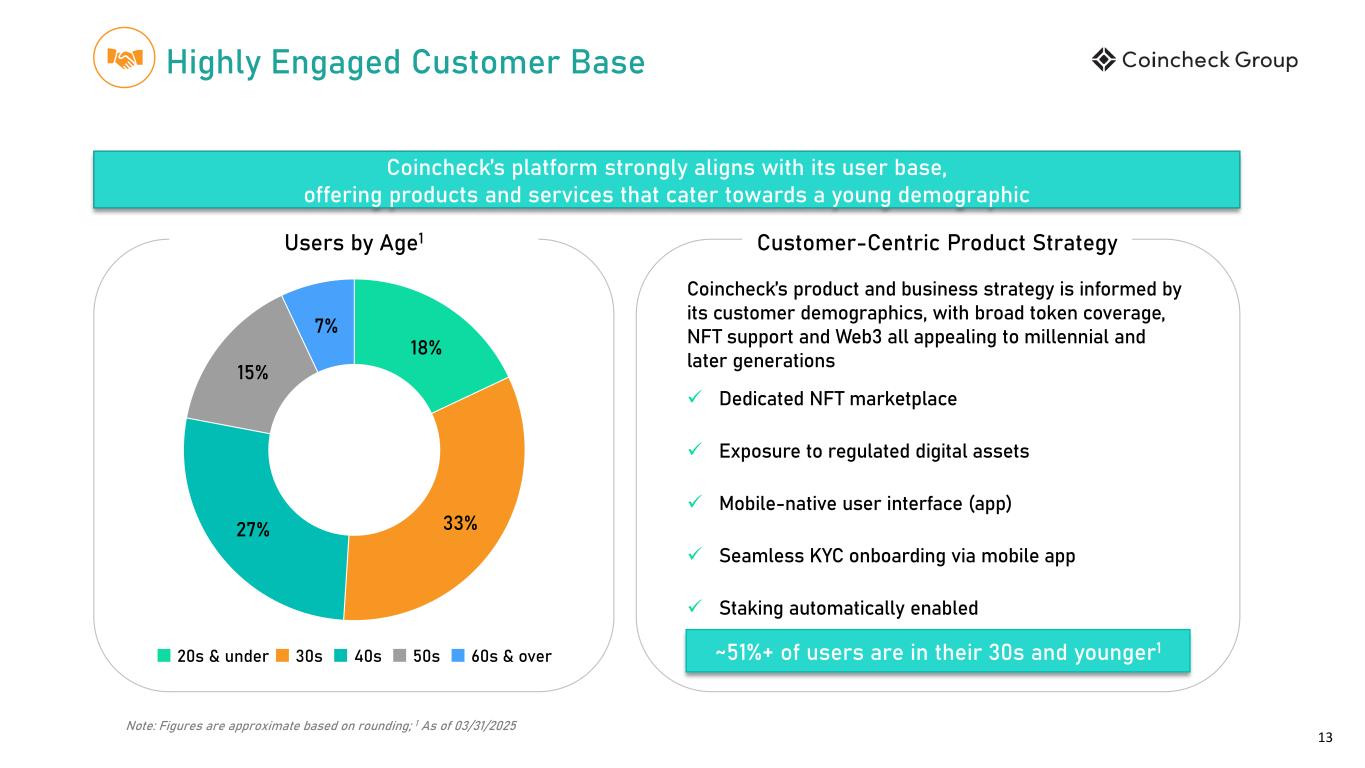

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 13 18% 33%27% 15% 7% Highly Engaged Customer Base Coincheck’s platform strongly aligns with its user base, offering products and services that cater towards a young demographic Users by Age1 Note: Figures are approximate based on rounding; 1 As of 03/31/2025 ■ 20s & under ■ 30s ■ 40s ■ 50s ■ 60s & over Customer-Centric Product Strategy Coincheck’s product and business strategy is informed by its customer demographics, with broad token coverage, NFT support and Web3 all appealing to millennial and later generations ✓ Dedicated NFT marketplace ✓ Exposure to regulated digital assets ✓ Mobile-native user interface (app) ✓ Seamless KYC onboarding via mobile app ✓ Staking automatically enabled ~51%+ of users are in their 30s and younger1

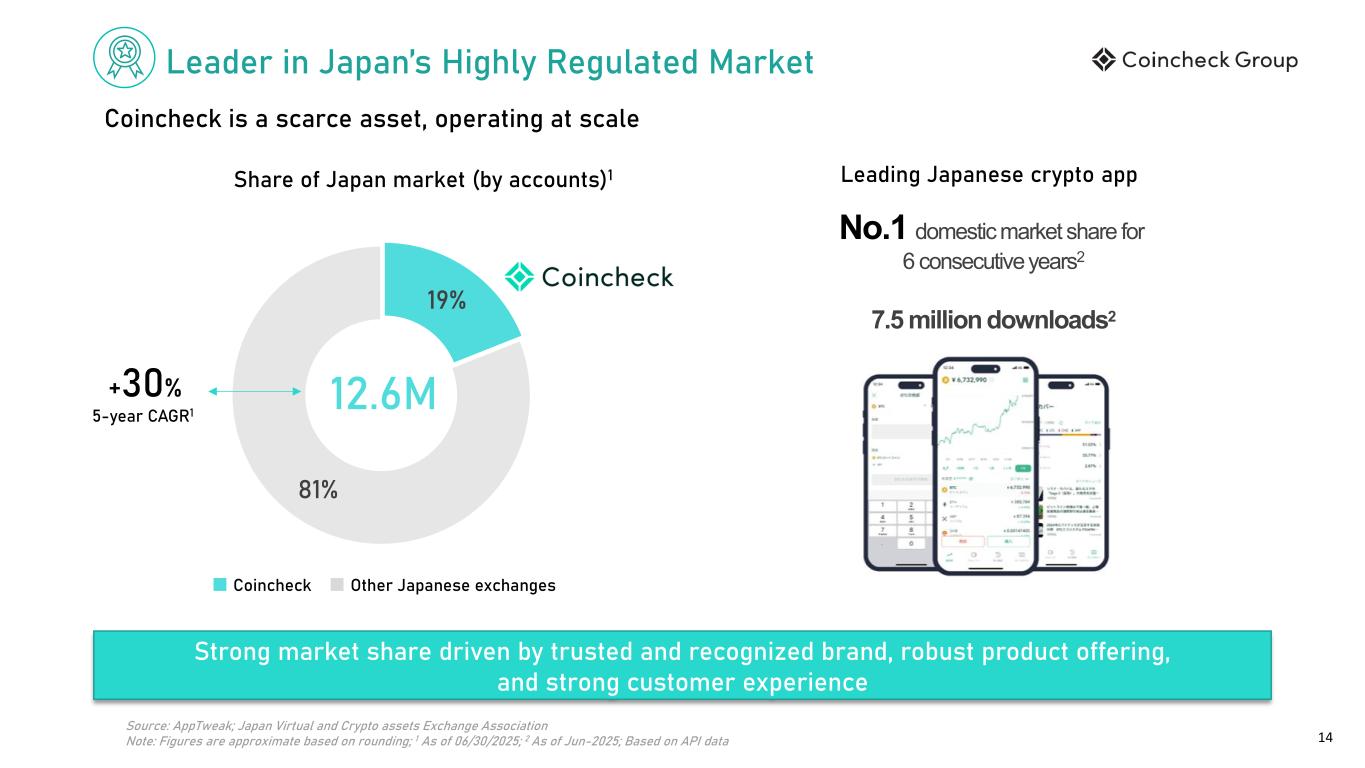

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 14 Leader in Japan’s Highly Regulated Market Coincheck is a scarce asset, operating at scale Share of Japan market (by accounts)1 Strong market share driven by trusted and recognized brand, robust product offering, and strong customer experience Source: AppTweak; Japan Virtual and Crypto assets Exchange Association Note: Figures are approximate based on rounding; 1 As of 06/30/2025; 2 As of Jun-2025; Based on API data ■ Coincheck ■ Other Japanese exchanges 19% 81% 12.6M No.1 domestic market share for 6 consecutive years2 7.5 million downloads2 +30% 5-year CAGR1 Leading Japanese crypto app

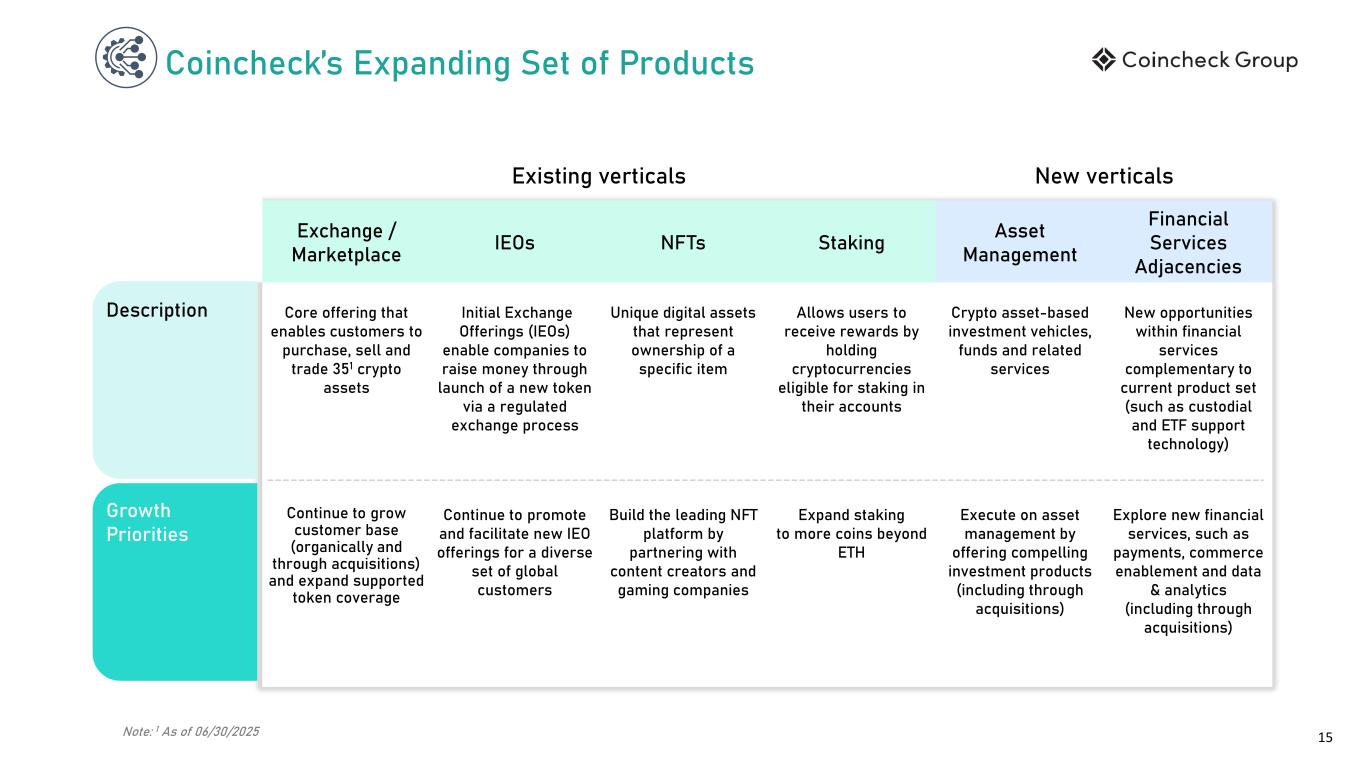

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 15 Existing verticals New verticals Exchange / Marketplace IEOs NFTs Staking Asset Management Financial Services Adjacencies Core offering that enables customers to purchase, sell and trade 351 crypto assets Initial Exchange Offerings (IEOs) enable companies to raise money through launch of a new token via a regulated exchange process Unique digital assets that represent ownership of a specific item Allows users to receive rewards by holding cryptocurrencies eligible for staking in their accounts Crypto asset-based investment vehicles, funds and related services New opportunities within financial services complementary to current product set (such as custodial and ETF support technology) Continue to grow customer base (organically and through acquisitions) and expand supported token coverage Continue to promote and facilitate new IEO offerings for a diverse set of global customers Build the leading NFT platform by partnering with content creators and gaming companies Expand staking to more coins beyond ETH Execute on asset management by offering compelling investment products (including through acquisitions) Explore new financial services, such as payments, commerce enablement and data & analytics (including through acquisitions) Coincheck’s Expanding Set of Products Description Growth Priorities Note: 1 As of 06/30/2025

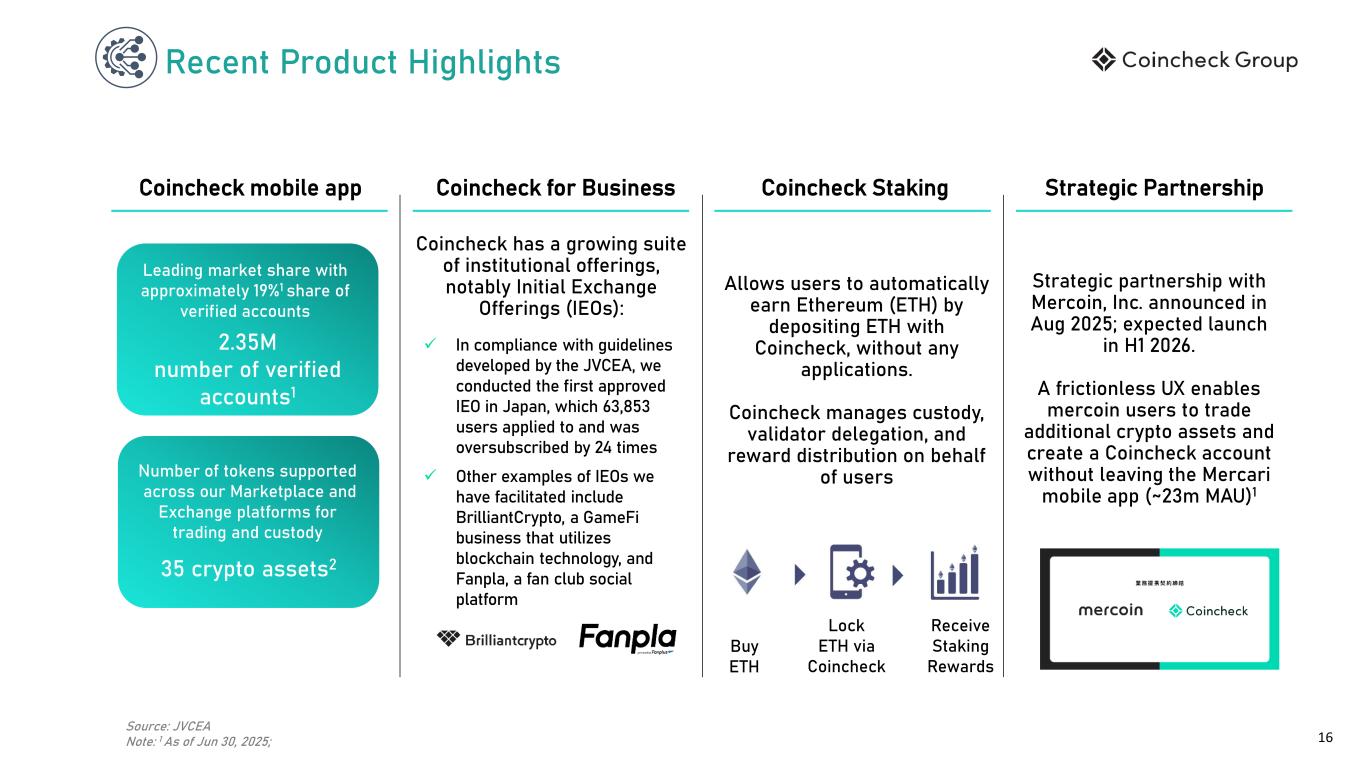

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 16 Recent Product Highlights Strategic partnership with Mercoin, Inc. announced in Aug 2025; expected launch in H1 2026. A frictionless UX enables mercoin users to trade additional crypto assets and create a Coincheck account without leaving the Mercari mobile app (~23m MAU)1 Coincheck Staking 2.35M number of verified accounts1 Leading market share with approximately 19%1 share of verified accounts 35 crypto assets2 Number of tokens supported across our Marketplace and Exchange platforms for trading and custody Coincheck mobile app Coincheck for Business ✓ In compliance with guidelines developed by the JVCEA, we conducted the first approved IEO in Japan, which 63,853 users applied to and was oversubscribed by 24 times ✓ Other examples of IEOs we have facilitated include BrilliantCrypto, a GameFi business that utilizes blockchain technology, and Fanpla, a fan club social platform Coincheck has a growing suite of institutional offerings, notably Initial Exchange Offerings (IEOs): Source: JVCEA Note: 1 As of Jun 30, 2025; Allows users to automatically earn Ethereum (ETH) by depositing ETH with Coincheck, without any applications. Coincheck manages custody, validator delegation, and reward distribution on behalf of users Strategic Partnership Buy ETH Lock ETH via Coincheck Receive Staking Rewards

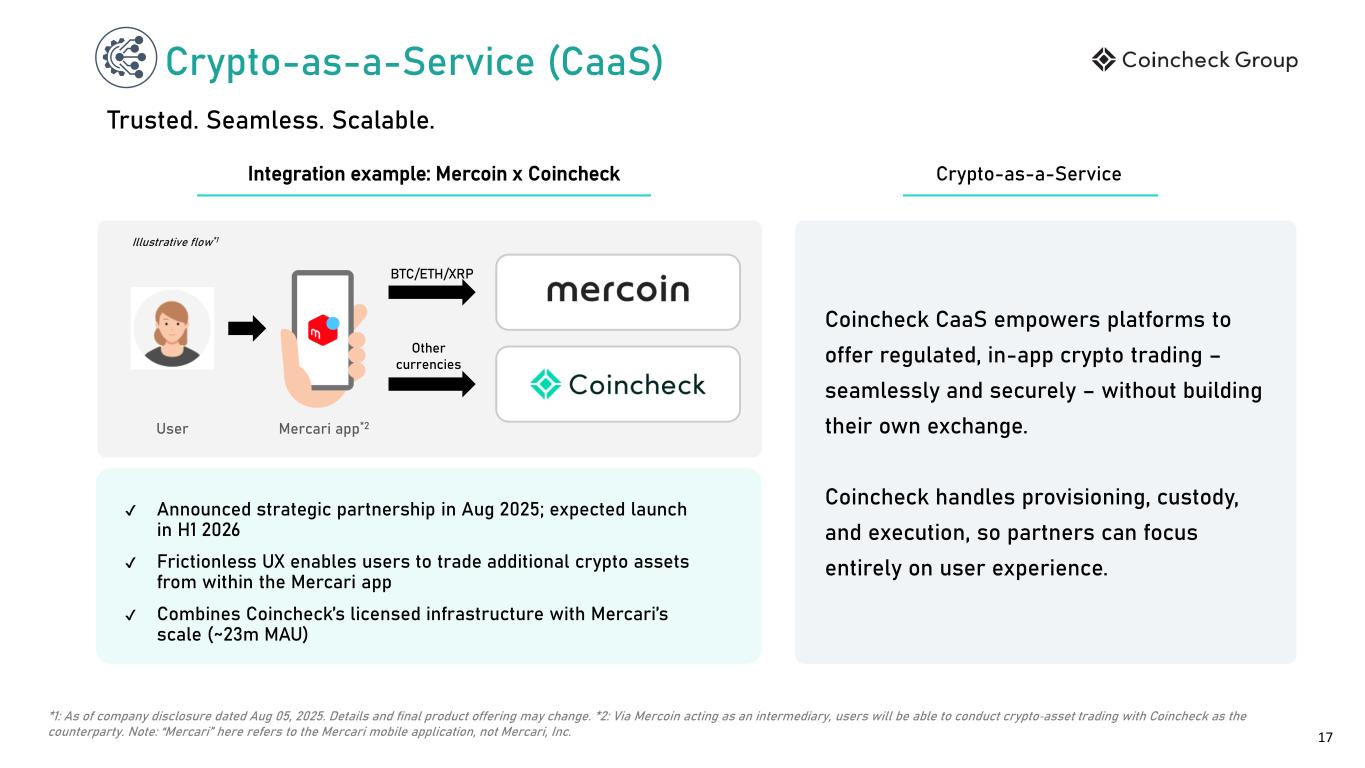

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 17 Coincheck CaaS empowers platforms to offer regulated, in-app crypto trading – seamlessly and securely – without building their own exchange. Coincheck handles provisioning, custody, and execution, so partners can focus entirely on user experience. ✔ Announced strategic partnership in Aug 2025; expected launch in H1 2026 ✔ Frictionless UX enables users to trade additional crypto assets from within the Mercari app ✔ Combines Coincheck’s licensed infrastructure with Mercari’s scale (~23m MAU) Crypto-as-a-Service (CaaS) Trusted. Seamless. Scalable. Crypto-as-a-ServiceIntegration example: Mercoin x Coincheck Mercari app*2 Other currencies BTC/ETH/XRP Illustrative flow*1 User *1: As of company disclosure dated Aug 05, 2025. Details and final product offering may change. *2: Via Mercoin acting as an intermediary, users will be able to conduct crypto‐asset trading with Coincheck as the counterparty. Note: “Mercari” here refers to the Mercari mobile application, not Mercari, Inc.

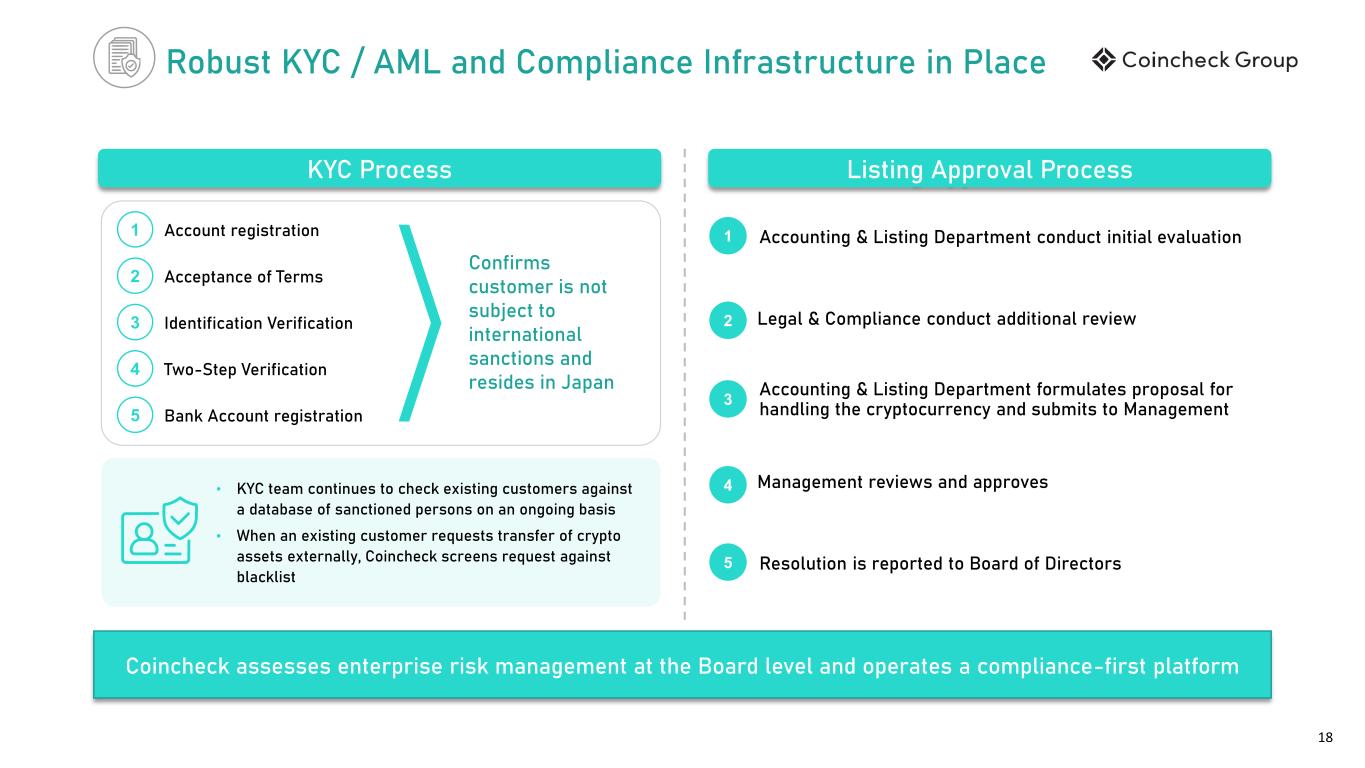

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 18 Robust KYC / AML and Compliance Infrastructure in Place KYC Process Listing Approval Process Accounting & Listing Department conduct initial evaluation1 Legal & Compliance conduct additional review2 Accounting & Listing Department formulates proposal for handling the cryptocurrency and submits to Management 3 Management reviews and approves4 Resolution is reported to Board of Directors5 v • KYC team continues to check existing customers against a database of sanctioned persons on an ongoing basis • When an existing customer requests transfer of crypto assets externally, Coincheck screens request against blacklist Account registration1 Acceptance of Terms2 Identification Verification3 Two-Step Verification4 Bank Account registration5 Confirms customer is not subject to international sanctions and resides in Japan Coincheck assesses enterprise risk management at the Board level and operates a compliance-first platform

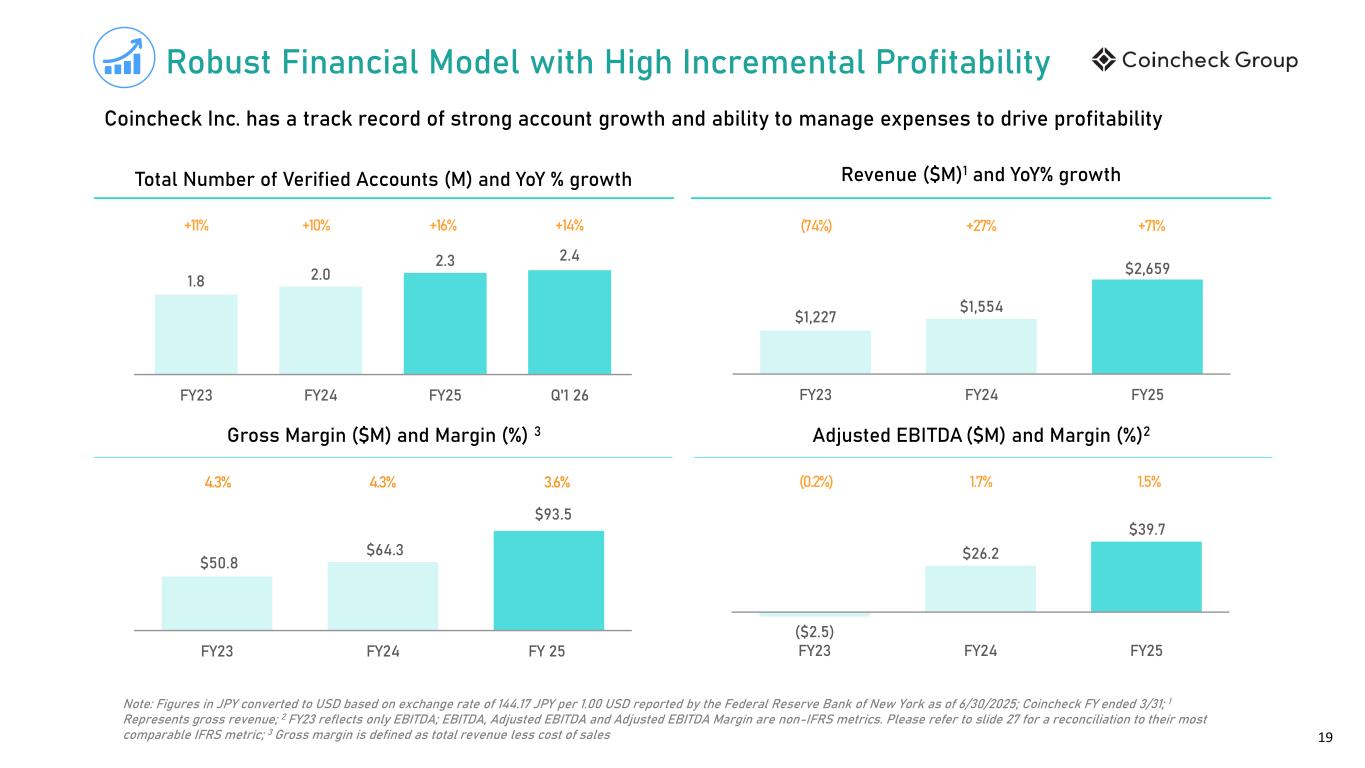

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 19 Robust Financial Model with High Incremental Profitability Coincheck Inc. has a track record of strong account growth and ability to manage expenses to drive profitability Revenue ($M)1 and YoY% growth Note: Figures in JPY converted to USD based on exchange rate of 144.17 JPY per 1.00 USD reported by the Federal Reserve Bank of New York as of 6/30/2025; Coincheck FY ended 3/31; 1 Represents gross revenue; 2 FY23 reflects only EBITDA; EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS metrics. Please refer to slide 27 for a reconciliation to their most comparable IFRS metric; 3 Gross margin is defined as total revenue less cost of sales Total Number of Verified Accounts (M) and YoY % growth 1.8 2.0 2.3 2.4 FY23 FY24 FY25 Q'1 26 +11% +10% +16% $1,227 $1,554 $2,659 FY23 FY24 FY25 (74%) +27% Adjusted EBITDA ($M) and Margin (%)2Gross Margin ($M) and Margin (%) 3 $50.8 $64.3 $93.5 FY23 FY24 FY 25 4.3% 4.3% ($2.5) $26.2 $39.7 FY23 FY24 FY25 (0.2%) 1.7% 1.5%3.6% +71%+14%

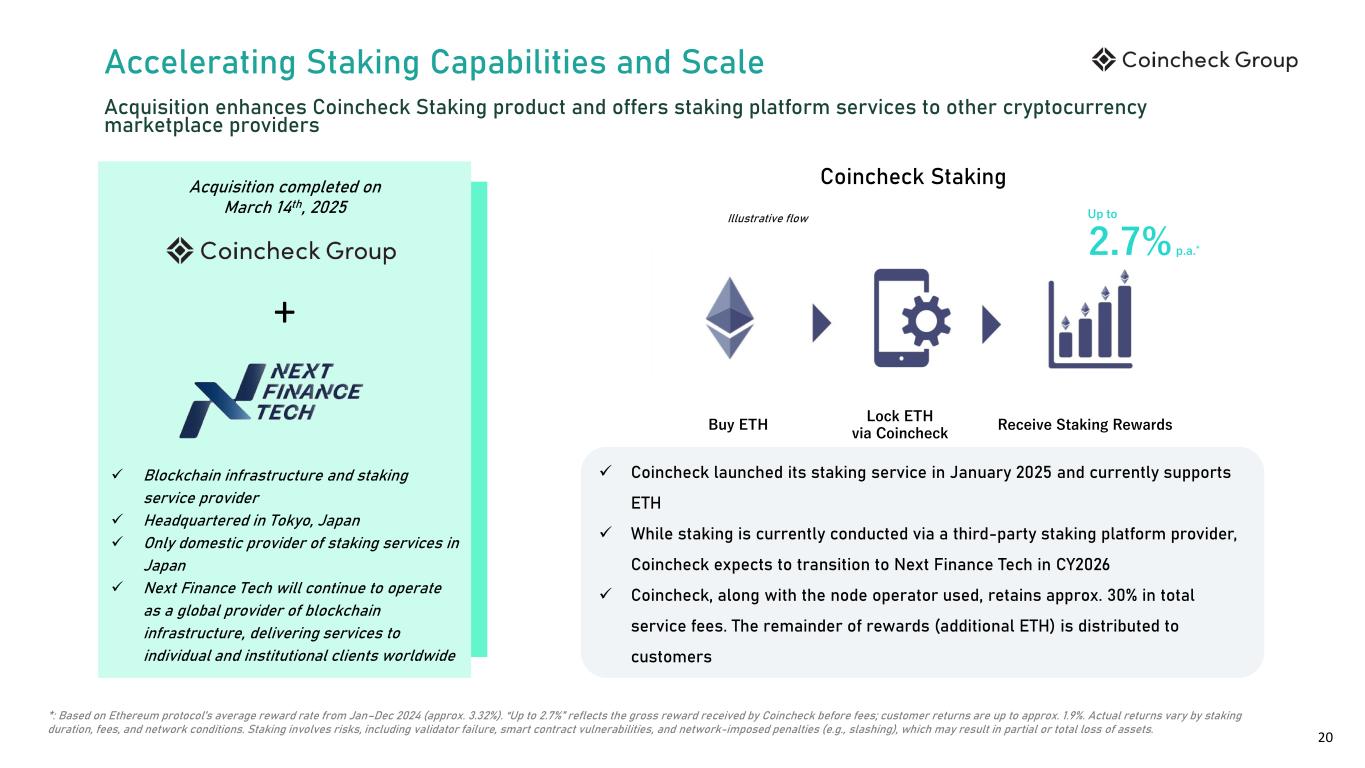

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 20 Accelerating Staking Capabilities and Scale Acquisition enhances Coincheck Staking product and offers staking platform services to other cryptocurrency marketplace providers ✓ Blockchain infrastructure and staking service provider ✓ Headquartered in Tokyo, Japan ✓ Only domestic provider of staking services in Japan ✓ Next Finance Tech will continue to operate as a global provider of blockchain infrastructure, delivering services to individual and institutional clients worldwide Coincheck Staking Illustrative flow Buy ETH Lock ETH via Coincheck Receive Staking Rewards ✓ Coincheck launched its staking service in January 2025 and currently supports ETH ✓ While staking is currently conducted via a third-party staking platform provider, Coincheck expects to transition to Next Finance Tech in CY2026 ✓ Coincheck, along with the node operator used, retains approx. 30% in total service fees. The remainder of rewards (additional ETH) is distributed to customers 2.7% p.a.* Up to + Acquisition completed on March 14th, 2025 *: Based on Ethereum protocol’s average reward rate from Jan–Dec 2024 (approx. 3.32%). “Up to 2.7%” reflects the gross reward received by Coincheck before fees; customer returns are up to approx. 1.9%. Actual returns vary by staking duration, fees, and network conditions. Staking involves risks, including validator failure, smart contract vulnerabilities, and network-imposed penalties (e.g., slashing), which may result in partial or total loss of assets.

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 21 Appendix

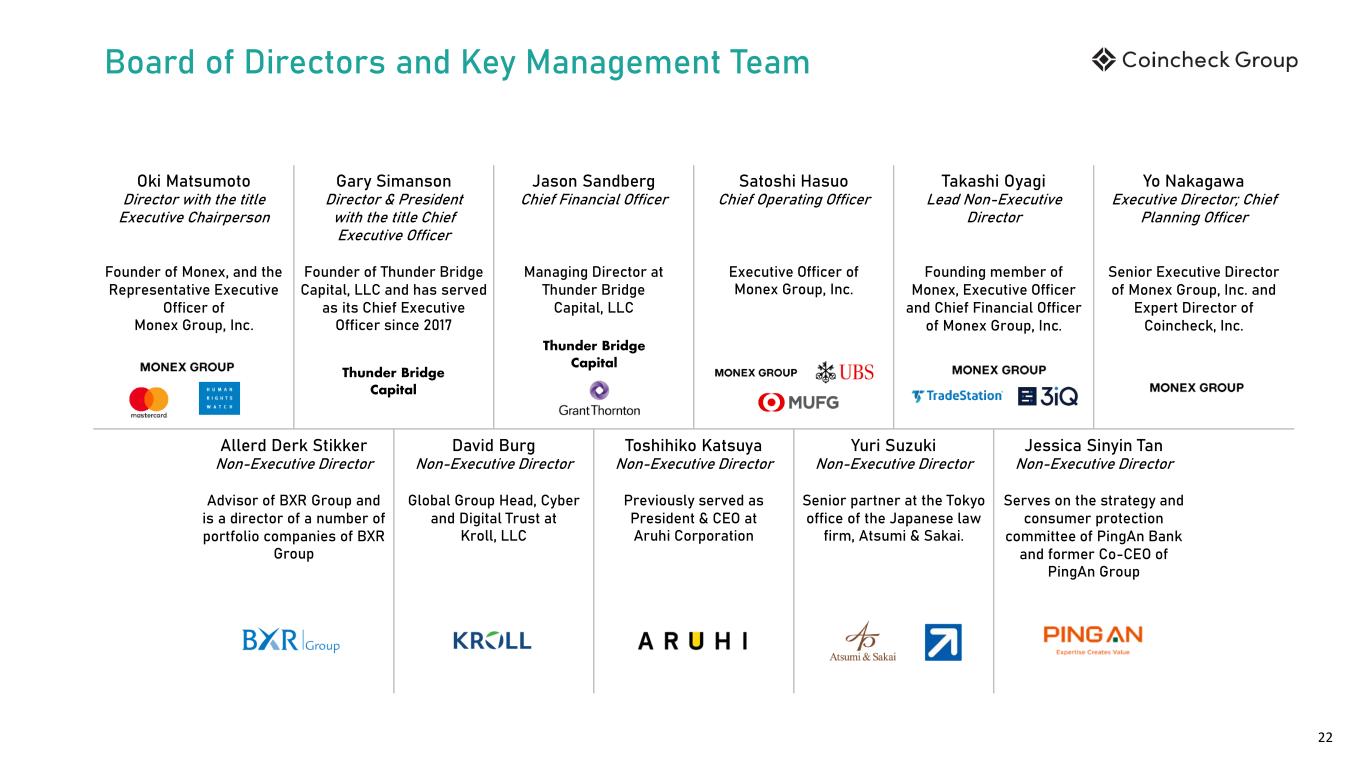

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 22 Allerd Derk Stikker Non-Executive Director Advisor of BXR Group and is a director of a number of portfolio companies of BXR Group David Burg Non-Executive Director Global Group Head, Cyber and Digital Trust at Kroll, LLC Toshihiko Katsuya Non-Executive Director Previously served as President & CEO at Aruhi Corporation Yuri Suzuki Non-Executive Director Senior partner at the Tokyo office of the Japanese law firm, Atsumi & Sakai. Jessica Sinyin Tan Non-Executive Director Serves on the strategy and consumer protection committee of PingAn Bank and former Co-CEO of PingAn Group Board of Directors and Key Management Team Oki Matsumoto Director with the title Executive Chairperson Founder of Monex, and the Representative Executive Officer of Monex Group, Inc. Gary Simanson Director & President with the title Chief Executive Officer Founder of Thunder Bridge Capital, LLC and has served as its Chief Executive Officer since 2017 Jason Sandberg Chief Financial Officer Managing Director at Thunder Bridge Capital, LLC Satoshi Hasuo Chief Operating Officer Executive Officer of Monex Group, Inc. Takashi Oyagi Lead Non-Executive Director Founding member of Monex, Executive Officer and Chief Financial Officer of Monex Group, Inc. Yo Nakagawa Executive Director; Chief Planning Officer Senior Executive Director of Monex Group, Inc. and Expert Director of Coincheck, Inc. Thunder Bridge Capital Thunder Bridge Capital

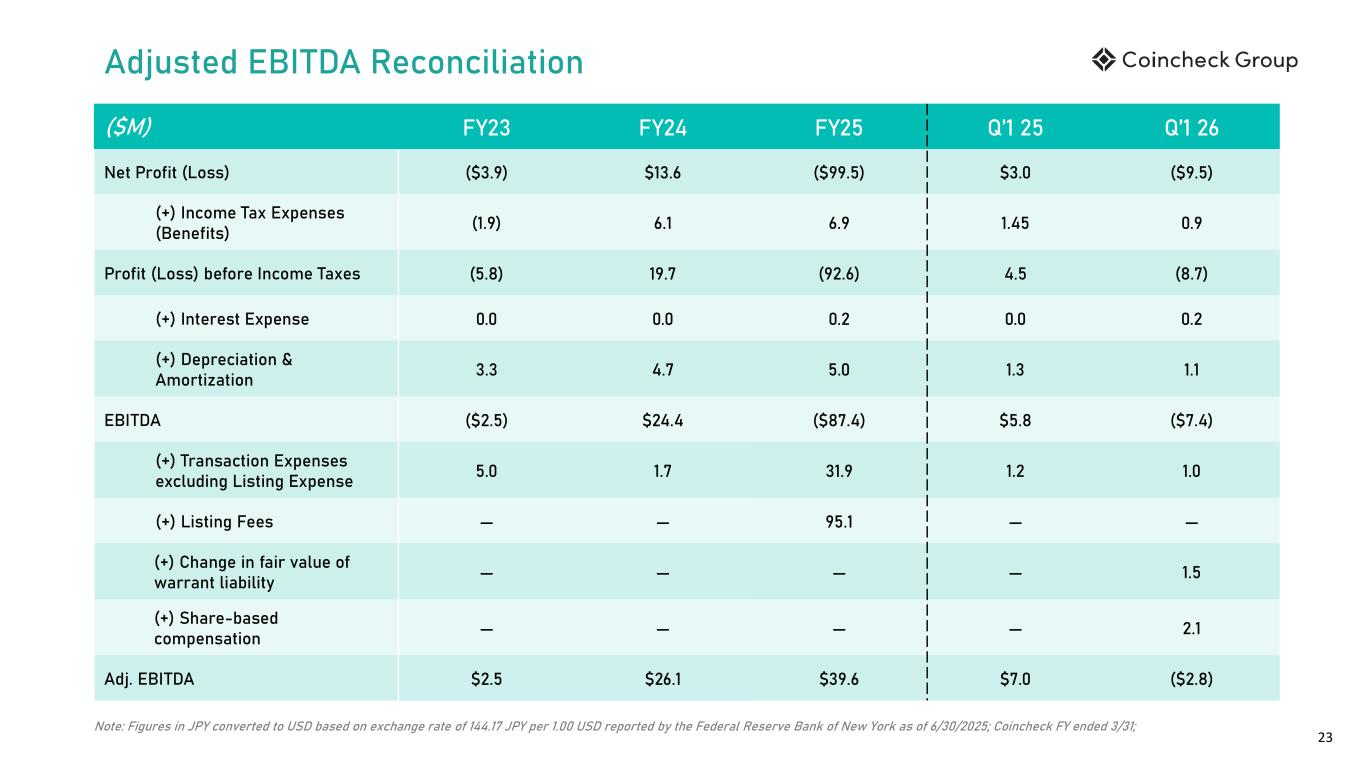

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 23 Adjusted EBITDA Reconciliation ($M) FY23 FY24 FY25 Q’1 25 Q’1 26 Net Profit (Loss) ($3.9) $13.6 ($99.5) $3.0 ($9.5) (+) Income Tax Expenses (Benefits) (1.9) 6.1 6.9 1.45 0.9 Profit (Loss) before Income Taxes (5.8) 19.7 (92.6) 4.5 (8.7) (+) Interest Expense 0.0 0.0 0.2 0.0 0.2 (+) Depreciation & Amortization 3.3 4.7 5.0 1.3 1.1 EBITDA ($2.5) $24.4 ($87.4) $5.8 ($7.4) (+) Transaction Expenses excluding Listing Expense 5.0 1.7 31.9 1.2 1.0 (+) Listing Fees — — 95.1 — — (+) Change in fair value of warrant liability — — — — 1.5 (+) Share-based compensation — — — — 2.1 Adj. EBITDA $2.5 $26.1 $39.6 $7.0 ($2.8) Note: Figures in JPY converted to USD based on exchange rate of 144.17 JPY per 1.00 USD reported by the Federal Reserve Bank of New York as of 6/30/2025; Coincheck FY ended 3/31;

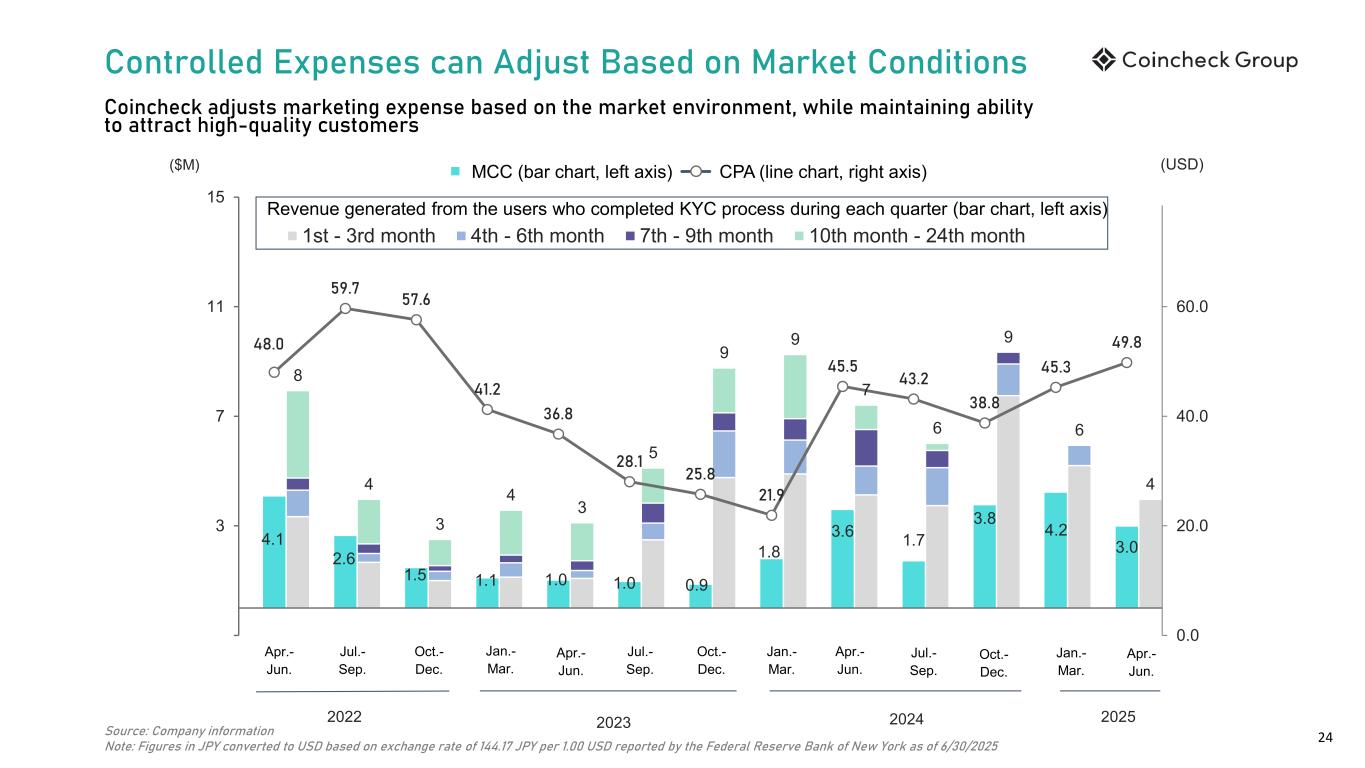

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 24 4.1 2.6 1.5 1.1 1.0 1.0 0.9 1.8 3.6 1.7 3.8 4.2 3.0 8 4 3 4 3 5 9 9 7 6 9 6 4 48.0 59.7 57.6 41.2 36.8 28.1 25.8 21.9 45.5 43.2 38.8 45.3 49.8 0.0 20.0 40.0 60.0 80.0 3 7 11 15 1st - 3rd month 4th - 6th month 7th - 9th month 10th month - 24th month Controlled Expenses can Adjust Based on Market Conditions Coincheck adjusts marketing expense based on the market environment, while maintaining ability to attract high-quality customers (USD) Revenue generated from the users who completed KYC process during each quarter (bar chart, left axis) MCC (bar chart, left axis) CPA (line chart, right axis)($M) Apr.- Jun. Jul.- Sep. Jan.- Mar. Oct.- Dec. Apr.- Jun. Jul.- Sep. Jan.- Mar. Oct.- Dec. Apr.- Jun. Oct.- Dec. Jul.- Sep. Jan.- Mar. 2022 2023 2024 2025 Apr.- Jun. Source: Company information Note: Figures in JPY converted to USD based on exchange rate of 144.17 JPY per 1.00 USD reported by the Federal Reserve Bank of New York as of 6/30/2025

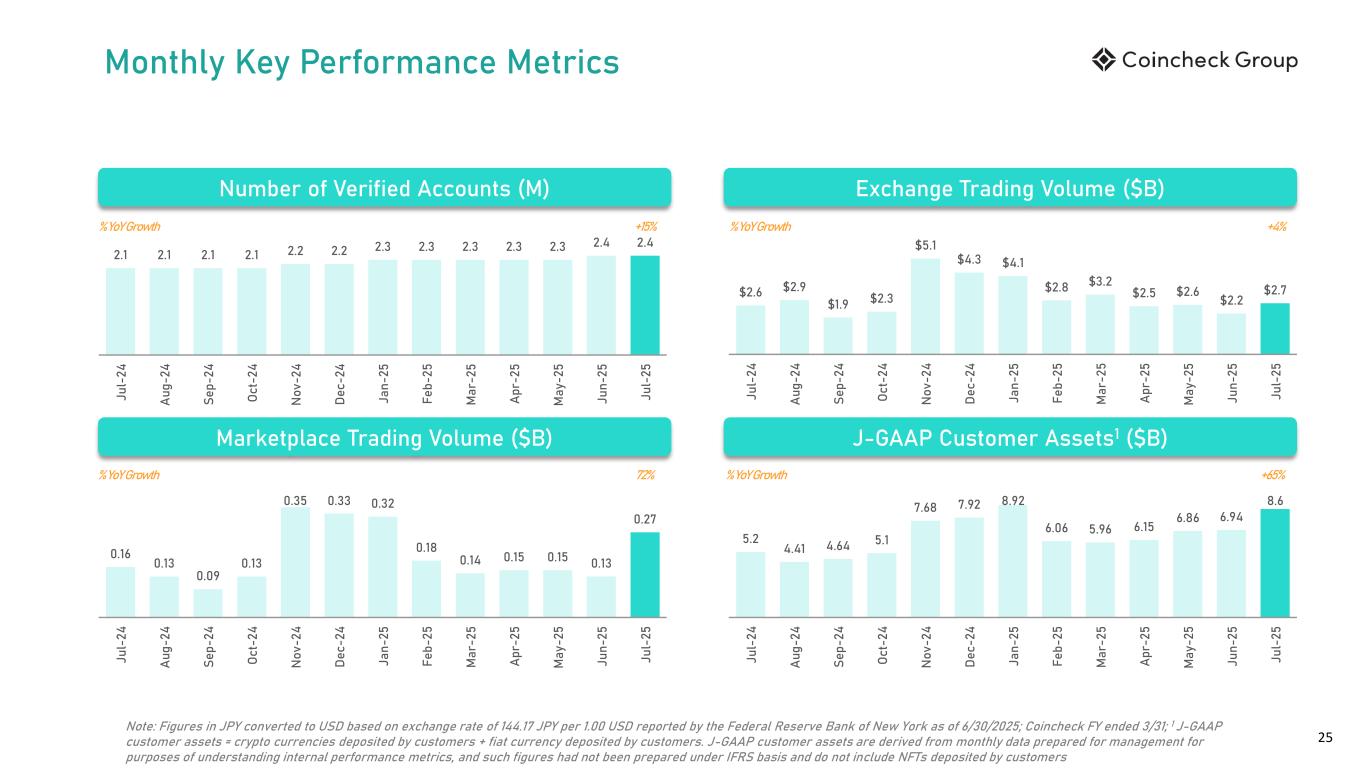

40-216-205 14-219-162 247-150-34 2-189-180 158-158-158 72-161-250 25 Number of Verified Accounts (M) Monthly Key Performance Metrics Note: Figures in JPY converted to USD based on exchange rate of 144.17 JPY per 1.00 USD reported by the Federal Reserve Bank of New York as of 6/30/2025; Coincheck FY ended 3/31; 1 J-GAAP customer assets = crypto currencies deposited by customers + fiat currency deposited by customers. J-GAAP customer assets are derived from monthly data prepared for management for purposes of understanding internal performance metrics, and such figures had not been prepared under IFRS basis and do not include NFTs deposited by customers 2.1 2.1 2.1 2.1 2.2 2.2 2.3 2.3 2.3 2.3 2.3 2.4 2.4 J u l- 2 4 A u g -2 4 S e p -2 4 O c t- 2 4 N o v -2 4 D e c -2 4 J a n -2 5 F e b -2 5 M a r- 2 5 A p r- 2 5 M a y- 2 5 J u n -2 5 J u l- 2 5 Exchange Trading Volume ($B) $2.6 $2.9 $1.9 $2.3 $5.1 $4.3 $4.1 $2.8 $3.2 $2.5 $2.6 $2.2 $2.7 J u l- 2 4 A u g -2 4 S e p -2 4 O c t- 2 4 N o v -2 4 D e c -2 4 J a n -2 5 F e b -2 5 M a r- 2 5 A p r- 2 5 M a y- 2 5 J u n -2 5 J u l- 2 5 Marketplace Trading Volume ($B) 0.16 0.13 0.09 0.13 0.35 0.33 0.32 0.18 0.14 0.15 0.15 0.13 0.27 J u l- 2 4 A u g -2 4 S e p -2 4 O c t- 2 4 N o v -2 4 D e c -2 4 J a n -2 5 F e b -2 5 M a r- 2 5 A p r- 2 5 M a y- 2 5 J u n -2 5 J u l- 2 5 J-GAAP Customer Assets1 ($B) 5.2 4.41 4.64 5.1 7.68 7.92 8.92 6.06 5.96 6.15 6.86 6.94 8.6 J u l- 2 4 A u g -2 4 S e p -2 4 O c t- 2 4 N o v -2 4 D e c -2 4 J a n -2 5 F e b -2 5 M a r- 2 5 A p r- 2 5 M a y- 2 5 J u n -2 5 J u l- 2 5 +15%% YoY Growth +4%% YoY Growth 72%% YoY Growth +65%% YoY Growth