F-3/A: Registration statement by foreign private issuers

Published on January 8, 2026

As filed with the Securities and Exchange Commission on January 8, 2026

Registration No. 333-292562

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Amendment No. 1 to

FORM F-3

REGISTRATION STATEMENT

Under

The Securities Act of 1933

FORM F-3

REGISTRATION STATEMENT

Under

The Securities Act of 1933

__________________________________________

COINCHECK GROUP N.V.

(Exact name of Registrant as specified in its charter)

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Translation of Registrant’s name into English)

__________________________________________

| The Netherlands | Not Applicable | |||||||||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |||||||||||||

Coincheck Group N.V.

Nieuwezijds Voorburgwal 62

1012 SJ Amsterdam

The Netherlands

+31 20-522-2555

(Address and telephone number of Registrant’s principal executive offices)

Nieuwezijds Voorburgwal 62

1012 SJ Amsterdam

The Netherlands

+31 20-522-2555

(Address and telephone number of Registrant’s principal executive offices)

__________________________________________

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

Telephone: (800) 221-0102

(Name, address, and telephone number of agent for service)

122 East 42nd Street, 18th Floor

New York, NY 10168

Telephone: (800) 221-0102

(Name, address, and telephone number of agent for service)

__________________________________________

Copies to:

Jonathan H. Talcott

E. Peter Strand

Michael K. Bradshaw, Jr.

Nelson Mullins Riley & Scarborough LLP

101 Constitution Ave, NW, Suite 900

Washington, DC 20001

(202) 689-2800

__________________________________________

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective as determined by market conditions and other factors.

If any of the securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two prospectuses:

•a base prospectus (the “Base Prospectus”) for the purpose of implementing a “shelf” registration process, which covers the offering, issuance and sale by us of up to $200 million of our ordinary shares, purchase contracts, warrants, subscriptions rights, debt securities and/or units from time to time in one or more offerings; and

•a prospectus (the “Selling Securityholder Prospectus”) that covers the offering and sale by us of up to 4,730,537 of our ordinary shares that are issuable by us upon the exercise of 4,730,537 Public Warrants (as defined below) that were previously registered.

The Selling Securityholder Prospectus also relates to the offer and sale from time to time by the selling securityholders named in this prospectus (collectively, the “Selling Securityholders”) of

(A)up to 128,882,309 Ordinary Shares, comprising

(i)up to 511,639 Ordinary Shares (the “Thunder Bridge Capital Ordinary Shares”) held by Thunder Bridge Capital LLC, an affiliate of TBCP IV, LLC (the “Thunder Bridge Sponsor” or “Sponsor”), that were among shares previously registered on the Prior Registration Statement (as defined below);

(ii)up to an aggregate of 122,587,617 Ordinary Shares (the “CNCK Ordinary Shares” and, together with the Thunder Bridge Capital Ordinary Shares, the “BCA Ordinary Shares”) received by the Coincheck Shareholders in exchange for their existing equity interests in Coincheck, Inc. in connection with the completion of the Business Combination, including (1) up to 109,097,910 Ordinary Shares that were received by Monex Group, Inc., (“Monex”) (2) up to 9,700,464 Ordinary Shares that were received by Koichiro Wada (“Koichiro Wada”), and (3) up to 3,789,243 Ordinary Shares that were received by Yusuke Otsuka (“Yusuke Otsuka” and, together with Thunder Bridge Sponsor, Monex and Koichiro Wada, the “BCA Selling Securityholders”), that were previously registered on the Prior Registration Statement (as defined below);

(iii)up to an aggregate of 775,553 Ordinary Shares (the “Next Finance Acquisition Shares”) received by the former holders (the “Next Finance Shareholders”) of all of the issued and outstanding shares (the “Next Finance Shares”) of Next Finance Tech Co. Ltd., a corporation under the laws of Japan (“Next Finance Tech Co.”) in exchange for their equity interests in Next Finance Tech Co., that are among shares previously registered on the Prior Registration Statement (as defined below);

(iv)up to 5,007,500 Ordinary Shares (the “Aplo Ordinary Shares”) received by the former holders (the “Aplo Shareholders”) of all of the issued and outstanding shares (the “Aplo Shares”) of Aplo SAS, a simplified joint stock company (société par actions simplifiée) under the laws of France (“Aplo”) in exchange for their equity interest in Aplo; and

(B)up to 129,611 Ordinary Shares issuable upon the exercise of the Private Warrants previously registered on the Prior Registration Statement (as defined below).

The Base Prospectus immediately follows after this explanatory note. The specific terms of any securities to be offered pursuant to the Base Prospectus will be set forth in one or more prospectus supplements to the base prospectus.

The Selling Securityholder Prospectus immediately follows the Base Prospectus. Pursuant to Rule 429 under the Securities Act of 1933, as amended (the “Securities Act”), the Selling Securityholder Prospectus that is a part of this registration statement (the “F-3 Registration Statement”) is a combined prospectus which relates to the registration statement on Form F-1 (File No. 333-284537), which was originally filed by Coincheck Group N.V.

(“Coincheck Group,” “Company,” “we” or “our”) on January 28, 2025 and declared effective on April 8, 2025 (the “Prior Registration Statement”). This registration statement is also being filed to convert the Prior Registration Statement into a Registration Statement on Form F-3 and to register certain additional ordinary shares for resale. All filing fees payable in connection with the registration of the securities registered by the Prior Registration Statement were paid by the Company at the time of the filing of the Prior Registration Statement.

The information contained in this preliminary prospectus is not complete and may be changed. No securities may be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED JANUARY 8, 2026 | ||||

COINCHECK GROUP N.V.

$200,000,000

ORDINARY SHARES

PURCHASE CONTRACTS

WARRANTS

SUBSCRIPTION RIGHTS

DEBT SECURITIES

UNITS

We may offer and sell from time to time, in one or more series, any one of the following securities of Coincheck Group N.V. (the “Company,” "Coincheck Parent", “we,” “us” or “our”), for total gross proceeds of up to $200 million:

•ordinary shares with a nominal value of one eurocent (EUR 0.01) (“ordinary shares”);

•purchase contracts;

•warrants to purchase our securities;

•subscription rights to purchase our securities;

•secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness, which may include senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities; or

•units comprised of, or other combinations of, the foregoing securities.

We may offer and sell these securities separately or together, in one or more series or classes and in amounts, at prices and on terms described in one or more offerings. We may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents, directly to purchasers or through a combination of these methods, on a continuous or delayed basis. If any underwriters, dealers or agents are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters, dealers or agents and any applicable fees, commissions, discounts or options to purchase additional shares to be provided to them will be set forth in a prospectus supplement. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering. The price to the public of such securities and the net proceeds we expect to receive from such a sale will also be set forth in the prospectus supplement. For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. Each time our securities are offered, we will provide a prospectus supplement containing

more specific information about the particular offering and attach it to this prospectus. The prospectus supplements may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectuses, as well as any documents incorporated by reference, before purchasing any of the securities being offered.

This prospectus may not be used to offer or sell securities without a prospectus supplement that includes a description of the method and terms of the offering.

Our Ordinary Shares and Public Warrants are listed on the Nasdaq Global Market (“Nasdaq”) under the symbols “CNCK” and “CNCKW,” respectively. Holders of Ordinary Shares and Public Warrants should obtain current market quotations for their securities. On January 6, 2026, the last reported sale prices for our Ordinary Shares and Public Warrants on Nasdaq were $2.91 per share and $0.41 per warrant, respectively. Prospective purchasers of our securities are urged to obtain current information as to the market prices of our securities, where applicable.

If we decide to seek a listing of any purchase contracts, warrants, subscriptions rights, debt securities or units offered by this prospectus, the related prospectus supplement will disclose the exchange or market on which the securities will be listed, if any, or where we have applied for listing, if anywhere.

We are a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company disclosure and reporting requirements. See “Prospectus Summary - Implications of Being a Foreign Private Issuer and a Controlled Company.”

An investment in the securities offered through this prospectus is speculative and involves a high degree of risk. You should carefully consider the risk factors beginning on page 7 of this prospectus and the risk factors in our most recent Annual Report on Form 20-F, which is incorporated by reference herein, and in the relevant prospectus supplements. We urge you to carefully read this prospectus, the applicable prospectus supplements and any related free writing prospectuses, as well as any documents incorporated by reference in this prospectus or any prospectus amendments or supplements, before investing.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2026.

TABLE OF CONTENTS

Page | |||||

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we have filed with the Securities and Exchange Commission, or SEC, employing a “shelf” registration process. Under this shelf registration process, we may offer and sell, either individually or in combination, in one or more offerings, any of the securities described in this prospectus, for total gross proceeds of up to $200 million. This prospectus provides you with a general description of the securities we may offer. Each time we offer securities under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize may also add, update or change any of the information contained in this prospectus or in the documents that we have incorporated by reference in this prospectus. This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

We urge you to read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectuses, as well as any documents incorporated by reference as described under the heading “Incorporation of Certain Information by Reference,” before investing in any of the securities being offered. You should rely only on the information contained in, or incorporated by reference in, this prospectus and any applicable prospectus supplement, along with the information contained in any related free writing prospectuses. We have not authorized anyone to provide you with different or additional information.

This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The distribution of this prospectus and the offering of securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

The information appearing in this prospectus, any applicable prospectus supplement and any related free writing prospectuses is accurate only as of the date on the front of such document and any information we have incorporated by reference in this prospectus or any prospectus supplement is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates. To the extent there are inconsistencies between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date will control.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” The representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

ii

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The information in this prospectus, any applicable prospectus supplement and any related free writing prospectuses, together with any information incorporated by reference in this prospectus and such prospectus supplement, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements other than statements of historical fact, including statements regarding our future operating results and financial position, our business strategy and plans, market growth, and our objectives for future operations, are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “could,” “would,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “project,” “target,” “continue” or the negative of these terms or other similar expressions, although not all forward-looking statements may contain these words. Forward-looking statements are only predictions and are based largely on our current expectations and projections about future events and financial trends that we reasonably believe may affect our business, financial condition and results of operations. Although we believe that the expectations reflected in our forward-looking statements are reasonable, actual outcomes could differ materially from those projected or assumed in any of our forward-looking statements. Our future business, financial condition and results of operations, as well as any forward-looking statements, are subject to change given the inherent risks and uncertainties of market and industry conditions.

Forward-looking statements are neither predictions nor guarantees of future outcomes. Forward-looking statements present estimates and assumptions only as of the date on the cover of the document in which they are contained, and are subject to significant known and unknown risks, uncertainties and assumptions. Accordingly, you are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. Important factors that could cause actual outcomes to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in this prospectus under “Risk Factors” and the following:

•the price of crypto assets and volume of transactions on Coincheck's platforms;

•the development, utility and usage of crypto assets, and people’s interest in investing in them and trading them, particularly in Japan;

•changes in economic conditions and consumer sentiment in Japan;

•cyberattacks and security breaches on the Coincheck platforms;

•the level of demand for any particular crypto asset or crypto assets generally;

•changes to any laws or regulations in the United States, Japan or the Netherlands that are adverse to the Company, or either’s failure to comply with any laws or regulations;

•administrative sanctions, including fines, or legal claims if we are found to have offered services in violations of the laws of jurisdictions other than Japan or to have violated international sanctions regimes;

•Coincheck’s ability to compete and increase market share in a highly competitive industry;

iii

•Coincheck’s ability to introduce new products and services, timely or at all;

•any interruptions in services provided by third-party service providers;

•the status of any particular crypto asset as to whether it is deemed a “security” in any relevant jurisdiction;

•legal, regulatory, and other risks in connection with our operation of Coincheck NFT Marketplace that could adversely affect our business, operating results, and financial condition;

•our obligations to comply with the laws, rules, regulations, and policies of a variety of jurisdictions if we expand our business outside of Japan;

•the inability to maintain the listing of our Ordinary Shares on Nasdaq;

•the ability to grow and manage growth profitably; and

•the other forward-looking statements regarding our company and its prospects included or incorporated by reference in this prospectus including, without limitation, those under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business” as such factors may be updated from time to time in our other filings with the SEC.

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with. Forward-looking statements necessarily involve risks and uncertainties, and our actual results could differ materially from those anticipated in the forward-looking statements due to a number of factors, including those set forth under “Risk Factors” and elsewhere contained or incorporated by reference in this prospectus. All written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this prospectus. Prior to investing in our ordinary shares, you should read this prospectus, our filings incorporated by reference herein and the documents we have filed as exhibits to this registration statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from what we currently expect.

Except as required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

iv

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We have proprietary rights to trademarks used in this prospectus that are important to our business, many of which are registered under applicable intellectual property laws. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the “®” or “TM” symbols, but the lack of such symbols is not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. The use or display herein of other companies’ trademarks, trade names or service marks is not intended to imply a relationship with, or endorsement or sponsorship of us by, any other companies, or a sponsorship or endorsement of any such other companies by us. Each trademark, trade name or service mark of any other company appearing in this prospectus is the property of its respective holder.

MARKET AND INDUSTRY DATA

Market data and certain industry forecast data used in this prospectus were obtained from internal reports, where appropriate, as well as third-party sources, including independent industry publications, as well as other publicly available information. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share. In addition, assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As a result, you should be aware that market, ranking and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. See “Cautionary Statement Regarding Forward-Looking Statements.”

v

FREQUENTLY USED TERMS

The following terms used in this prospectus have the meanings indicated below:

Term | Description | |||||||

Aplo SAS | Aplo is a digital assets prime brokerage that serves institutional crypto investors, that Coincheck Parent acquired in October 2025. | |||||||

Bitcoin (“BTC”) | The first system of global, decentralized, scarce, digital money as initially introduced in a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto. | |||||||

Block | Synonymous with digital pages in a ledger. Blocks are added to an existing blockchain as transactions occur on the network. Miners are rewarded for “mining” a new block. | |||||||

Blockchain | A cryptographically secure digital ledger that maintains a record of all transactions that occur on the network and follows a consensus protocol for confirming new blocks to be added to the blockchain. | |||||||

Board or Board of Directors | The board of directors of Coincheck Group N.V. | |||||||

Business Combination | The Business Combination consummated on December 10, 2024, pursuant to the Business Combination Agreement. | |||||||

Business Combination Agreement | The Business Combination Agreement, dated as of March 22, 2022, as amended from time to time, by and among Thunder Bridge, Coincheck Group B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (which was converted into a Dutch public limited liability company (naamloze vennootschap) and renamed Coincheck Group N.V. immediately prior to the Business Combination), M1 GK, Merger Sub and Coincheck. | |||||||

Coincheck | Coincheck, Inc., a Japanese joint stock company (kabushiki kaisha). | |||||||

Coincheck Parent | Coincheck Group N.V., a Dutch public limited liability company (naamloze vennootschap) (which was Coincheck Group B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) prior to its conversion in connection with the Business Combination.) | |||||||

Coincheck Shareholders | Monex Group, Inc., Koichiro Wada and Yusuke Otsuka. | |||||||

Coincheck NFT Marketplace | Coincheck’s service that enables non-fungible tokens, or NFTs, to be traded between users or purchased by users from Coincheck. | |||||||

cold wallet | Sometimes also described as cold storage, the storage of private keys in any fashion that is disconnected from the internet in order to protect data from unauthorized access. Common examples include offline computers, USB drives or paper records. | |||||||

Cover counterparties | Counterparties with which cover transactions are executed. | |||||||

Cover transactions | Transactions executed by Coincheck on an external exchange or on Coincheck’s Exchange platform in order to hedge Coincheck’s own position arising from transactions in crypto assets with users of Coincheck’s Marketplace platform. | |||||||

Crypto | A broad term for any cryptography-based market, system, application, or decentralized network. | |||||||

vi

Term | Description | |||||||

Crypto asset (or “token”) | A digital asset built using blockchain technology, including cryptocurrencies and NFTs. Under Japan’s Payment Services Act, digital assets that constitute a “security token” (i.e., electronically recorded transferable rights (“ERTRs”) or electronically recorded transferable rights to be indicated on securities (“ERTRISs”) under Japan’s Financial Instruments and Exchange Act (“FIEA”)) are excluded from the definition of crypto assets. Accordingly, crypto assets consist only of digital assets that have been determined not to constitute ERTRs or ERTRISs. | |||||||

Cryptocurrency | Bitcoin and alternative coins, or “altcoins,” launched after the success of Bitcoin. This category of crypto asset is designed to work as a medium of exchange, store of value, or to power applications and excludes security tokens. | |||||||

Customer assets | Cryptocurrencies held for customers + fiat currency deposited by customers. This definition, as used in the description of our business, does not include NFTs. | |||||||

Customers (or “users”) | Parties who hold accounts and utilize the services provided on crypto asset platforms. This definition, as used in the description of our business, generally does not include cover counterparties, and thus such definition differs from the definition of “customer” under IFRS 15. Notwithstanding the foregoing, for purposes of the Company’s audited consolidated financial statements and unaudited financial statements incorporated by reference, “customers” refers to customers that meet the definition of a customer under IFRS 15, including the parties described in the preceding paragraph as well as cover counterparties. | |||||||

Ethereum (“ETH”) | A decentralized global computing platform that supports smart contract transactions and peer-to-peer applications, or “Ether,” the native crypto assets on the Ethereum network. | |||||||

Exchange Act | The U.S. Securities Exchange Act of 1934, as amended. | |||||||

Exchange platform | Coincheck’s exchange platform, targeted to more sophisticated crypto investors and traders, which facilitates crypto asset purchase and sale transactions between customers generally on a no-fee basis, and on which Coincheck from time to time purchases or sells crypto assets to help support the covering of transactions on its Marketplace platform. | |||||||

Initial Exchange Offering (“IEO”)/Initial Token Offering | A fundraising event where a crypto start-up raises money through a cryptocurrency exchange. An IEO is a type of Initial Token Offering where a company or project electronically issues utility tokens to procure funds, with a cryptocurrency exchange acting as the main party for screening the project and selling the issuer tokens. Interested supporters can buy tokens with fiat currency or cryptocurrency. The token may be exchangeable in the future for a new cryptocurrency to be launched by the project, or a discount or early rights to a product or service proposed to be offered by the project. | |||||||

Japan Virtual and Crypto assets Exchange Association (the “JVCEA”) | The JVCEA is a self-regulatory organization for the Japanese cryptocurrency industry under the Payment Services Act, which is formally recognized by the Financial Services Agency of Japan (the “JFSA”). The JVCEA was established in 2018 after a hacking incident of NEM digital tokens occurred with an operational focus on the inspection of the security of domestic exchanges and the enforcement of stricter regulations. The members of the JVCEA consist of the 33 licensed class 1 Japanese virtual currency exchange service providers as of January 31, 2025. | |||||||

M1 GK | M1 Co G.K., a Japanese limited liability company (godo kaisha) that was merged into Coincheck on June 20, 2025. | |||||||

Marketplace platform | As of September 30, 2025, Coincheck’s platform that supports 33 different types of cryptocurrencies and enables users to trade cryptocurrencies with Coincheck in yen or with other cryptocurrencies. | |||||||

vii

Term | Description | |||||||

Marketplace platform business | Coincheck’s business is related to the Marketplace platform, where Coincheck buys and sells crypto assets to users on the Marketplace platform and executes cover transactions on an external exchange or Coincheck’s Exchange platform for the purpose of hedging Coincheck’s own position. | |||||||

Merger Sub | Coincheck Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of Coincheck Parent. | |||||||

Miner | Individuals or entities who operate a computer or group of computers that add new transactions to blocks and verify blocks created by other miners. Miners collect transaction fees and are rewarded with new tokens for their service. | |||||||

Mining | The process by which new blocks are created, and thus new transactions are added to the blockchain. | |||||||

Monex | Monex Group, Inc., a Japanese joint stock company (kabushiki kaisha) listed on the Tokyo Stock Exchange. | |||||||

Nasdaq | Nasdaq Global Market. | |||||||

NEM (“XEM”) | NEM (abbreviated as “XEM” on exchange platforms) is a type of open-source cryptocurrency developed for the “New Economic Movement” network. NEM is a crypto asset with a strong community in Japan in particular, and the goal of NEM is to establish a new economic framework based on the principles of decentralization, economic freedom and equality rather than the existing frameworks managed by countries and governments. | |||||||

Network | The collection of all miners that use computing power to maintain the ledger and add new blocks to the blockchain. Most networks are decentralized, which reduce the risk of a single point of failure. | |||||||

Next Finance | Next Finance Tech Co., Ltd, a Japanese private company engaged in a staking platform services business, that Coincheck Parent acquired in March 2025. | |||||||

Non-fungible token (“NFT”) | A unique and non-interchangeable unit of data stored on a blockchain which allows for a verified and public proof of ownership, first launched on the Ethereum blockchain. | |||||||

SEC | The U.S. Securities and Exchange Commission. | |||||||

Securities Act | The U.S. Securities Act of 1933, as amended. | |||||||

Security token | A security using encryption technology. This includes digital forms of traditional equity or fixed income securities, or may be assets deemed to be a security based on their characterization as an investment contract or note. | |||||||

Smart contract | Software that digitally facilitates or enforces a rules-based agreement or terms between transacting parties. | |||||||

US$ or $ | Refers to U.S. dollars. | |||||||

Wallet | A place to store public and private keys for crypto assets. Wallets are typically software, hardware or paper records. | |||||||

viii

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere or incorporated by reference in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in the shares offered hereby and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference in this prospectus. This summary contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions, or future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements” before you decide to invest in our ordinary shares, you should also read the entire prospectus carefully, including “Risk Factors” beginning on page 7, and the financial statements and related notes included or incorporated by reference in this prospectus.

Unless otherwise designated or the context requires otherwise, the terms “we,” “us,” “our,” “Coincheck Group,” “the Company” and “our company” refer to Coincheck Group N.V. and its subsidiaries, which prior to the Business Combination was the business of Coincheck.

Overview

Since the launch of our crypto asset exchange in 2014, we have provided a young, highly-engaged retail customer base with the opportunity to become familiar with crypto assets by offering a service we believe is easy for anyone to use, regardless of financial or technological literacy. We operate, through our platforms, one of the largest multi-cryptocurrency marketplaces in Japan. We had as of March 31, 2025 and September 30, 2025, according to the JVCEA, a 24.9% and 18.1%, respectively, market share in Japan by trading volume, and our approximately 2.3 million verified users as of March 31, 2025 and 2.4 million verified users as of September 30, 2025 represents an 18.5% retail market share as of March 31, 2025 and 18.3% retail market share as of September 30, 2025. As of March 31, 2023, 2024 and 2025, our customer assets were ¥344 billion, ¥744 billion and ¥859 billion, respectively. As of September 30, 2025 customer assets were ¥1,189 billion. Our marketplace trading volume was ¥157.1 billion, ¥234.6 billion and ¥337.5 billion during the years ended March 31, 2023, 2024 and 2025, respectively. Our marketplace trading volume during the six months ended September 30, 2025 was ¥156.2 billion

We believe that our customers choose us due to our trusted and recognized brand, robust product offering and strong customer service. Approximately 49.3% of our verified accounts are held by customers under 40 as of September 30, 2025, providing the opportunity for our business to grow alongside our customers as they reach their prime earning years. We believe that this, combined with our constant innovation and robust compliance infrastructure, position us to capitalize on the potential growth of the Japanese crypto economy.

Our Marketplace platform offers our customers access to 33 cryptocurrencies, including Bitcoin, Ethereum and XRP, while our Exchange platform, which offers 20 cryptocurrencies, is geared more towards sophisticated and institutional crypto investors and provides liquidity support for transactions on our Marketplace platform. We believe we are well positioned to benefit from increasing adoption of cryptocurrencies and other new technologies within Japan, the world’s fourth largest economy. We currently derive most of our total revenue from transactions on our Marketplace platform.

We also continue to be an innovator in the Japanese crypto economy with the goal of providing to Japanese customers and institutions broad access to technological developments in the industry. For example, we offer our Coincheck NFT Marketplace, a separate display screen for our customers, which we expect to have synergies within our retail customer base, and conducted Japan’s first IEO during 2021. Our smartphone application is our main point of contact with our customers, and we believe it provides a user friendly experience with sophisticated user interface and experience. To maintain the quality of customer experience, we continuously invest in flexible system and software development, and engineers and product developers, to maintain the quality of the customer experience.

1

We believe that having recently become a publicly traded company listed on Nasdaq will help us access international capital markets, increase our ability to make acquisitions of crypto businesses both inside and outside of Japan, and enhance hiring and retention of key personnel via equity compensation incentives.

Our Mission

We believe we are, today, a leader in the Japanese retail crypto asset industry through our Marketplace platform offering and related retail crypto services. Our mission is threefold: (1) to increase our share of the growing Japanese crypto asset retail market through our Marketplace platform, including by adding or enhancing new or recent features and related services attractive to our customers; (2) to expand our institutional business, such as through the recent launch of the Coincheck Prime brand and our Coincheck IEO platform; and (3) mainly through acquisitions, investments, or joint ventures or other strategic partnerships, to acquire and operate retail and institutional crypto businesses outside of Japan, such as in Europe and other regions.

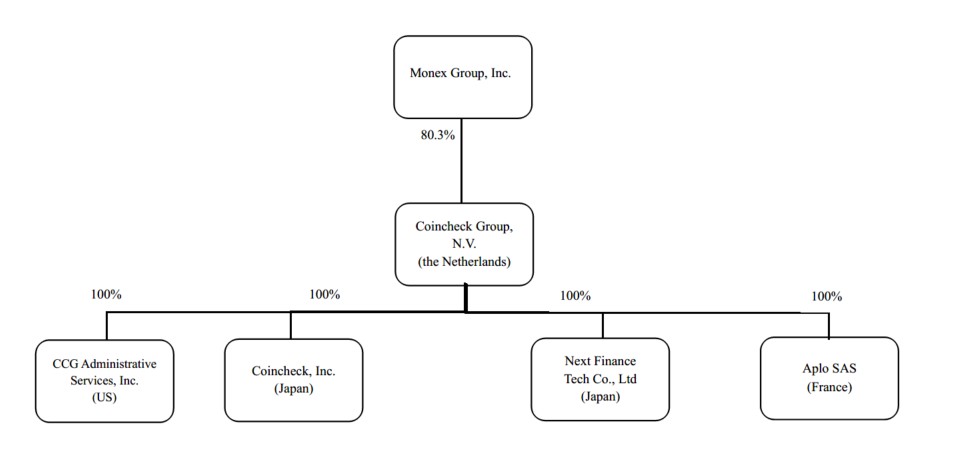

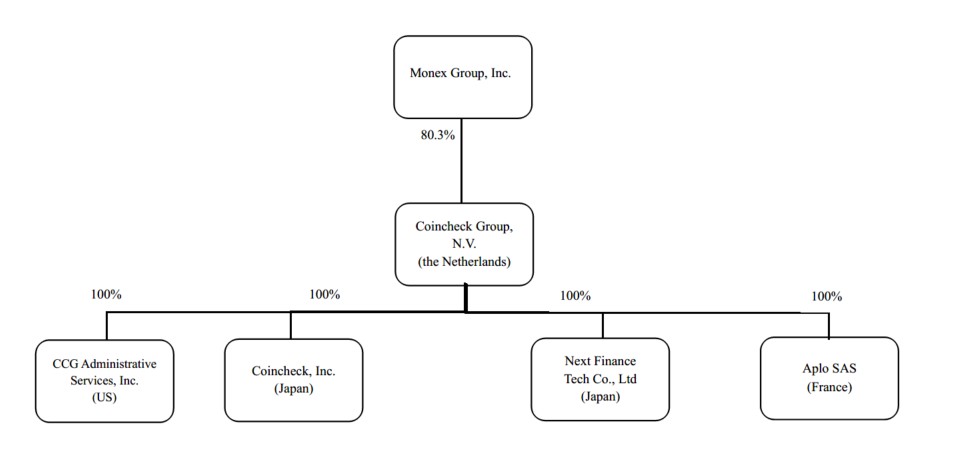

Our Organizational Structure

Business Combination

On December 10, 2024 (the “Business Combination Closing Date”), we consummated the Business Combination pursuant to the Business Combination Agreement, by and among Thunder Bridge Capital Partners IV, Inc., a Delaware corporation (“Thunder Bridge”), Coincheck Group B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (which was converted into a Dutch public limited liability company (naamloze vennootschap) and renamed Coincheck Group N.V. immediately prior to the Business Combination), M1 Co G.K., a Japanese limited liability company (godo kaisha) (“M1 GK”), Coincheck Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Coincheck Parent (“Merger Sub”) and Coincheck, Inc., a Japanese joint stock company (kabushiki kaisha). Pursuant to the terms set forth in the Business Combination Agreement, (i) Coincheck Parent issued ordinary shares in its share capital (the “Ordinary Shares”) to M1 GK and, pursuant to a share exchange, M1 GK, at that time a wholly owned subsidiary of Coincheck Parent, exchanged all of its shares of Coincheck Parent for all of the outstanding common shares of Coincheck (the “Share Exchange”), resulting in Coincheck becoming a direct wholly owned subsidiary of M1 GK and an indirect wholly owned subsidiary of Coincheck Parent. Immediately after giving effect to the Share Exchange, Coincheck Parent changed its legal form from a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) to a Dutch public limited liability company (naamloze vennootschap); (ii) Merger Sub merged with and into Thunder Bridge on the Business Combination Closing Date, with Thunder Bridge continuing as the surviving corporation (the “Merger”); (iii) as a result of the Merger, each outstanding Thunder Bridge share sold as part of a unit in Thunder Bridge’s initial public offering (the “IPO” or “Thunder Bridge’s IPO”; each unit, a “Thunder Bridge Unit”; and each Thunder Bridge share, a “Thunder Bridge Public Share”), for the avoidance of doubt, not including any Thunder Bridge Shares held by TBCP IV, LLC, Thunder Bridge’s sponsor (the “Thunder Bridge Sponsor” or “Sponsor”), as of the date of the Business Combination Agreement (the “Sponsor Shares”), was exchanged for one Ordinary Share; (iv) as a result of the Merger, each Sponsor Share was exchanged for one Ordinary Share and (v) as a result of the Merger, each outstanding private warrant exercisable for Thunder Bridge shares (a “Thunder Bridge Private Warrant”) and each outstanding public warrant exercisable for Thunder Bridge shares sold as part of a unit in Thunder Bridge’s IPO (a “Thunder Bridge Public Warrant” and the Thunder Bridge Public Warrants together with the Private Warrants, the “Thunder Bridge Warrants”) became a warrant exercisable for such number of Ordinary Shares per Thunder Bridge Warrant that the holder thereof was entitled to acquire if such Thunder Bridge Warrant was exercised prior to the Business Combination (each such private and public warrant exercisable for Ordinary Shares, a “Private Warrant” and “Public Warrant,” respectively, and, the Private Warrants and the Public Warrants together, the “Warrants”). At the Closing on the Business Combination Closing Date, the Sponsor forfeited and surrendered, and Coincheck Parent repurchased for no consideration, 2,365,278 Ordinary Shares.

The transaction was unanimously approved by Thunder Bridge’s board of directors and was approved at the special meeting of Thunder Bridge’s shareholders held on December 5, 2024 (the “Special Meeting”). Thunder Bridge’s shareholders also voted to approve all other proposals presented at the Special Meeting. As a result of the

2

Business Combination, Thunder Bridge, M1 GK and Coincheck have become wholly owned subsidiaries of Coincheck Parent. On December 11, 2024, Ordinary Shares and Public Warrants commenced trading on the Nasdaq Global Market, or “Nasdaq,” under the symbols “CNCK” and “CNCKW,” respectively. Following the Business Combination, M1 GK was a direct, wholly owned subsidiary of Coincheck Parent and the sole shareholder of Coincheck, but, on June 20, 2025, was merged into Coincheck, resulting in Coincheck Parent becoming the sole shareholder of Coincheck.

Next Finance Acquisition

On March 12, 2025, we entered into a Sale and Purchase Agreement (the “Next Finance SPA”) with the Next Finance Shareholders of Next Finance Tech Co. Based in Japan, Next Finance Tech Co. is a blockchain infrastructure company that provides staking platform services.

On March 14, 2025 (the “Next Finance Closing Date”), pursuant to the Next Finance SPA, we purchased the Next Finance Shares (the “Next Finance Acquisition”) for an aggregate consideration of ¥265,287,960 and an aggregate of 1,111,450 Ordinary Shares (the “Next Finance Acquisition Shares”). The Next Finance Acquisition Shares were issued in reliance on an exemption under the Securities Act. In connection with the Next Finance Acquisition, we agreed to register the Next Finance Acquisition Shares for resale under the Securities Act and pay all fees and expenses incident to such registration.

The Next Finance SPA provides that, subject to certain customary exceptions, certain of the Next Finance Shareholders may not transfer any of the Next Finance Acquisition Shares during the period beginning on the Next Finance Closing Date and ending on December 31, 2026, provided, however, an aggregate of 70% of such shares are released from such transfer restrictions at five predetermined intervals between May 14, 2025 and July 1, 2026.

Aplo Acquisition

Coincheck Parent entered into a Share Contribution and Transfer Agreement dated August 27, 2025 (the "SCTA") to acquire all of the issued and outstanding shares of Aplo SAS, a simplified joint stock company (société par actions simplifiée) under the laws of France, with its registered seat at 15, rue des Halles 75001 Paris, France, and registered with the Trade and Companies Registry of Paris under unique identification number 878 929 405 ("Aplo"). Aplo is a digital asset prime brokerage that serves institutional crypto investors, and is headquartered in Paris, France. The transaction pursuant to the SCTA closed on October 14, 2025 (the "Closing Date"). Pursuant to the terms of the SCTA, on the Closing Date the shareholders of Aplo delivered to Coincheck Parent 100% of the issued and outstanding shares of Aplo, making Coincheck Parent the sole shareholder of Aplo, in exchange for 5,007,500 newly issued Ordinary Shares of Coincheck Parent (the "Share Consideration"). Pursuant to the SCTA, the number of Ordinary Shares constituting the Share Consideration was calculated by dividing (a) $24 million by (b) the average per-share closing price of the Ordinary Shares on Nasdaq over the 20 consecutive trading days that ended with the second trading day prior to the Closing Date. To complete its acquisition of 100% share ownership of Aplo, Coincheck Parent also paid approximately €148 thousand (the "Cash Consideration") to certain warrant holders of Aplo who, as part of closing, exercised their warrants in exchange for Aplo shares and transferred those Aplo shares to Coincheck Parent in exchange for the Cash Consideration. Under the SCTA, Aplo's selling shareholders also agreed to certain "lock-up" periods with respect to the Ordinary Shares they received. The initial accounting for this business combination is incomplete as of the issuance date. This is primarily because Coincheck Parent has not completed the necessary valuations of the acquired assets and liabilities. The Company anticipates completing this analysis within the measurement period. One component of the Company’s mission that has been stated in its prior public disclosures is, through acquisitions, investments, or joint ventures or other strategic partnerships, to acquire and operate retail and institutional crypto businesses outside of Japan, such as in Europe and other regions. This acquisition has been a step in furtherance of that objective.

The following diagram depicts a simplified organizational structure* of the Company and the ownership percentages (excluding the impact of Ordinary Shares underlying the Warrants, Ordinary Shares authorized for issuance pursuant to the Omnibus Incentive Plan and Ordinary Shares held in treasury) as of January 6, 2026. See “Security Ownership of Certain Beneficial Owners” incorporated by reference herein for more information.

3

Our Strengths

For additional information on the below attributes, please see “Business — Our Strengths” incorporated by reference herein.

•We have a leading position in the Japanese retail market.

•We have a young, highly-engaged customer base.

•We have user-friendly platforms and product offerings.

•We have a trusted brand.

•We have a robust and historically profitable financial model.

•We have a strong and experienced management team to support continued growth

Our Corporate Information

Coincheck Group B.V. was incorporated by Monex Group, Inc. (“Monex”) under the laws of the Netherlands as a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) in February 2022 for the purpose of effectuating the Business Combination and changed its legal form to a Dutch public limited liability company (naamloze vennootschap) and was renamed Coincheck Group N.V. immediately prior to the Business Combination.

Coincheck Parent’s registered and principal executive office is Nieuwezijds Voorburgwal 162, 1012 SJ Amsterdam, the Netherlands. Coincheck Parent’s principal website address is https://coincheckgroup.com/. Coincheck Parent does not incorporate the information contained on, or accessible through, Coincheck Parent’s website into this prospectus, and you should not consider it a part of this prospectus.

Implications of Being a Foreign Private Issuer

We report under the Exchange Act as a non-U.S. company with foreign private issuer status. Under Rule 405 of the Securities Act, the determination of foreign private issuer status is made annually on the last business day

4

of an issuer’s most recently completed second fiscal quarter and, accordingly, the next determination will be made with respect to us on September 30, 2026.

The discussion below summarizes the significant differences between our corporate governance practices and the Nasdaq listing standards applicable to U.S. companies. The Dutch Corporate Governance Code of the Netherlands (“DCGC”) is based on a “comply or explain” principle, and as set below, we also discuss certain ways in which our governance practices deviate from those suggested in the DCGC.

Under the Nasdaq rules, U.S. domestic listed companies are required to have a majority independent board,. Under the DCGC of the Netherlands, it is required (on a comply-or-explain basis) that the majority of non-executive directors qualifies as independent within the meaning of the DCGC. In addition, the Nasdaq rules require U.S. domestic listed companies to have an independent compensation committee and that our director nominations be made, or recommended to our full Board of Directors, by our independent directors or by a nominations committee that is comprised entirely of independent directors, which are not required under our home country laws. Currently, we have a majority independent board and all of our Board committees consist solely of independent directors ("independent" within the meaning of the Nasdaq rules / US law), but, other than always maintaining an audit committee with only independent directors, that could change in the future. In deviation of the DGCG, we have a chairperson (voorzitter) who is not independent within the meaning of the DCGC (our Lead Non-Executive Director).

Further, for so long as we qualify as a foreign private issuer, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

•the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

•the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and imposing liability for insiders who profit from trades made within a short period of time;

•the rules under the Exchange Act requiring the filing with the SEC of an annual report on Form 10-K (although we will file annual reports on a corresponding form, annual report on Form 20-F, for foreign private issuers), quarterly reports on Form 10-Q containing unaudited financial and other specified information (although we have furnished, and intend to furnish, quarterly financial results reports, typically in the form of an earnings press release, on a current reporting form for foreign private issuers), or current reports on Form 8-K, upon the occurrence of specified significant events; and

•Regulation Fair Disclosure or Regulation FD, which regulates selective disclosure of material non-public information by issuers.

Accordingly, there may be less publicly available information concerning our business than there would be if we were a U.S. public company.

Also, in lieu of Nasdaq’s quorum requirement of at least 33 1/3 percent of outstanding shares for general (i.e., shareholder) meetings, we follow home country practice, which has no quorum requirements, and our Articles of Association do not require a quorum at general meetings, meaning resolutions may be adopted at Coincheck Parent’s general meetings irrespective of the issued share capital issued or represented. Additionally, to the extent we rely on Dutch law with respect to issuance of shares, our practice varies from the requirements of the corporate governance standards of Nasdaq, which generally require an issuer to obtain shareholder approval for the issuance of securities in connection with such events.

Thus, due to our status as a foreign private issuer and our intent to follow certain home country corporate governance practices, our shareholders do not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq corporate governance standards.

5

Implications of Being a Controlled Company

Monex holds more than a majority of the voting power of our Ordinary Shares eligible to vote in the election of our directors. As a result, we are a “controlled company” within the meaning of the Nasdaq corporate governance standards (the “corporate governance standards”). Under the corporate governance standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company.”

As a “controlled company,” we may elect not to comply with certain corporate governance standards, including the requirements that (1) a majority of our Board consist of independent directors, (2) our Board have a compensation committee that is comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, and (3) our Board have a nominating and corporate governance committee that is comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. Although we are not currently relying on these exemptions, if we do rely on them in the future our shareholders will not have the same protections afforded to shareholders of companies that are subject to all of the Nasdaq corporate governance standards. In the event that we do rely on them in the future and we cease to be a “controlled company” and our Ordinary Shares continue to be listed on Nasdaq, we will be required to comply with these corporate governance standards within the applicable transition periods or may rely on an alternate exemption, including those available to a foreign private issuer.

6

RISK FACTORS

Investing in our securities is speculative and involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risk factors included in our 2024 Annual Report for the fiscal year ended March 31, 2025 (“2024 Annual Report”), together with any applicable prospectus supplements and any related free writing prospectuses, as well as any documents incorporated by reference in this prospectus or such prospectus supplements. You should also carefully consider other information contained or incorporated by reference in this prospectus or any applicable prospectus supplements, including our financial statements and the related notes thereto incorporated by reference in this prospectus. The risks and uncertainties described in any applicable prospectus supplements and our other filings with the SEC incorporated by reference in this prospectus and such prospectus supplements are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial could also adversely affect us. If any of risks we describe occur, our business, financial condition or results of operations could be materially harmed. In such case, the value of our securities could decline and you may lose some or all of your investment. Please also carefully consider the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

Unless otherwise indicated in the applicable prospectus supplement, we intend to use the net proceeds from these sales for working capital and general corporate purposes.

The amounts and timing of these expenditures, as well as the specific uses thereof, are not presently determinable and will depend on numerous factors, including the market price of our securities at the time of sale, actual proceeds received, the development of our current business initiatives and our evolving business needs. Our management will have broad discretion to allocate the net proceeds, if any, we receive in connection with securities offered pursuant to this prospectus for any purpose. Pending use of the net proceeds, we intend to invest the net proceeds in short-term, interest-bearing, investment-grade securities or in cash or money market funds.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock, and we do not anticipate paying any cash dividends in the foreseeable future. The payment of dividends, if any, in the future is within the discretion of our Board of Directors and will depend on our earnings, capital requirements and financial condition and other relevant facts. We currently intend to retain all future earnings, if any, to finance the development and growth of our business.

7

DESCRIPTION OF SECURITIES WE MAY OFFER

General

This prospectus describes the general terms of our securities. The following description is not complete and may not contain all the information you should consider before investing in our securities. For a more detailed description of these securities, you should read the applicable provisions of Dutch law and our Articles of Association. When we offer to sell a particular series of these securities, we will describe the specific terms of the series in a supplement to this prospectus. Accordingly, for a description of the terms of any series of securities, you must refer to both the prospectus supplement relating to that series and the description of the securities described in this prospectus. To the extent the information contained in the prospectus supplement differs from this summary description, you should rely on the information in the prospectus supplement.

Under Dutch law, the authorized share capital of a public limited liability company is the maximum capital that the company may issue without amending the Articles of Association. At least one fifth of the authorized share capital must at all times be issued. Pursuant to the Articles of Association, Coincheck Parent’s authorized share capital amounts to €4,000,000, divided into 400,000,000 ordinary shares with a nominal value of €0.01 each.

We, directly or through agents, dealers or underwriters designated from time to time, may offer, issue and sell, together or separately, up to $200 million in the aggregate of:

•ordinary shares;

•purchase contracts;

•warrants to purchase our securities;

•subscription rights to purchase our securities;

•secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness, which may include senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities; or

•units comprised of, or other combinations of, the foregoing securities.

We may issue the debt securities exchangeable for or convertible into shares of ordinary shares or other securities that may be sold by us pursuant to this prospectus, or any combination of the foregoing. When a particular series of securities is offered, a supplement to this prospectus will be delivered with this prospectus, which will set forth the terms of the offering and sale of the offered securities.

Ordinary Shares

As of January 6, 2026, the total issued share capital of Coincheck Parent is comprised of 138,292,400 Ordinary Shares. There are 135,927,122 Ordinary Shares outstanding. There are 2,365,278 Ordinary Shares held in treasury. There are also 4,860,148 warrants outstanding, each exercisable at $11.50 per one Ordinary Share, of which 4,730,537 are Public Warrants listed on Nasdaq and 129,611 are Private Warrants held by TBCP IV, LLC or its permitted transferees.

Form of Ordinary Shares

All Ordinary Shares will be held in registered form. No share certificates will be issued.

Issuance of shares

8

Under Dutch law, shares may in principle be issued and rights to subscribe for shares (e.g., stock options) may be granted pursuant to a resolution of the general meeting or another corporate body of the company authorized for that purpose by the company’s general meeting. The Articles of Association provide that Ordinary Shares may be issued and rights to subscribe for such shares may be granted pursuant to a resolution adopted by (i) Coincheck Parent’s general meeting at the proposal of the Board, or (ii) if so authorized by Coincheck Parent’s general meeting, by the Board. For as long as, and to the extent that the authorization referred to under (ii) is effective, Coincheck Parent’s general meeting will not have the power to resolve to issue Ordinary Shares or grant rights to subscribe for such shares.

Pursuant to Dutch law, the authorization referred to under (ii) may be granted, and subsequently extended, in each case for a period not exceeding five years. The authorization cannot be withdrawn, unless determined otherwise at the time of the authorization. The resolution to authorize the Board as corporate body authorized to issue Ordinary Shares and grant rights to subscribe for shares must state the maximum number of shares that may be issued under the authorization.

No general meeting resolution or resolution of the Board is required for the issuance of shares pursuant to the exercise of previously granted rights to subscribe for shares.

At the annual general meeting of Coincheck Parent, held on September 23, 2025 (the "2025 AGM Date" and such general meeting the "2025 AGM"), the general meeting authorized the Board, for a period of 18 months as from the 2025 AGM Date, to issue Ordinary Shares and grant rights to subscribe for such shares up to 73,000,000 Ordinary Shares (the "Issuance Authorization")..

In connection with Coincheck Parent’s Omnibus Incentive Plan, or any other similar equity plan as adopted by the Board, the Board is furthermore irrevocably authorized, for a period of 5 years as from the Business Combination Closing Date, as corporate body authorized to issue Ordinary Shares and grant rights to subscribe for such shares up to 9,079,565 Ordinary Shares (the “Absolute Share Limit”), such Absolute Share Limit to be automatically increased from time to time in accordance with the Omnibus Incentive Plan.

Preemptive rights

Pursuant to Dutch law and the Articles of Association, each shareholder has a preemptive right in proportion to the aggregate amount of its Ordinary Shares upon the issuance of new Ordinary Shares or the grant of rights to subscribe for such shares, except in cases where Ordinary Shares are issued or rights thereto are granted: (i) to employees of Coincheck Parent or a company within the Coincheck Group, (ii) against payment other than in cash, or (iii) to persons exercising a previously granted right to subscribe for Ordinary Shares.

Pursuant to the Articles of Association, the preemptive rights in respect of newly issued Ordinary Shares or rights to subscribe for such shares, may be restricted or excluded by a resolution of the Board if and insofar as it has been designated as corporate body authorized for that purpose by Coincheck Parent’s general meeting. The Board may only be designated in accordance with the preceding sentence to the extent that it is also designated as corporate body authorized to resolve upon the issuance of Ordinary Shares and grant of rights to subscribe for such shares. The designation may be granted, and subsequently extended, in each case for a period not exceeding five years, and cannot be withdrawn, unless determined otherwise at the time of designation.

If the Board is not designated as described above, Coincheck Parent’s general meeting may resolve to limit or exclude the preemptive rights in respect of issuances of Ordinary Shares and grant rights to subscribe for shares, but only at the proposal of the Board. A resolution of Coincheck Parent’s general meeting to limit or exclude preemptive rights or to designate the Board as corporate body authorized to resolve upon the exclusion or limitation or preemptive rights, requires a two/thirds majority of votes cast in a general meeting if less than half of the issued share capital is represented at the meeting concerned. If half of the issued share capital or more is represented at the general meeting, the resolution may be adopted with a simple majority of votes cast.

9

At the 2025 AGM, the general meeting authorized the Board, for a period of 18 months as from the 2025 AGM Date, to limit or exclude preemptive rights in respect of issuances of Ordinary Shares and grants of rights to subscribe for such shares pursuant to the Issuance Authorization.

In connection with Coincheck Parent’s Omnibus Incentive Plan, or any other similar equity plan as adopted by the Board, the Board furthermore has been irrevocably designated to, for a period of 5 years from the Closing Date, if applicable, restrict or exclude preemptive rights in respect of issuances of Ordinary Shares and grants of rights to subscribe for such shares under the Omnibus Incentive Plan (or any other similar equity plan as adopted by the Board).

Purchase and Repurchase of Ordinary Shares

Pursuant to Dutch law, Coincheck Parent nor its subsidiaries may subscribe for Ordinary Shares to be issued. Coincheck Parent and its subsidiaries may acquire (repurchase) Ordinary Shares, subject to the applicable provisions and restrictions of Dutch law and the Articles of Association, to the extent that: (i) the Ordinary Shares are fully paid-up, (ii) if the Ordinary Shares are repurchased for valuable consideration, such repurchase would not cause Coincheck Parent’s shareholders’ equity (eigen vermogen) to fall below an amount equal to the sum of the paid-up and called-up part of the issued share capital and the reserves that Coincheck Parent must maintain pursuant to Dutch law and the Articles of Association, and (iii) immediately after the acquisition of such Ordinary Shares, Coincheck Parent, together with its subsidiaries, would not hold, as shareholders or pledgees, shares having an aggregate nominal value that exceeds 50% of Coincheck Parent’s issued share capital. In addition, Coincheck Parent nor its subsidiaries may hold more than one-tenth of its issued share capital for more than three years after it was converted into a public limited liability company (naamloze vennootschap) or after it acquired its own shares (i) for no consideration or (ii) under universal succession of title (algemene titel).

Coincheck Parent may only acquire Ordinary Shares if Coincheck Parent’s general meeting has authorized the Board to do so. Such an authorization may be granted for a maximum period of 18 months and must specify the number of Ordinary Shares that may be acquired, the manner in which they may be acquired and the relevant price range. No authorization is required for the acquisition of Ordinary Shares for no valuable consideration or under universal succession of title, or if the Ordinary Shares are acquired by Coincheck Parent with the intention of transferring them to Coincheck Parent’s employees or employees within Coincheck Parent pursuant to an applicable arrangement.

At the 2025 AGM, the general meeting authorized the Board, for a period of 18 months as from the 2025 AGM Date, to have Coincheck Parent acquire fully paid-up Ordinary Shares up to the maximum number of 10% of Coincheck Parent’s issued share capital at the 2025 AGM Date.

Coincheck Parent cannot derive any right to any distribution or any voting rights from any repurchased Ordinary Shares. Coincheck Parent’s subsidiaries that have acquired Ordinary Shares will not be entitled to exercise their voting rights or to receive any dividends on such shares.

Capital reduction

Coincheck Parent’s general meeting may resolve to reduce Coincheck Parent’s issued share capital by (i) cancelling Ordinary Shares, or (ii) reducing the nominal value of the Ordinary Shares through an amendment of the Articles of Association (provided that the nominal value of an Ordinary Share cannot be less than EUR 0.01 under Dutch law). In either case, the reduction would be subject to applicable statutory provisions, including the observance of a two-month creditor opposition period.

A resolution to cancel Ordinary Shares may only relate to Ordinary Shares held by Coincheck Parent itself or in respect of which Coincheck Parent holds the depositary receipts. A resolution to reduce Coincheck Parent’s issued share capital requires a majority of at least two/thirds of the votes cast at Coincheck Parent’s general meeting if less than half of the issued share capital is represented at the meeting concerned. If half of the issued share capital or more is represented at the general meeting, the resolution may be adopted with a simple majority of votes cast.

10

Transfer of shares

Pursuant to the Articles of Association, for as long as one or more Ordinary Shares are listed and admitted to trading on a regulated foreign stock exchange, the Board may resolve, in accordance with applicable Dutch law, that the laws of the State of New York, United States of America, rather than Dutch law shall apply to the property law aspects of the Ordinary Shares included in the part of the shareholders’ register kept outside the Netherlands by the relevant transfer agent appointed by the Board for that purpose. The Board has adopted such resolution and, as a result, the laws of the State of New York, United States of America, govern the property law aspects applicable to Ordinary Shares registered in Coincheck Parent's shareholders register maintained by Coincheck Parent's registrar.

Discriminating provisions

There are no provisions in the Articles of Association that discriminate against a shareholder because of its ownership of a certain number of Ordinary Shares.

Distributions

Coincheck Parent may only make distributions (whether interim or annual) on the Ordinary Shares if its equity exceeds the sum of its paid-up and called-up capital and the reserves it must maintain pursuant to Dutch law and the Articles of Association.

Coincheck Parent does not anticipate making any distributions on Ordinary Shares in the foreseeable future.

Distribution of dividends

Pursuant to Dutch law and the Articles of Association, the distribution of dividends may only take place after the adoption of Coincheck Parent’s annual accounts which show that the distribution is permitted. The Board may resolve to reserve all or part of Coincheck Parent’s profits. Any profits remaining after the reservation referred to in the previous sentence shall be at the disposal of the general meeting. Coincheck Parent’s general meeting may resolve to distribute the remaining profits to Coincheck Parent’s shareholders. Coincheck Parent’s general meeting, at the proposal of the Board, may resolve that (part of) the distribution is made in kind, including in the form of Ordinary Shares, or in a currency other than the Euro.

Coincheck Parent will adopt a policy on reservation and distribution of its profits.

Interim distributions

Subject to the provisions of Dutch law and the Articles of Association, the Board, or Coincheck Parent’s general meeting at the proposal of the Board, may resolve upon interim distributions on the Ordinary Shares to be charged to Coincheck Parent’s freely distributable reserves. For this purpose, the Board must prepare an interim statement of assets and liabilities, reflecting that (i) the capital requirements set out above are met, and (ii) Coincheck Parent has sufficient funds available for distribution. Interim distribution may be made in cash or in kind, including in the form of Ordinary Shares.

General Meetings

Location

Coincheck Parent general meetings are held in Amsterdam, Haarlemmermeer (which includes Schiphol Airport), The Hague or Rotterdam, the Netherlands. In deviation from the foregoing and to the extent permitted by law, the Board may decide that a general meeting is only accessible by electronic means in accordance with the applicable legal provisions.

11

Annual general meeting

Coincheck Parent must hold at least one general meeting per year. This annual general meeting must be held within six months after the end of Coincheck Parent’s financial year.

Other general meetings

In addition to the annual general meeting, a general meeting must also be held within three months after the board has determined it to be likely that Coincheck Parent’s equity has decreased to an amount equal to or lower than half of its paid-up and called-up capital, in order to discuss the measures to be taken if so required. If the Board fails to hold such general meeting in a timely manner, each shareholder or other person entitled to attend the general meeting may be authorized by the Dutch court to convene a general meeting.