COINCHECK GROUPS UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS AS OF JUNE 30, 2025 AND MARCH 31, 2025 AND FOR THE THREE MONTHS ENDED JUNE 30, 2025 AND 2024 AND RELATED MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS]

Published on August 28, 2025

Exhibit 99.1

Acronyms and defined terms used in the text include the following:

|

Term |

Description |

|

|

altcoin |

A term sometimes used to refer to a cryptocurrency other than Bitcoin. |

|

|

Bitcoin (“BTC”) |

The first system of global, decentralized, scarce, digital money as initially introduced in a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto. |

|

|

blockchain |

A cryptographically secure digital ledger that maintains a record of all transactions that occur on a network and follows a consensus protocol for confirming new blocks to be added. |

|

|

Board or Board of Directors |

The board of directors of Coincheck Group N.V. |

|

|

Business Combination |

The Business Combination consummated on December 10, 2024 pursuant to the Business Combination Agreement, including related transactions therein described. |

|

|

Business Combination Agreement |

The Business Combination Agreement, dated as of March 22, 2022, as amended, by and among Thunder Bridge, Coincheck Parent, M1 GK, Coincheck Merger Sub, Inc., and Coincheck, and the agreements contemplated therein for related transactions to be signed or completed at closing. |

|

|

Coincheck |

Coincheck, Inc., a Japanese joint stock company (kabushiki kaisha) and the principal operating subsidiary of Coincheck Parent, and is a licensed cryptocurrency exchange services provider in Japan. |

|

|

Coincheck Parent |

Coincheck Group N.V., a Dutch public limited liability company (naamloze vennootschap). |

|

|

Coincheck NFT Marketplace |

Coincheck’s service available to customers that enables non-fungible tokens (NFTs) to be purchased. |

|

|

cold wallet |

Sometimes also described as cold storage, the storage of private keys in any fashion that is disconnected from the internet in order to protect data from unauthorized access. Common examples include offline computers, USB drives or paper records. |

|

|

cover counterparties |

Counterparties with which cover transactions are executed. |

|

|

cover transactions |

Transactions executed by Coincheck on the Exchange platform with a customer, or with a party on an external exchange or market maker that is connected via API to Coincheck’s systems, in order to offset Coincheck’s own positions or reduce its exposure arising from transactions in crypto assets with customers using Coincheck’s Marketplace platform. |

|

|

crypto |

A broad term for any cryptography-based market, system, application, or decentralized network. |

|

|

crypto asset or a “token” |

A digital asset built using blockchain technology, including cryptocurrencies and NFTs. Under PSA, digital assets that constitute a “security token” (i.e., ERTRs or ERTRISs under FIEA) are excluded from the definition of crypto assets. Accordingly, crypto assets consist only of digital assets that have been determined not to constitute ERTRs or ERTRISs. |

1

|

Term |

Description |

|

|

cryptocurrency |

Bitcoin and altcoins. This category of crypto asset is designed to work as a medium of exchange, store of value, or to power applications and excludes security tokens. |

|

|

customer account or customer’s account |

The single account, as governed by one customer agreement, opened by a customer that enables the customer to use the Marketplace platform, Exchange platform, Coincheck NFT Marketplace, participate in Coincheck’s IEO platform offerings, and otherwise use Coincheck’s crypto services offered to its accountholders (i.e., there is one account per verified user for all accountholder services, and not separate accounts or customer agreements for each platform or service). |

|

|

customer assets |

Cryptocurrencies held for customers + fiat currency deposited by customers, on a J-GAAP basis. This definition, as used in the description of our business, does not include NFTs. |

|

|

customers (or “users”) |

Parties who hold accounts and utilize the services provided on crypto asset platforms. This definition, as used in the description of our business, generally does not include cover counterparties, and thus such definition differs from the definition of “customer” under IFRS 15. Notwithstanding the foregoing, for purposes of the Company’s unaudited financial statements included elsewhere in this report, “customers” refers to customers that meet the definition under IFRS 15, including cover counterparties. |

|

|

ERTRs and ERTRISs |

Electronically recorded transferable rights (ERTRs) and electronically recorded transferable rights to be indicated on securities (ERTRIS) under FIEA. |

|

|

Ethereum |

A decentralized global computing platform that supports smart contract transactions and peer-to-peer applications, as well as the native crypto assets, such as Ether (ETH), on the Ethereum network. |

|

|

Exchange platform |

Coincheck’s exchange platform, targeted to more sophisticated crypto investors and traders, which facilitates crypto asset purchase and sale transactions between customers generally on a no-fee basis, and on which Coincheck from time to time purchases or sells crypto assets to help support the covering of transactions on its Marketplace platform. |

|

|

FIEA |

Japan’s Financial Instruments and Exchange Act |

|

|

fork |

A “soft” fork aims to be a backward-compatible upgrade to a blockchain, allowing nodes running older versions to still validate new transactions. A “hard” fork is a non-backward-compatible change that requires all nodes to upgrade to the new version, often resulting in a permanent split in the blockchain which results in two different blockchains, the original, and the new version, resulting in the creation of a new token. |

|

|

hot wallet |

A wallet that is connected to the Internet, enabling it to broadcast transactions. |

|

|

Initial Exchange Offering (“IEO”)/Initial Token Offering |

A fundraising event where a crypto start-up raises money through a cryptocurrency exchange. An IEO is a type of Initial Token Offering where a company or project electronically issues utility tokens to procure funds, with a cryptocurrency exchange acting as the main party for screening the project and selling the issuer tokens. Interested supporters can buy tokens with fiat currency or cryptocurrency. The token may be exchangeable in the future for a new cryptocurrency to be launched by the project, or a discount or early rights to a product or service proposed to be offered by the project. |

2

|

Term |

Description |

|

|

Japan Virtual and Crypto assets Exchange Association (the “JVCEA”) |

The JVCEA is a self-regulatory organization for the Japanese cryptocurrency industry under the Payment Services Act, which is formally recognized by the Financial Services Agency of Japan (the “JFSA”). The JVCEA was established in 2018 after a hacking incident of NEM digital tokens occurred with an operational focus on the inspection of the security of domestic exchanges and the enforcement of stricter regulations. The members of the JVCEA consist of the 32 licensed class 1 Japanese virtual currency exchange service providers as of April 15, 2025. |

|

|

M1 GK |

M1 Co G.K., a Japanese limited liability company (godo kaisha) that was a direct, wholly owned subsidiary of Coincheck Parent and the sole shareholder of Coincheck, which was merged into Coincheck on June 20, 2025, resulting in Coincheck Parent becoming the sole shareholder of Coincheck. |

|

|

Marketplace platform |

Coincheck’s main platform offering that supports, as of June 30, 2025, 34 different cryptocurrencies, and is used primarily by retail customers to buy and sell the supported cryptocurrencies. |

|

|

miner |

Individuals or entities who operate a computer or group of computers that add new transactions to blocks and verify blocks created by other miners. Miners collect transaction fees and are rewarded with new tokens for their service. |

|

|

Monex |

Monex Group, Inc., a Japanese joint stock company (kabushiki kaisha) listed on the Tokyo Stock Exchange. |

|

|

Nasdaq |

Nasdaq Global Market. |

|

|

NEM (“XEM”) |

NEM (abbreviated as “XEM” on exchange platforms) is a type of open-source cryptocurrency developed for the “New Economic Movement” network. NEM is a crypto asset with a strong community in Japan in particular, and the goal of NEM is to establish a new economic framework based on the principles of decentralization, economic freedom and equality rather than the existing frameworks managed by countries and governments. |

|

|

network |

Also sometimes referred to as a crypto network, cryptocurrency network or blockchain network, a system of interconnected computers that records and verifies cryptocurrency transactions, including the collection of all miners that use computing power to maintain the ledger and add new blocks to the blockchain. |

|

|

Next Finance |

Next Finance Tech Co., Ltd, a Japanese private company engaged in a staking platform services business, that Coincheck Parent acquired in March 2025. |

|

|

non-fungible token, or NFT |

A unique and non-interchangeable unit of data stored on a blockchain which allows for a verified and public proof of ownership, first launched on the Ethereum blockchain. |

|

|

on-chain |

A type of crypto transaction that is directly recorded as data on a blockchain. A type of transaction that is not directly recorded on a blockchain is referred to as “off-chain.” |

|

|

Ordinary Shares |

Ordinary Shares of Coincheck Parent, traded on Nasdaq under the symbol “CNCK.” |

|

|

protocol |

A type of algorithm or software that governs how a blockchain operates. |

3

|

Term |

Description |

|

|

Private Warrants |

Warrants, issued by Coincheck Parent, and held by Thunder Bridge Sponsor. |

|

|

PSA |

Japan’s Payment Services Act, a law governing registration and other requirements relating to the issuance and exchange of prepaid payments, as amended to cover crypto assets. |

|

|

public key or private key |

Each public address has a corresponding public key and private key that are cryptographically generated. A private key allows the recipient to access any funds belonging to the address, similar to a bank account password. A public key helps validate transactions that are broadcasted to and from the address. Addresses are shortened versions of public keys, which are derived from private keys. |

|

|

Public Warrants |

Warrants, issued by Coincheck Parent, and traded on Nasdaq under the symbol “CNCKW.” |

|

|

SEC |

The U.S. Securities and Exchange Commission. |

|

|

Securities Act |

The U.S. Securities Act of 1933, as amended. |

|

|

smart contract |

Software that digitally facilitates or enforces a rules-based agreement or terms between transacting parties. |

|

|

Thunder Bridge |

Thunder Bridge Capital Partners IV, Inc., a Delaware corporation, the special purpose acquisition company (SPAC) for the de-SPAC transaction embodied by the Business Combination Agreement. |

|

|

Thunder Bridge Sponsor |

TBCP IV, LLC, a Delaware limited liability company, Thunder Bridge’s sponsor and the recipient of Ordinary Shares as “sponsor shares” pursuant to the Business Combination Agreement. |

|

|

wallet |

A place to store public and private keys for crypto assets. |

|

|

Warrants |

The Public Warrants and Private Warrants, collectively. |

4

COINCHECK GROUP N.V. and its subsidiaries.

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

5

COINCHECK GROUP N.V. and its subsidiaries.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

(UNAUDITED)

|

For the three months ended |

||||||||||

|

(In millions) |

Notes |

2024 |

2025 |

|||||||

|

Revenue: |

|

|

|

|

||||||

|

Revenue |

5 |

¥ |

|

|

¥ |

|

|

|||

|

Other revenue |

5 |

|

|

|

|

|

|

|||

|

Total revenue |

5 |

|

|

|

|

|

|

|||

|

|

|

|

|

|||||||

|

Expenses: |

|

|

|

|

||||||

|

Cost of sales |

|

|

|

|

|

|

||||

|

Selling, general and administrative expenses |

|

|

|

|

|

|

||||

|

Operating profit (loss) |

|

|

|

|

( |

) |

||||

|

|

|

|

|

|||||||

|

Other income and expenses |

|

|

|

|

||||||

|

Other income |

|

|

|

|

|

|

||||

|

Other expenses |

|

( |

) |

|

( |

) |

||||

|

Financial income |

|

|

|

|

|

|

||||

|

Financial expenses |

|

( |

) |

|

( |

) |

||||

|

Profit (loss) before income taxes |

9 |

|

|

|

|

( |

) |

|||

|

Income tax expense |

10 |

|

|

|

|

|

|

|||

|

Net profit (loss) for the period attributable to owners of the Company |

9 |

|

|

|

|

( |

) |

|||

|

|

|

|

|

|||||||

|

Other comprehensive income: |

|

|

|

|

||||||

|

Foreign currency translation adjustment |

|

|

|

|

|

|||||

|

Total comprehensive income (loss) for the period attributable to owners of the Company |

9 |

¥ |

|

|

¥ |

( |

) |

|||

|

|

|

|

|

|||||||

|

Earnings (loss) per share: |

|

(Yen) |

|

|

(Yen) |

|

||||

|

Basic and diluted earnings (loss) per share |

9 |

¥ |

|

|

¥ |

( |

) |

|||

|

Weighted-average shares – basic and diluted* |

9 |

|

|

|

|

|

|

|||

____________

*

The accompanying notes are an integral part of these condensed consolidated interim financial statements (unaudited).

6

COINCHECK GROUP N.V. and its subsidiaries.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(UNAUDITED)

|

As of |

||||||||||

|

(In millions) |

Notes |

March 31, |

June 30, |

|||||||

|

Assets: |

|

|

|

|

||||||

|

Current assets: |

|

|

|

|

||||||

|

Cash and cash equivalents |

¥ |

|

|

¥ |

|

|

||||

|

Cash segregated as deposits |

|

|

|

|

|

|

||||

|

Customer accounts receivable |

|

|

|

|

|

|

||||

|

Other financial assets |

7 |

|

|

|

|

|

|

|||

|

Crypto assets held |

7 |

|

|

|

|

|

|

|||

|

Other current assets |

|

|

|

|

|

|

||||

|

Total current assets |

|

|

|

|

|

|

||||

|

Noncurrent assets: |

|

|

|

|

||||||

|

Property and equipment |

|

|

|

|

|

|

||||

|

Intangible assets |

|

|

|

|

|

|

||||

|

Crypto asset held |

7 |

|

|

|

|

|

|

|||

|

Other financial assets |

7 |

|

|

|

|

|

|

|||

|

Deferred tax assets |

|

|

|

|

|

|

||||

|

Total non-current assets |

|

|

|

|

|

|

||||

|

Total assets |

|

|

|

|

|

|

||||

|

|

|

|

|

|||||||

|

Liabilities and Equity: |

|

|

|

|

||||||

|

Liabilities: |

|

|

|

|

||||||

|

Current liabilities: |

|

|

|

|

||||||

|

Deposits received |

|

|

|

|

|

|

||||

|

Other financial liabilities |

7 |

|

|

|

|

|

|

|||

|

Crypto asset borrowings |

7 |

|

|

|

|

|

|

|||

|

Income taxes payable |

|

|

|

|

|

|

||||

|

Excise tax payable |

|

|

|

|

|

|

||||

|

Other current liabilities |

|

|

|

|

|

|

||||

|

Total current liabilities |

|

|

|

|

|

|

||||

|

Non-current liabilities: |

|

|

|

|

||||||

|

Other financial liabilities |

7 |

|

|

|

|

|

|

|||

|

Warrant liability |

7 |

|

|

|

|

|

|

|||

|

Provisions |

|

|

|

|

|

|

||||

|

Total non-current liabilities |

|

|

|

|

|

|

||||

|

Total Liabilities |

|

|

|

|

|

|

||||

|

|

|

|

|

|||||||

|

Equity: |

|

|

|

|

||||||

|

Ordinary Shares |

|

|

|

|

|

|

||||

|

Capital surplus |

|

|

|

|

|

|

||||

|

Share-based payment reserve |

|

|

|

|

|

|||||

|

Treasury Shares |

|

( |

) |

|

( |

) |

||||

|

Retained earnings (accumulated deficit) |

|

( |

) |

|

( |

) |

||||

|

Foreign currency translation adjustment |

|

|

|

|

|

|

||||

|

Total equity |

|

|

|

|

|

|

||||

|

Total liabilities and equity |

¥ |

|

|

¥ |

|

|

||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements (unaudited).

7

COINCHECK GROUP N.V. and its subsidiaries.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN EQUITY

(UNAUDITED)

|

(In millions) |

Notes |

Ordinary |

Common |

Capital |

Share- |

Treasury |

Retained |

Foreign |

Total |

|||||||||||||||||||||

|

Balance as of April 1, 2024 |

¥ |

¥ |

|

|

¥ |

|

¥ |

¥ |

|

¥ |

|

|

¥ |

¥ |

|

|

||||||||||||||

|

Effect of reverse recapitalization |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Balance as of April 1, 2024, recasted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Net profit for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Balance as of June 30, 2024 |

¥ |

|

¥ |

|

¥ |

|

¥ |

¥ |

|

¥ |

|

|

¥ |

¥ |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Balance as of April 1, 2025 |

¥ |

|

¥ |

|

¥ |

|

|

|

¥ |

( |

) |

¥ |

( |

) |

¥ |

|

¥ |

|

|

|||||||||||

|

Share-based payments |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Foreign currency translation adjustment in foreign operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Net loss for the period |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||||||||||||||||

|

Balance as of June 30, 2025 |

¥ |

|

¥ |

|

¥ |

|

¥ |

|

¥ |

( |

) |

¥ |

( |

) |

|

|

¥ |

|

|

|||||||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements (unaudited).

8

COINCHECK GROUP N.V. and its subsidiaries.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

For the three months ended |

||||||||||

|

(In millions) |

Notes |

2024 |

2025 |

|||||||

|

Cash flows from operating activities: |

|

|

|

|

||||||

|

Profit (loss) before income taxes |

¥ |

|

|

¥ |

( |

) |

||||

|

Depreciation and amortization |

|

|

|

|

|

|

||||

|

Interest expense |

|

|

|

|

|

|

||||

|

Share-based payments |

|

|

|

|

|

|||||

|

Foreign exchange loss |

|

|

|

|

|

|||||

|

Impairment loss of other assets (non-current assets) |

|

|

|

|

|

|||||

|

Change in fair value of warrant liability |

|

|

|

|

|

|||||

|

Decrease in cash segregated as deposits |

|

|

|

|

|

|

||||

|

(Increase) decrease in crypto assets held (current assets) |

|

|

|

|

( |

) |

||||

|

Increase in customer accounts receivable |

|

( |

) |

|

( |

) |

||||

|

Increase in other financial assets (current assets) |

|

( |

) |

|

( |

) |

||||

|

Decrease in other current assets |

|

|

|

|

|

|

||||

|

Increase (decrease) in deposits received |

|

( |

) |

|

|

|

||||

|

Increase (decrease) in crypto asset borrowings |

|

( |

) |

|

|

|

||||

|

Increase in other financial liabilities |

|

|

|

|

|

|

||||

|

Increase in other current liabilities |

|

( |

) |

|

( |

) |

||||

|

Other, net |

|

|

|

|

|

|

||||

|

Cash provided by operating activities |

|

|

|

|

|

|

||||

|

Interest income received |

|

|

|

|

|

|

||||

|

Interest expenses paid |

|

( |

) |

|

( |

) |

||||

|

Income taxes paid |

|

( |

) |

|

( |

) |

||||

|

Net cash provided by operating activities |

|

|

|

|

|

|

||||

|

|

|

|

|

|||||||

|

Cash flows from investing activities |

|

|

|

|

||||||

|

Purchase of property and equipment |

|

( |

) |

|

( |

) |

||||

|

Expenditure on internally generated intangible assets |

|

( |

) |

|

( |

) |

||||

|

Proceeds from refund of guarantee deposits |

|

|

|

|

|

|||||

|

Purchase of other financial assets (non-current assets) |

|

|

|

( |

) |

|||||

|

Net cash used in investing activities |

|

( |

) |

|

( |

) |

||||

|

|

|

|

|

|||||||

|

Cash flows from financing activities |

|

|

|

|

||||||

|

Proceeds from short-term loans payable |

|

|

|

|

|

|

||||

|

Repayments of short-term loans payable |

|

( |

) |

|

( |

) |

||||

|

Proceeds from loan from related party |

|

|

|

|

|

|

||||

|

Repayments of loan from related party |

|

( |

) |

|

( |

) |

||||

|

Repayments of lease obligations |

|

( |

) |

|

( |

) |

||||

|

Net cash provided by (used in) financing activities |

|

( |

) |

|

|

|

||||

|

Effect of exchange rate change on cash and cash equivalents |

|

|

|

( |

) |

|||||

|

Net increase in cash and cash equivalents |

|

|

|

|

|

|

||||

|

Cash and cash equivalents at the beginning of period |

|

|

|

|

|

|

||||

|

Cash and cash equivalents at the end of period |

¥ |

|

|

¥ |

|

|

||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements (unaudited).

9

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

1. Reporting Entity

Coincheck Group N.V. (“Coincheck Parent”) is a Dutch public limited liability company (naamloze vennootschap). The condensed consolidated interim financial statements consist of Coincheck Parent and its subsidiaries (together referred to as the “Company”). The Company primarily engages in providing end-to-end crypto asset exchange services by offering its customers multi-cryptocurrency marketplace and exchange platforms (the “Marketplace platform” and the “Exchange platform,” respectively) with a deep pool of liquidity for trading crypto assets through its user-friendly applications.

Coincheck Parent became publicly traded on Nasdaq on December 11, 2024 as a result of the business combination among Thunder Bridge Capital Partners IV, Inc., a Delaware corporation (“Thunder Bridge”), Coincheck Parent, M1 Co G.K. (“M1 GK”), a Japanese limited liability company (godo kaisha) and a wholly owned subsidiary of Coincheck Parent, Coincheck Merger Sub, Inc. (“Merger Sub”), a Delaware corporation and a wholly-owned subsidiary of Coincheck Parent, and Coincheck, Inc., a Japanese joint stock company (kabushiki kaisha) (“Coincheck”) (the “Business Combination”) pursuant to the Business Combination Agreement, dated as of March 22, 2022, as amended from time to time, by and among such parties (the “Business Combination Agreement”) in the following steps:

• On December 10, 2024, Coincheck and Coincheck Parent caused M1 GK to implement a share exchange (kabushiki koukan) under and in accordance with the applicable provisions of the Companies Act of Japan, pursuant to which the Ordinary Shares of Coincheck were exchanged for Ordinary Shares of Coincheck Parent (“Ordinary Shares”) (the “Share Exchange”).

• The effect of the Share Exchange was that, amongst others, Coincheck shareholders became holders of the Ordinary Shares, and Coincheck became a direct, wholly owned subsidiary of M1 GK and an indirect wholly-owned subsidiary of Coincheck Parent.

• Following the Share Exchange, Merger Sub was merged with and into Thunder Bridge (the “Merger”), following which the separate corporate existence of Merger Sub ceased and Thunder Bridge continued as the surviving corporation and became a wholly-owned subsidiary of Coincheck Parent.

• As a result of the Merger: (a) each Thunder Bridge common share issued and outstanding immediately prior to the Merger was exchanged for the right to receive one Ordinary Share; and (b) each Thunder Bridge warrant that was outstanding immediately prior to the Merger (a “Thunder Bridge Warrant”) was automatically and irrevocably modified, pursuant to and in accordance with the Warrant Agreement, dated June 29, 2021, by and among Thunder Bridge and Continental Stock Transfer & Trust Company, as amended by the Warrant Assumption and Amendment Agreement, dated as of December 10, 2024, by and among Thunder Bridge, Coincheck Parent and Continental Stock Transfer & Trust Company (the “Warrant Agreement”), to provide that, in lieu of the amount of Thunder Bridge common shares that a holder of a Thunder Bridge Warrant would have been entitled to acquire if the Thunder Bridge Warrant was exercised prior to the Merger, the holder thereof was now entitled to acquire the same amount of Ordinary Shares.

As a result of the Business Combination, Thunder Bridge, M1 GK and Coincheck have become wholly-owned subsidiaries of Coincheck Parent. On December 11, 2024, Ordinary Shares and public warrants of Coincheck Parent commenced trading on the Nasdaq Stock Market, (“Nasdaq”) under the symbols “CNCK” and “CNCKW,” respectively.

The transaction has been accounted for with Thunder Bridge being identified as the “acquired” entity for financial reporting purposes, accordingly, accounted for as the equivalent of Coincheck issuing shares for the net assets of Thunder Bridge, accompanied by a recapitalization. Therefore, these condensed consolidated interim financial statements have been presented as a continuation of Coincheck. Accordingly, the figures for the three months ended June 30, 2024, represent the results of Coincheck, including the effects of the recast of the share capital and earnings per share calculations.

On January 31, 2025, Thunder Bridge changed its name to CCG Administrative Services, Inc. (“CCG AS”)

10

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

1. Reporting Entity (cont.)

Next Finance Tech Co., Ltd and its subsidiaries (“Next Finance”) were acquired by the Company in March 2025.

On June 20, 2025, M1 GK and Coincheck merged, with Coincheck as the surviving entity and M1 GK dissolved immediately effective post-merger.

2. Basis of preparation of condensed consolidated interim financial statements

(1)

The condensed consolidated interim financial statements for the three months ended June 30, 2025, have been prepared in accordance with IAS 34, Interim Financial Reporting, and presented in a format consistent with the consolidated financial statements under IAS 1, Presentation of Financial Statements. However, they do not include all of the notes that would be required in a complete set of financial statements. Thus, these condensed consolidated interim financial statements should be read in conjunction with the consolidated financial statements for the year ended March 31, 2025.

(2)

The condensed consolidated interim financial statements were authorized for issuance on August 28, 2025 by the Chief Financial Officer, Jason Sandberg.

(3)

The preparation of condensed consolidated interim financial statements in accordance with IFRS requires management to make certain judgments, estimates, and assumptions that affect the application of the Company’s accounting policies and the reported amounts of assets, liabilities, revenues and expenses, as well as the disclosure of contingent assets and liabilities. Actual results could differ from these estimates.

These estimates and underlying assumptions are reviewed on a continuous basis. Changes in these accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

The significant judgements made by management in applying the Company’s accounting policies and the key sources of estimation uncertainty were the same as those described in the consolidated financial statements for the year ended March 31, 2025.

3. Material accounting policies

The accounting policies adopted in the presentation of these condensed consolidated interim financial statements are consistent with those adopted for the presentation of the consolidated financial statements for the year ended March 31, 2025. The Company adopted IAS 21, The Effects of Changes in Foreign Exchange Rates, for the fiscal year ending March 31, 2026. The adoption did not have a material impact on the condensed consolidated interim financial statements.

Additionally, for share-based payment arrangements granted to employees and others providing similar services, the grant-date fair value of equity-settled share-based payment arrangements granted to employees is generally recognized as an expense, with a corresponding increase in equity, over the vesting period of the awards. The amount recognized as an expense is adjusted to reflect the number of awards for which the related service and non-market performance conditions are expected to be met, such that the amount ultimately recognized is based on the number of awards that meet the related service and non-market performance conditions at the vesting date.

4. Segment reporting

Operating segments are defined as components of an entity for which separate financial information is available and that is regularly reviewed by the Chief Operating Decision Maker (CODM) in deciding how to allocate resources to an individual segment and in assessing performance. The CEO of the Company is

11

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

4. Segment reporting (cont.)

the CODM of the Company. The CODM reviews financial information for purposes of making operating decisions, allocating resources, and evaluating financial performance. While the Company does have revenue from multiple services, no measures of profitability by service are available. As a result, discrete financial information is not available for each such component. As such, the Company has determined that it operates as

The Company’s revenue is entirely derived from operations within Japan. Furthermore, there is no single customer from which revenue amounts to 10% or more of the Company’s total revenue.

5. Revenue

(1) Revenue breakdown

Revenue breakdowns by revenue from contracts with customers and other sources for the three months ended June 30, 2024 and 2025, are as follows:

|

For the three months ended |

||||||

|

(In millions) |

2024 |

2025 |

||||

|

Revenue arising from contracts with customers |

|

|

||||

|

Transaction revenue(1) |

¥ |

|

¥ |

|

||

|

Commission received(2) |

|

|

|

|

||

|

Sub-total |

|

|

|

|

||

|

|

|

|||||

|

Other sources |

|

|

||||

|

Staking revenue |

|

|

|

|||

|

Other revenue(3) |

|

|

|

|

||

|

Sub-total |

|

|

|

|

||

|

Total |

¥ |

|

¥ |

|

||

____________

(1)

(2)

(3)

(2) Contract balance

As of March 31 and June 30, 2025, there were significant contract assets or contract liabilities.

For the three months ended June 30, 2024 and 2025, there was revenue recognized for performance obligations fulfilled (or partially fulfilled) in the past.

(3) Transaction price allocated to the remaining performance obligations

The Company does not have any contracts in which the projected initial contract period was longer than one year.

(4) Assets recognized from the costs to obtain or fulfill contracts with customers

The Company does not have any significant costs to obtain or fulfill contracts with customers.

12

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

6. Financial instruments

(1) The fair values of financial assets and liabilities are determined as below. Information about the fair value hierarchy is described in Note 6 “Fair value measurement”.

(a) Cash and cash equivalents

Since cash and cash equivalents mainly consist of bank deposits, the carrying amount approximates their fair value.

(b) Cash segregated as deposits

Cash segregated as deposits includes cash deposited in trust accounts. The carrying amount approximates its fair value.

(c) Customer accounts receivable, Other financial assets, Deposits received, and Other financial liabilities

Other financial assets include receivables, guarantee deposits and USD Coin (a stablecoin). The carrying amount of instruments with short-term maturity approximates their fair value. The fair value of instruments with long-term maturity is measured using future cash flows discounted by a rate reflecting the counterparty or the Company’s credibility, which is a reasonable approximation of the carrying amount.

(d) Warrant liabilities

As part of Thunder Bridge’s IPO, Thunder Bridge issued private and public warrants to third-party investors where each whole warrant entitled the holder to purchase share of Thunder Bridge’s Class A common stock at an exercise price of per share. Simultaneously with the closing of the IPO, Thunder Bridge completed the private sale of warrants where each warrant allowed the holder to purchase

Pursuant to a warrant assumption and amendment agreement, dated as of December 10, 2024, Thunder Bridge private and public warrants were exchanged for Coincheck Parent’s private and public warrants, respectively, and subject to the same material terms. As of December 10, 2024, there were

The warrants expire on the earlier of the fifth anniversary of December 10, 2024 or the date on which Coincheck Parent may call the public warrants for redemption, subject to the conditions outlined in the warrant assumption and amendment agreement. The warrants are exercisable at a price of per share.

7. Fair value measurement

(1) Fair value hierarchy

When measuring the fair value of an asset or a liability, the Company uses observable market data as far as possible. Fair values are categorized into different levels in the fair value hierarchy based on the inputs used in the valuation techniques as follows:

|

Level 1: |

Quoted prices without adjustments in an active market for identical assets or liabilities. |

|||

|

Level 2: |

Inputs other than the quoted prices included within Level 1 that are observable for the assets or liabilities, either directly or indirectly. |

|||

|

Level 3: |

Unobservable inputs for the assets or liabilities. |

13

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

7. Fair value measurement (cont.)

The level of fair value hierarchy is determined by the lowest-level input that is significant to the measurement of the fair value.

There were no transfers between levels for the three months ended June 30, 2024 and 2025.

(2) Fair value hierarchy of assets and liabilities measured at fair value on a recurring basis

Fair value hierarchy of assets and liabilities measured at fair value on a recurring basis in the condensed consolidated interim statements of financial position is as follows:

As of March 31, 2025

|

(In millions) |

Note |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||

|

Crypto assets held(1) |

¥ |

|

¥ |

¥ |

¥ |

|

||||||||

|

Other financial assets(2) |

|

|

|

|

|

|

|

|||||||

|

Total |

¥ |

|

¥ |

¥ |

|

¥ |

|

|||||||

|

|

|

|

|

|||||||||||

|

Crypto asset borrowings |

¥ |

|

¥ |

¥ |

¥ |

|

||||||||

|

Warrant liability |

|

|

|

|

||||||||||

|

Public warrant liabilities |

5 |

|

|

|

|

|

|

|||||||

|

Private warrant liabilities(3) |

5 |

|

|

|

|

|

|

|||||||

|

Total |

¥ |

|

¥ |

¥ |

|

¥ |

|

|||||||

As of June 30, 2025

|

(In millions) |

Note |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||

|

Crypto assets held(1) |

¥ |

|

¥ |

¥ |

¥ |

|

||||||||

|

Other financial assets(2) |

|

|

|

|

|

|

|

|||||||

|

Total |

¥ |

|

¥ |

¥ |

|

¥ |

|

|||||||

|

|

|

|

|

|||||||||||

|

Crypto asset borrowings |

¥ |

|

¥ |

¥ |

¥ |

|

||||||||

|

Warrant liability |

|

|

|

|

||||||||||

|

Public warrant liabilities |

5 |

|

|

|

|

|

|

|||||||

|

Private warrant liabilities(3) |

5 |

|

|

|

|

|

|

|||||||

|

Total |

¥ |

|

¥ |

¥ |

|

¥ |

|

|||||||

____________

(1)

(2)

14

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

7. Fair value measurement (cont.)

The following table presents a reconciliation of other financial assets and warrant liabilities measured at fair value on a recurring basis using significant unobservable inputs:

Equity security investments

|

For the three months ended |

||||||||

|

(In millions) |

2024 |

2025 |

||||||

|

Balance, beginning of period |

¥ |

|

|

¥ |

|

|

||

|

Purchases |

|

|

|

|

|

|||

|

Change in fair value |

|

( |

) |

|

( |

) |

||

|

Balance, end of period |

¥ |

|

|

¥ |

|

|

||

Private warrant liabilities

|

(In millions) |

For the |

|||

|

Balance, beginning of period |

¥ |

|

|

|

|

Change in fair value |

|

|

|

|

|

Foreign exchange impact |

|

( |

) |

|

|

¥ |

|

|

||

____________

(3)

|

As of |

||||||||||

|

March 31, |

June 30, |

|||||||||

|

Exercise price |

USD |

|

|

USD |

|

|

||||

|

Share price |

USD |

|

|

USD |

|

|

||||

|

Volatility |

|

% |

|

% |

||||||

|

Expected life (in years) |

|

|

|

|

||||||

|

Risk-free rate |

|

% |

|

% |

||||||

|

Dividend yield |

|

% |

|

% |

||||||

(3) Fair value hierarchy of assets and liabilities measured at fair value on a non-recurring basis

As of March 31, 2025

There were no significant assets or liabilities measured at fair value on a nonrecurring basis as of March 31, 2025.

As of June 30, 2025

There were no significant assets or liabilities measured at fair value on a nonrecurring basis as of June 30, 2025.

15

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

8. Share-based payments

For the three months ended June 30, 2025, Coincheck Parent established an equity-settled share-based payment program. Under this program, the Company granted Restricted Share Units (the “RSUs”) to managing directors and officers, audit and supervisory board members of the Company, and the Company’s qualified employees and non-employee consultants. The RSUs are vested upon the satisfaction of service-based conditions or market conditions. Once vested, the RSUs are settled by delivery of one Ordinary Share per unit.

A summary of RSUs activity is as follows:

(1) RSUs with service-based conditions (equity settled)

The RSUs with service-based conditions vest over a service period ranging from ten months to three years.

|

Number of |

Weighted Average |

||||

|

Balance as of April 1, 2025 |

$ |

||||

|

Granted |

|

|

|

||

|

Vested |

|

||||

|

Forfeited and cancelled |

|

||||

|

Balance as of June 30, 2025 |

|

|

|

||

(2) RSUs with market conditions (equity settled)

The RSUs with market conditions vest over three years, under which the average closing price for the Ordinary Shares for the 30 calendar days up to and including on trading prior to the date of vesting is at least $

|

Number of |

Weighted Average |

||||

|

Balan as of April 1, 2025 |

$ |

||||

|

Granted |

|

|

|

||

|

Vested |

|

||||

|

Forfeited and cancelled |

|

||||

|

Balance as of June 30, 2025 |

|

|

|

||

The fair value of RSUs with service-based conditions has been measured based on the Company’s observable share price. For RSUs with market conditions, the fair value has been measured using a Monte Carlo simulation. The valuation of all RSUs has incorporated neither dividends nor other features. The cost of RSUs is recognized in condensed consolidated interim statements of profit or loss and other comprehensive income together with a corresponding increase in share-based payment reserve in condensed consolidated interim statements of change in equity.

As of June 30, 2025, the total unrecognized compensation cost related to unvested RSUs was $

16

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

9. Earnings per share

The bases for calculating basic earnings (losses) per share and diluted earnings (losses) per share for the three months ended June 30, 2024 and 2025, are as follows:

|

For the three months ended |

|||||||

|

(In millions, except per share data) |

2024 |

2025 |

|||||

|

Net profits (losses) for the period attributable to owners of Coincheck Parent |

¥ |

|

¥ |

( |

) |

||

|

Basic and diluted net earnings (losses) per share |

¥ |

|

¥ |

( |

) |

||

|

Weighted-average number of shares, basic and diluted |

|

|

|

|

|

||

Weighted-average number of shares has been recasted to reflect the transaction on December 10, 2024. Basic net earnings (losses) per share are computed by dividing net profit (loss) by the weighted-average number of shares of Ordinary Shares outstanding during each period. It excludes the dilutive effects of any potentially issuable common shares (i.e., warrants, RSUs). Diluted net profit (loss) per share is calculated by including any potentially dilutive share issuances in the denominator. For the three months ended June 30, 2024 and 2025, the diluted earnings per share is equal to basic earnings per share, as there were no potentially dilutive securities. For the three months ended June 30, 2025, all potentially dilutive securities were not included in the calculation of diluted losses per share as their effect would be anti-dilutive.

10. Income tax expense

The Company’s consolidated effective tax rate was

11. Related parties

(1) Related party transactions

Below are the related-party balances as of March 31 and June 30, 2025:

| (Unit: In millions) | Name of related party | Detail of transaction | Outstanding balance as of | |||||

| March 31, | June 30, | |||||||

| Subsidiaries of parent company | | | | | ||||

| Associates of parent company | | | | | ||||

Below is the related-party transaction impact on the condensed consolidated interim statements of profit or loss and other comprehensive income for the three months ended June 30, 2024 and 2025:

| (Unit: In millions) | Name of related party | Detail of transaction | For the three months ended | |||||||

| 2024 | 2025 | |||||||||

| Parent company | | | ¥ | | ¥ | |||||

| Subsidiaries of parent company | | |

| |

| | ||||

| Associates of parent company | | |

| |

| | ||||

| |

| |

| | ||||||

| |

| |

| | ||||||

| |

| |

| |||||||

____________

(1)

17

COINCHECK GROUP N.V. and its subsidiaries.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

11. Related parties (cont.)

(2)

(3)

(4)

(5)

(2) Subsidiary

The number of consolidated subsidiaries decreased to 5 in the three months ended June 30, 2025, due to merger of M1 GK, compare with 6 as of March 31, 2025.

| Name of subsidiary | Place of | Contents of business | Percentage of | ||||

| Coincheck, Inc. | | | | % | |||

| CCG Administrative Services, Inc. | | | | % | |||

| Next Finance Tech Group | | | | % | |||

| Next Finance Tech Digital Assets Co., Ltd. | | | | % | |||

| Next Finance Tech International Co., Ltd. | | | | % | |||

12. Events after the reporting date

There were no events after the reporting date and through the date when the condensed consolidated interim financial statements were authorized for issue that would require adjustment to these condensed consolidated interim statements or disclosure.

18

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Unless the context otherwise requires, all references in this section to “we,” “us,” or “our” refer to Coincheck, Inc. prior to the closing of the Business Combination and Coincheck Group N.V. and subsidiaries after closing. Acronyms and defined terms used below have the meanings ascribed to them in the definitions list at the beginning of this document.

The following discussion of our financial condition and results of operations should be read in conjunction with the unaudited condensed consolidated interim financial statements as of and for the three months ended June 30, 2025, and related notes contained therein. Our condensed consolidated interim financial statements are prepared in accordance with IAS 34, which differs in certain significant respects from accounting principles generally accepted (GAAP) in other jurisdictions, including U.S. GAAP and Japanese GAAP.

This discussion and analysis contains forward-looking statements. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on information available as of the date of this filing and our managements’ current intentions, expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside of our control. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. We do not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this filing. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the following:

• the price of crypto assets and volume of transactions on Coincheck’s platforms;

• the development, utility and usage of crypto assets, and people’s interest in investing in them and trading them, particularly in Japan;

• changes in economic conditions and consumer sentiment in Japan;

• cyberattacks and security breaches on, or affecting, Coincheck’s platform;

• the level of demand for any particular crypto asset or crypto assets generally;

• costs, management integration and governance issues, failures to succeed as planned or estimated, dependence on third parties, new regulatory requirements, and other risks associated or connected to any mergers or acquisitions, or major strategic commercial or business ventures or arrangements, we undertake to expand or grow our business, both inside and outside of Japan;

• changes to any laws or regulations in the United States, Japan or the Netherlands that are adverse to the Company, Coincheck, or either’s failure to comply with any laws or regulations;

• administrative sanctions, including fines, or legal claims if we are found to have offered services in violations of the laws of jurisdictions other than Japan or to have violated international sanctions regimes;

• Coincheck’s ability to compete and increase market share in a highly competitive industry;

19

• Coincheck’s ability to introduce new products and services, timely or at all;

• any interruptions in services provided by third-party service providers;

• the status of any particular crypto asset as to whether it is deemed a “security” in any relevant jurisdiction;

• legal, regulatory, and other risks in connection with Coincheck’s operation of the Coincheck NFT Marketplace that could adversely affect our business, operating results, and financial condition;

• our obligations to comply with the laws, rules, regulations, and policies of a variety of jurisdictions if we expand our business outside of Japan;

• the inability to maintain the listing of our Ordinary Shares on Nasdaq;

• the ability to grow and manage growth profitably; and

• other risks and uncertainties indicated in this discussion and analysis, as well as those set forth in our Form 20-F for the fiscal year ended March 31, 2025, filed with the SEC on July 30, 2025, accessible on the SEC’s website at www.sec.gov. (the “Form 20-F”), including those set forth under the section of the Form 20-F titled “Risk Factors.”

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should keep in mind that any event described in a forward-looking statement made in this discussion and analysis or elsewhere might not occur.

Overview

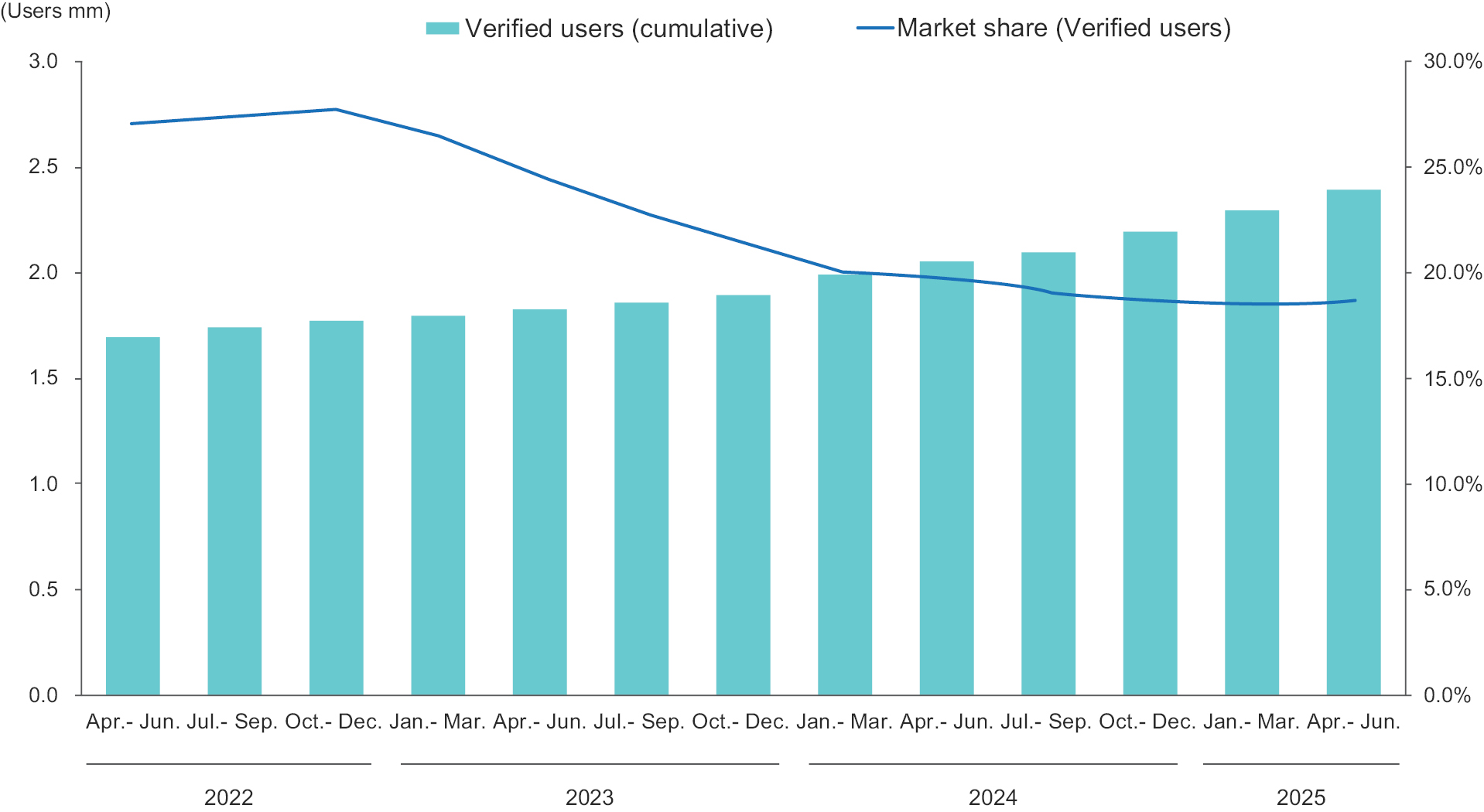

We believe we are a leader in the Japanese cryptocurrency industry for providing a crypto asset marketplace to retail investors. We offer our retail customers a multi-cryptocurrency marketplace, which we sometimes call our Marketplace platform business, where we, after securing matching or offsetting orders of our customers or otherwise verifying sufficient liquidity, are the seller or buyer against our customers’ executed orders. Our customers may also use our Exchange platform, which is targeted at more experienced cryptocurrency investors, where we do not act as buyer or seller, but only facilitate order books through which the buyer and seller transact directly with each other. We sometimes make purchases on the Exchange platform to support liquidity for our transactions on the Marketplace platform. On both platforms, in the aggregate (excluding purchases we make on the Exchange platform), we had as of June 30, 2025, according to the JVCEA, a 23.6% market share in Japan by trading volume. We also had, according to the JVCEA, 18.7% of the market share for retail users by number of verified users in Japan.

As of June 30, 2025, our number of verified users exceeded 2.3 million, with approximately 50.0% of those accounts held by customers under age 40. Each verified user has one customer account, which we sometimes call a verified account.

For the three months ended June 30, 2025 and 2024, 99.3% and 99.1%, respectively, of our total revenue consisted of transaction revenue generated from the Marketplace platform. We offer 34 different crypto assets on our Marketplace platform as of June 30, 2025. As of June 30, 2025, more than 90% of our users utilize our mobile trading application for our Marketplace platform, while the remaining users utilize our desktop trading application. We generally do not charge commissions or fees for use of our Exchange platform.

We believe that we are one of the leading innovators in the Japanese crypto markets. In 2021, we introduced our Coincheck NFT Marketplace platform and also conducted Japan’s first approved IEO.

The growth of crypto assets and crypto markets has come in waves, typically aligned with crypto asset price cycles, which tend to be volatile and draw new customers, investments, and developers into the crypto ecosystem. For example, according to closing day pricing information from CoinMarketCap, as the price of Bitcoin surged from approximately ¥432 thousand during March 2020 to all-time highs of more than ¥7,500 thousand in November 2021, we experienced a corresponding increase in the usage on our Marketplace platform. However, the price of Bitcoin subsequently declined to approximately ¥3,781 thousand as of March 31, 2023. Then, the price of Bitcoin rebounded

20

to approximately ¥10,801 thousand during the fiscal year ended March 31, 2024. For the fiscal year ended March 31, 2025, the price of Bitcoin slightly declined to ¥10,084 thousand as of June 30, 2024, then reached a new all-time high of approximately ¥17,041 thousand in January 2025 then declined to approximately ¥12,382 thousand as of March 31, 2025. The price then recovered to approximately to ¥15,415 thousand as of June 30, 2025, which we believe was a key factor supporting our increased revenue for the three months ended June 30, 2025 as compared to the three months ended June 30, 2024.

There have been a number of major crypto asset price cycles over the past decade, and price cycles continue to be volatile. Due to the highly volatile nature of crypto asset prices and trading activity, historically our operating results have fluctuated significantly from quarter to quarter in line with market sentiment and trading activity.

As of June 30, 2025 customer assets were ¥1,000 billion, and our marketplace trading volume during the three months ended June 30, 2025 was ¥62 billion.

For the three months ended June 30, 2025, our total revenue was ¥83,989 million; our net loss was ¥1,377 million; EBITDA, a non-IFRS measure, was a loss of ¥1,063 million; and Adjusted EBITDA (which we calculated differently for the three months ended June 30, 2025 than we had for the previous quarter, as explained in the next paragraph), a non-IFRS measure, was a loss of ¥399 million. For the three months ended June 30, 2024, our total revenue was ¥75,300 million; our net profit was ¥436 million; EBITDA, a non-IFRS measure, was ¥835 million; and Adjusted EBITDA, a non-IFRS measure, was ¥1,014 million. See “— Key Business Metrics and Trends — Non-IFRS Financial Measures” below for information regarding our use of EBITDA and Adjusted EBITDA and a reconciliation of net profit, the most directly comparable IFRS measure, for the quarter to EBITDA and Adjusted EBITDA.

Adjusted EBITDA was calculated differently for the three months ended June 30, 2025 than it was previously calculated for the three months ended March 31, 2025. When the Company announced its financial results on May 13, 2025 for the three months (and full year) ended March 31, 2025, the further adjustment to calculate Adjusted EBITDA consisted only of transaction expenses. In evaluating how Adjusted EBITDA should be calculated for the three months ended June 30, 2025 (and the foreseeable future), the Company considered, in addition to transaction expenses, the non-cash expenses of (i) share-based compensation, which the Company did not have prior to April 1, 2025, and that the majority of the share-based compensation consisted of Coincheck Group restricted share unit awards granted to two of Coincheck, Inc.’s co-founders, and other restricted share unit awards related to the business combination with Thunder Bridge, and (ii) change in fair value of warrant liability, which fluctuates quarter to quarter based on the Company’s share price. The Company believes that showing its EBITDA results, further adjusted to exclude share-based compensation and change in fair value of warrant liability, can present a clearer view of the Company’s operational performance, and is helpful to view together with EBITDA and net profit or loss.

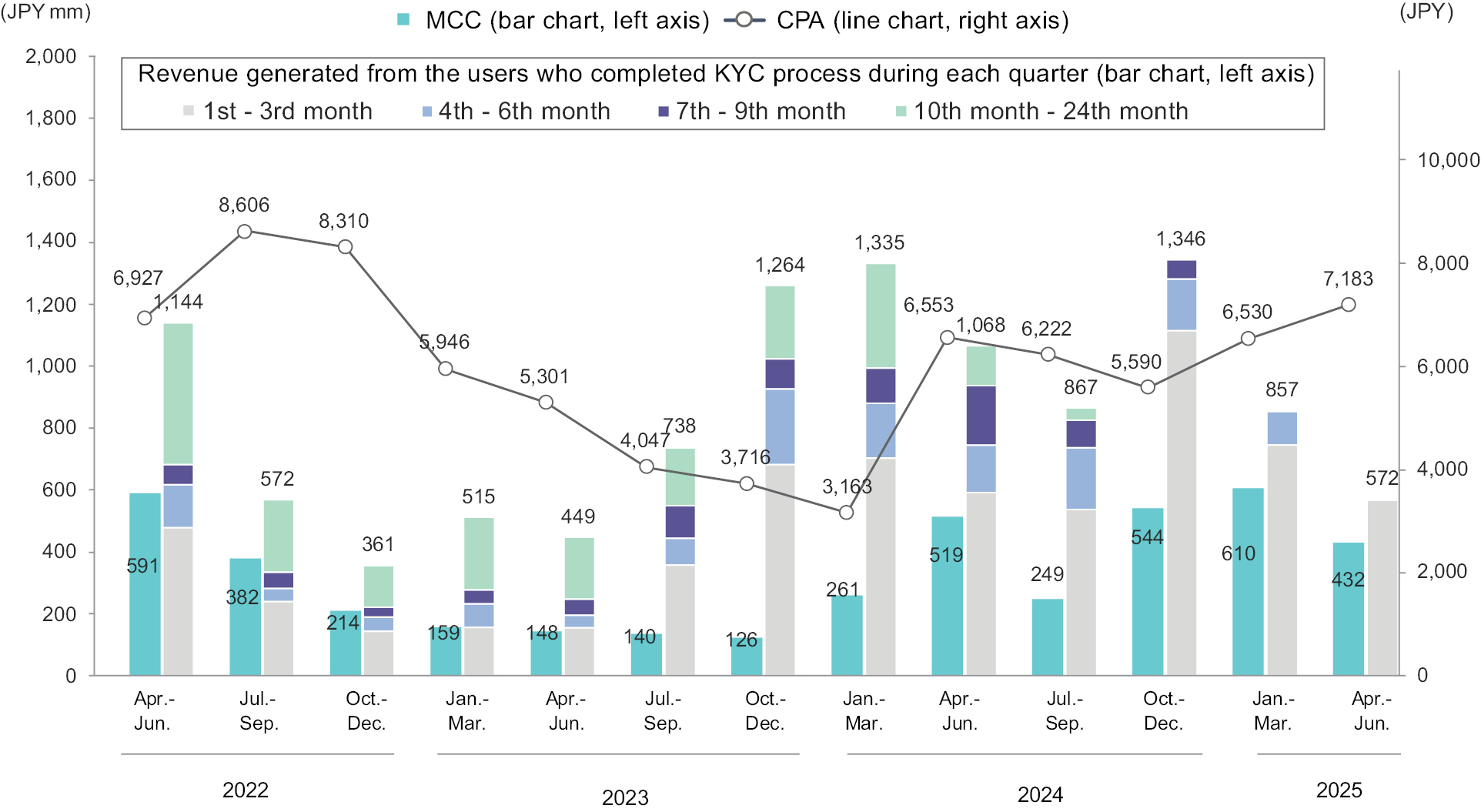

Monthly KPIs

The below table shows monthly operating data1 from April 2023 through June 2025:

|

April |

May |

June |

|||||||

|

2023 |

|||||||||

|

(In millions, except number of verified accounts) |

|||||||||

|

Exchange trading volume |

¥ |

161,783 |

¥ |

149,721 |

¥ |

180,540 |

|||

|

Marketplace trading volume |

¥ |

10,699 |

¥ |

7,872 |

¥ |

11,659 |

|||

|

Customer assets |

¥ |

350,923 |

¥ |

339,193 |

¥ |

362,197 |

|||

|

Number of verified users |

|

1,810,351 |

|

1,820,242 |

|

1,830,148 |

|||

____________

1 Exchange trading volume includes trading between matched sellers and purchasers but does not include transactions in which we are a party (including our transactions with cover counterparties). Monthly exchange trading volume data reflects trading volume by sellers and purchasers on a gross basis, and is based on information that we are required to prepare for purposes of monthly reporting to the JVCEA using the calculation methods they prescribe.

21

|

July |

August |

September |

October |

November |

December |

|||||||||||||

|

2023 |

||||||||||||||||||

|

(In millions, except number of verified accounts) |

||||||||||||||||||

|

Exchange trading volume |

¥ |

153,038 |

¥ |

135,467 |

¥ |

107,178 |

¥ |

196,953 |

¥ |

264,854 |

¥ |

291,973 |

||||||

|

Marketplace trading volume |

¥ |

14,361 |

¥ |

11,060 |

¥ |

9,140 |

¥ |

16,365 |

¥ |

18,190 |

¥ |

24,101 |

||||||

|

Customer assets |

¥ |

377,832 |

¥ |

345,869 |

¥ |

350,550 |

¥ |

413,291 |

¥ |

440,819 |

¥ |

468,415 |

||||||

|

Number of verified users |

|

1,844,687 |

|

1,855,980 |

|

1,864,765 |

|

1,872,825 |

|

1,884,184 |

|

1,898,785 |

||||||

|

January |

February |

March |

April |

May |

June |

|||||||||||||

|

2024 |

||||||||||||||||||

|

(In millions, except number of verified accounts) |

||||||||||||||||||

|

Exchange trading volume |

¥ |

343,495 |

¥ |

368,271 |

¥ |

625,318 |

¥ |

463,858 |

¥ |

314,754 |

¥ |

271,697 |

||||||

|

Marketplace trading volume |

¥ |

24,808 |

¥ |

31,101 |

¥ |

55,205 |

¥ |

28,222 |

¥ |

23,112 |

¥ |

21,659 |

||||||

|

Customer assets |

¥ |

476,125 |

¥ |

669,685 |

¥ |

744,197 |

¥ |

658,150 |

¥ |

736,853 |

¥ |

747,891 |

||||||

|

Number of verified users |

|

1,915,646 |

|

1,935,987 |

|

1,981,152 |

|

2,014,832 |

|

2,040,838 |

|

2,060,379 |

||||||

|

July |

August |

September |

October |

November |

December |

|||||||||||||

|

2024 |

||||||||||||||||||

|

(In millions, except number of verified accounts) |

||||||||||||||||||

|

Exchange trading volume |

¥ |

371,801 |

¥ |

411,847 |

¥ |

278,985 |

¥ |

324,265 |

¥ |

728,271 |

¥ |

621,560 |

||||||

|

Marketplace trading volume |

¥ |

22,725 |

¥ |

18,992 |

¥ |

13,412 |

¥ |

18,916 |

¥ |

50,405 |

¥ |

48,116 |

||||||

|

Customer assets |

¥ |

750,367 |

¥ |

635,917 |

¥ |

669,357 |

¥ |

735,675 |

¥ |

1,106,754 |

¥ |

1,142,224 |

||||||

|

Number of verified users |

|

2,077,756 |

|

2,090,251 |

|

2,100,374 |

|

2,110,974 |

|

2,152,448 |

|

2,197,619 |

||||||

|

January |

February |

March |

April |

May |

June |

|||||||||||||

|

2025 |

||||||||||||||||||

|

(In millions, except number of verified accounts) |

||||||||||||||||||

|

Exchange trading volume |

¥ |

595,095 |

¥ |

410,136 |

¥ |

454,278 |

¥ |

366,050 |

¥ |

375,677 |

¥ |

310,449 |

||||||

|

Marketplace trading volume |

¥ |

46,700 |

¥ |

25,630 |

¥ |

19,637 |

¥ |

21,673 |

¥ |

21,333 |

¥ |

18,525 |

||||||

|

Customer assets |

¥ |

1,285,614 |

¥ |

873,796 |

¥ |

859,205 |

¥ |

886,884 |

¥ |

989,365 |

¥ |

1,000,301 |

||||||

|

Number of verified users |

|

2,258,295 |

|

2,278,320 |

|

2,291,103 |

|

2,302,376 |

|

2,325,978 |

|

2,351,223 |

||||||

Key Business Metrics and Trends

In addition to our financial results, we use these business metrics, and some of the components of them described below, to evaluate our business, measure our performance, identify trends affecting our business, and make strategic decisions:

Verified Users

Verified users represent users who have fully completed the account-opening application procedures, including KYC procedures, with us. Accordingly, there should only be one account per user (which we sometimes refer to as a verified account). The verified user total is adjusted for accounts that are subsequently closed, but not for those that are inactive. Our verified users increased sequentially for all quarters primarily due, we believe, to growth in our products and services and the overall increase in interest in BTC, Ethereum, XRP and other crypto assets in Japan. As of June 30, 2025, our number of verified users was approximately 2.4 million. Verified user metrics are used as a key performance indicator in our business management process because our current businesses principally serve retail users. We are able to compare our number of verified users against industry data compiled by the JVCEA to assess our competitive position. Our definition of verified users may be revised in the future if the industry data or metric used changes or there are changes in Japanese rules regarding approval of new users or accounts and how that should be defined.

22

Verified Users

Source: Public information made available by the JVCEA.

Monthly Users

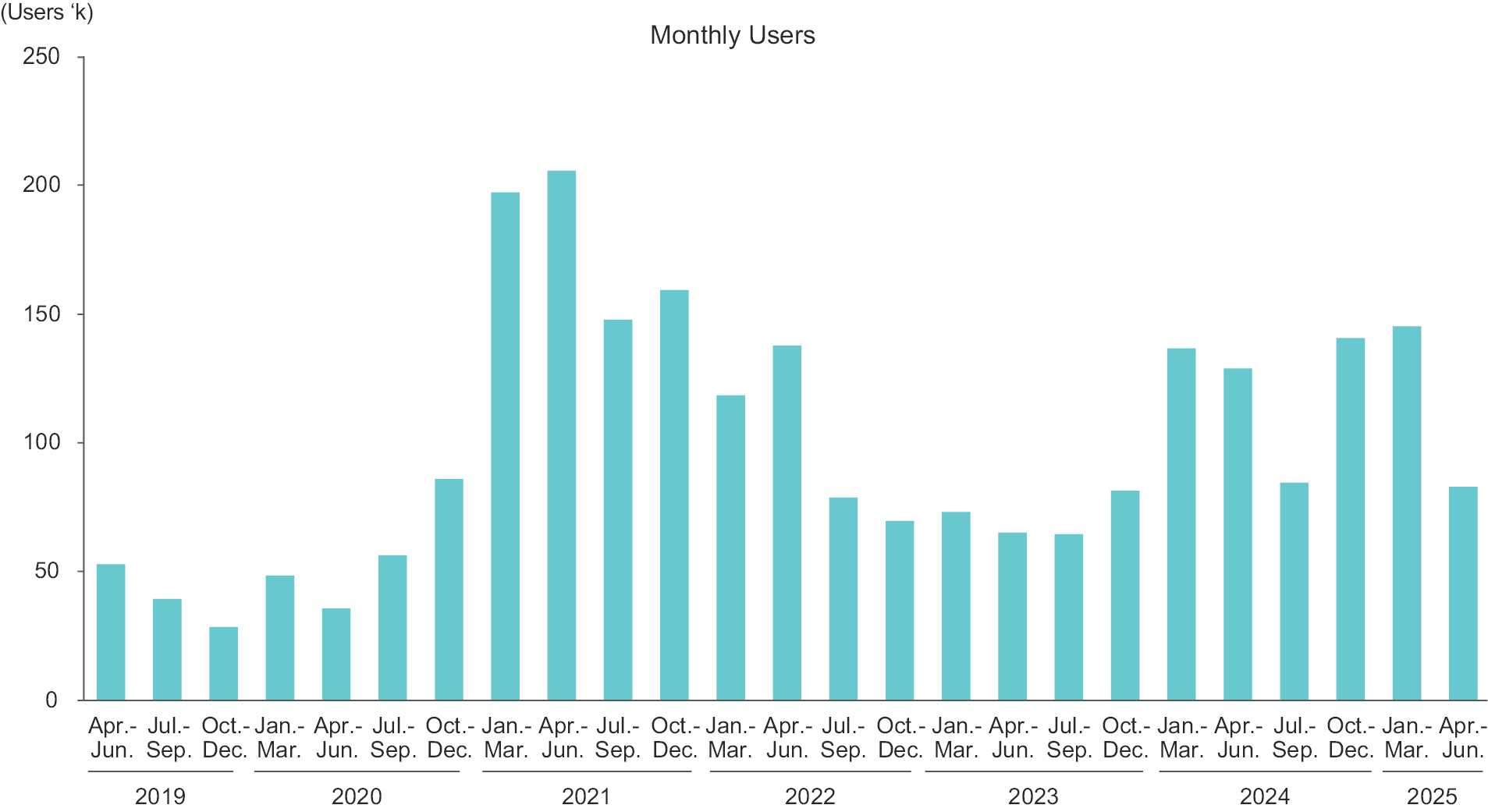

Monthly users represent our verified users with at least one transaction (a purchase, sale, deposit or withdrawal) on either our Marketplace or Exchange platform in the prior calendar month. We view them as the active users on our cryptocurrency exchanges. Monthly users drive retail trading volume, and growth in our monthly users has historically been correlated with both the price of Bitcoin, Ethereum, XRP and other crypto assets and volatility within the crypto asset market. We have aimed to expand our revenue opportunities by, in recent years, adding new cryptocurrencies to give more investment options and by marketing cryptocurrency trading to retail investors. Our number of monthly users was on a declining trend since its peak in the first quarter of the fiscal year ended March 31, 2022 (April — June 2021); however, beginning in the third quarter of the fiscal year ended March 31, 2024, we have seen an increase in our number of monthly users. Our number of average monthly users was approximately 83,711 for the first quarter of the fiscal year ending March 31, 2026.

23

Source: Internal data

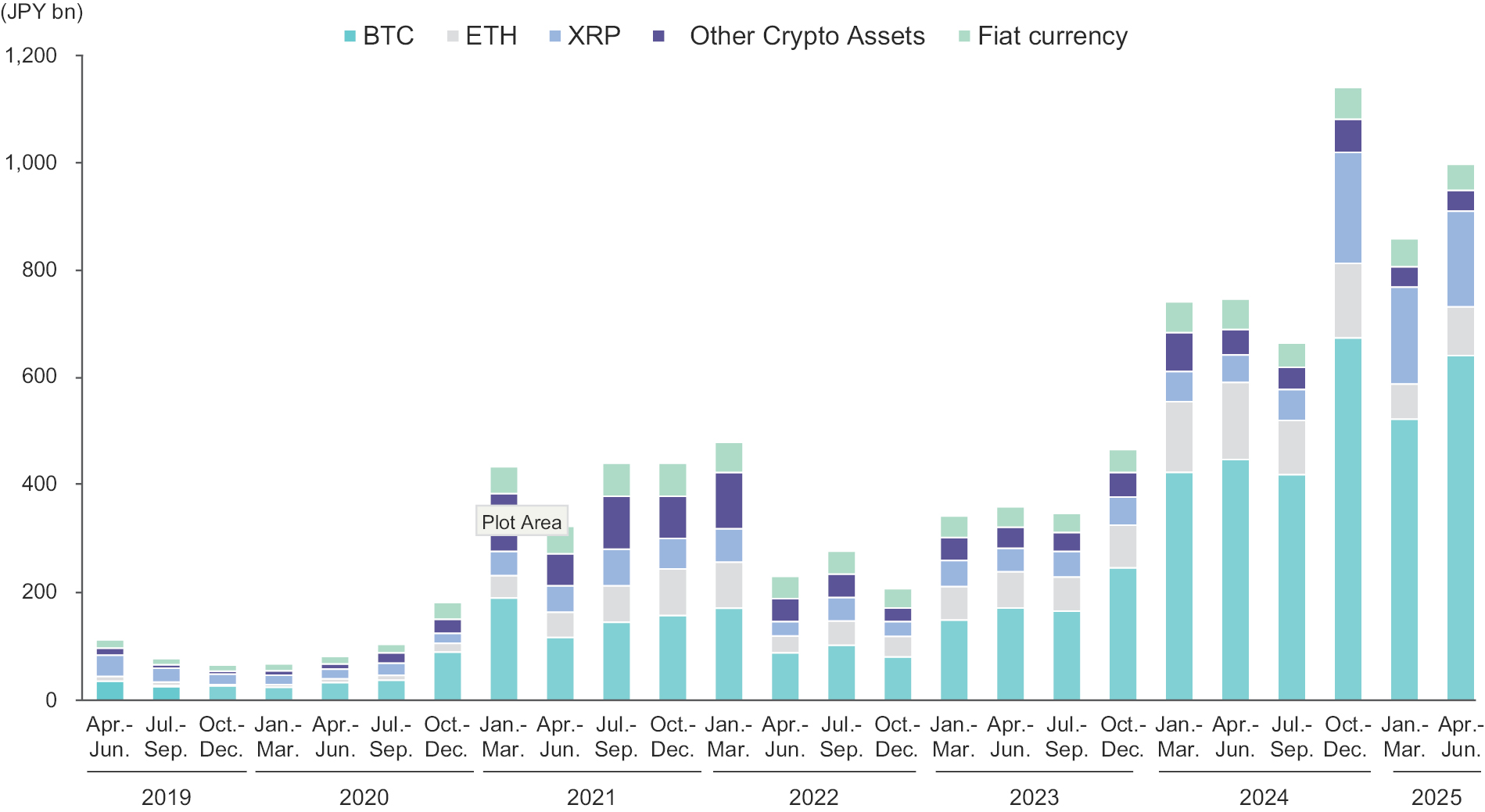

Customer Assets (by Currency)

Customer assets are a measure of the scale of total value held on our cryptocurrency exchanges as of the period indicated. We believe that customer assets reflect the trusted nature of our cryptocurrency exchanges and services. The value of our customer assets is driven by the price, quantity, and type of crypto assets held by customers. Customer assets include cash deposited by customers, which is segregated in a trust account with a trust bank, and customers’ crypto assets that we hold in custody.

Changes in the price and quantity, particularly for Bitcoin, Ethereum and XRP, or in the types and mix of crypto assets we make available to our customers, can result in growth or decline in customer assets within a particular period. For example, we could see an increase in the quantity of customer assets we hold — meaning measured in units of crypto assets — but the value of customer assets could decline if the corresponding price of a crypto asset declines. Conversely, a decline in the quantity of assets we hold can be offset, or partially offset, by rising crypto asset prices.

Our ability to protect our customers’ crypto assets is also an important factor, since any inability to do so could result in us compensating our customers for their loss (even if we are not legally required to do so), our customers losing trust in our services, the withdrawal of customer assets or a reduction in the deposit of customer assets. We work continuously to comply with applicable security measures to ensure that customer assets are protected. We provide custody services to our customers for their crypto assets. Customer assets as of June 30, 2025, and March 31, 2025 were ¥1,000 billion and ¥859 billion, respectively.

Because the amount and value of our customer assets are driven by multiple factors, some of which are market dependent, this metric has fluctuated in recent periods. For example, according to closing day pricing information from CoinMarketCap, the prices of Bitcoin and Ethereum reached their lowest levels during the fiscal year ended March 31, 2023. However, despite those price declines, our customer assets grew that fiscal year (compared to the prior fiscal year) to ¥344 billion, driven by growth in the price, quantity, or transactions in other types of crypto assets we support, such as XRP. As of June 30, 2024, our customer assets grew further still, to ¥748 billion, of which ¥50 billion consisted of XRP. As of June 30, 2025, our customer assets grew to ¥1,000 billion, of which ¥178 billion consisted of XRP.

24

Customer Assets

Source: Coincheck internal data.

Trading Volume (by Cryptocurrency)

The trading volume of our Marketplace platform customers is directly correlated with our revenue and is influenced by both price and volatility of Bitcoin, Ethereum, XRP and other crypto assets. We have experienced periods of low and high trading volume, and therefore revenue, driven by periods of rising or declining crypto asset prices and/or lower or higher volatility within the crypto asset market. During periods of rising Bitcoin prices and higher volatility, we have generally observed higher trading volume on both our Marketplace platform and Exchange platform.

There are a number of factors that contribute to changes in price and volatility of a given crypto asset, including, but not limited to: changes in the supply and demand for a particular crypto asset; crypto market sentiment; macroeconomic factors; utility of a particular crypto asset; and other events, such as exchange outages or social media commentary. Market participation by well-known investors can also affect consumer sentiment.

Occasionally, planned network events, such as an airdrop, where the network provides holders of a particular crypto asset with a reward, or a “halving,” which is when the reward for validating transactions for a crypto network is reduced by half, can lead to shifts in customer interest in a specific crypto asset. Event-driven changes in customer interest may be temporary and, as a result, our financial performance following such events may not be indicative of future operating performance or financial condition.

25

The following table shows the trading volume by currency on our Marketplace platform for each quarter beginning with the three months ended June 30, 2024:

|

For the three months ended |

|||||||||||||||